Levy of GST - Credit Card loan - tax charged by the bank on each ...

Bank's Interest Installments Not Classified as Credit Card Service, Exempt from IGST Levy.

July 27, 2023

Case Laws GST HC

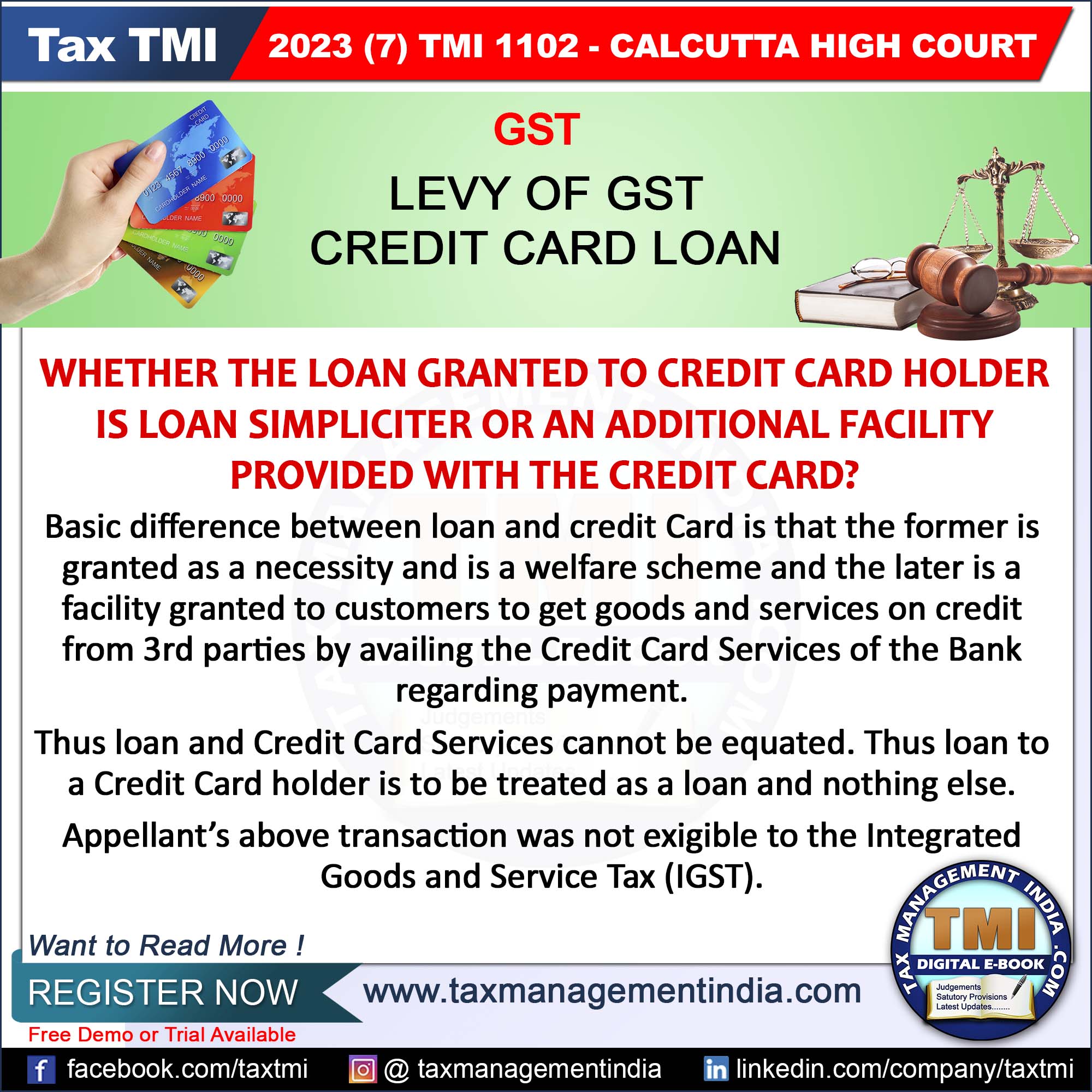

Levy of GST - Credit Card loan - tax charged by the bank on each instalment of interest together with the loan amount paid by the appellant. - the appellant’s above transaction with the bank was a service which could not be termed as a credit card service and was not exigible to the Integrated Goods and Service Tax (IGST) - HC

View Source