Penalty proceedings u/s. 270A - Additions made u/s 43CA r.w.s. ...

Penalty Proceedings Deemed Arbitrary Due to Lack of Specifics on Misreporting u/s 270A.

August 8, 2023

Case Laws Income Tax AT

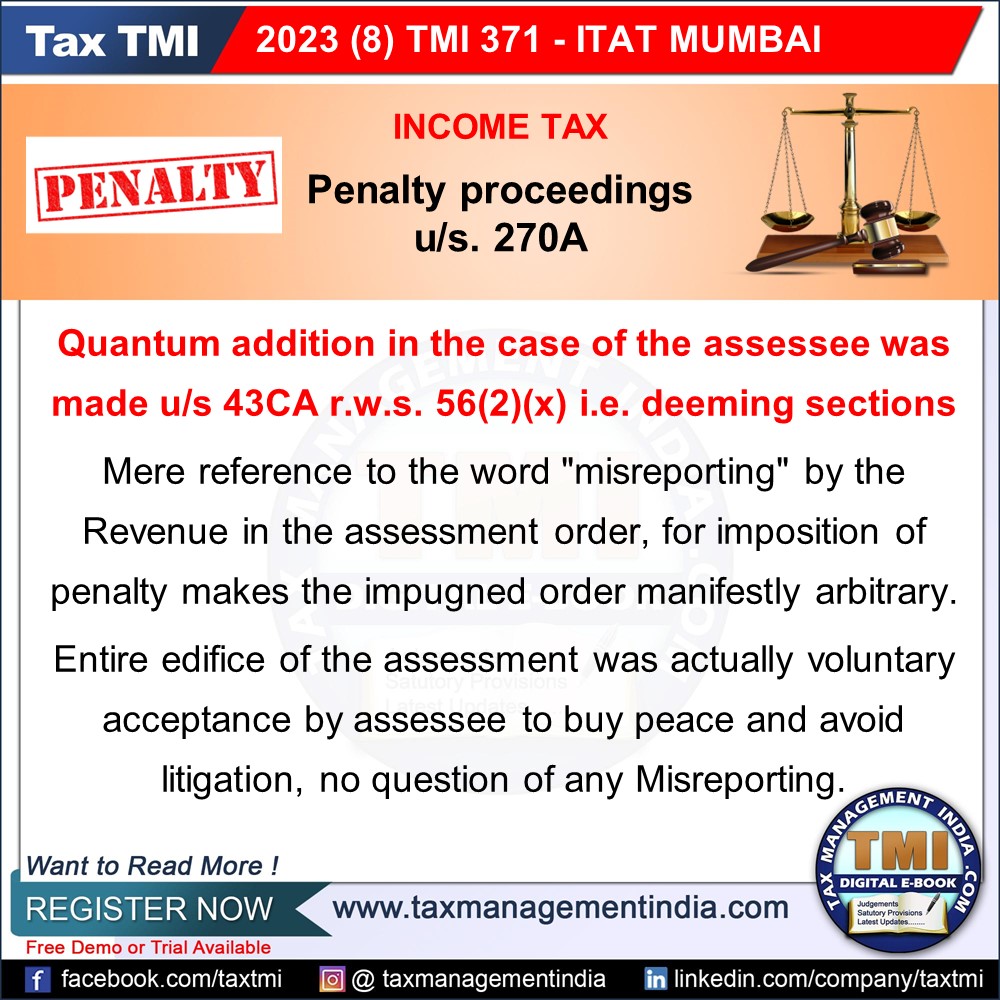

Penalty proceedings u/s. 270A - Additions made u/s 43CA r.w.s. 56 (2) (x) i.e. deeming sections - There is not even a whisper as to which limb of section 270A of the Act is attracted and how the ingredient of sub-section (9) of section 270A is satisfied. - Mere reference to the word "misreporting" by the Revenue in the assessment order, for imposition of penalty makes the impugned order manifestly arbitrary. - AT

View Source