Corporate Social Responsibility (“CSR”) expenses - deduction ...

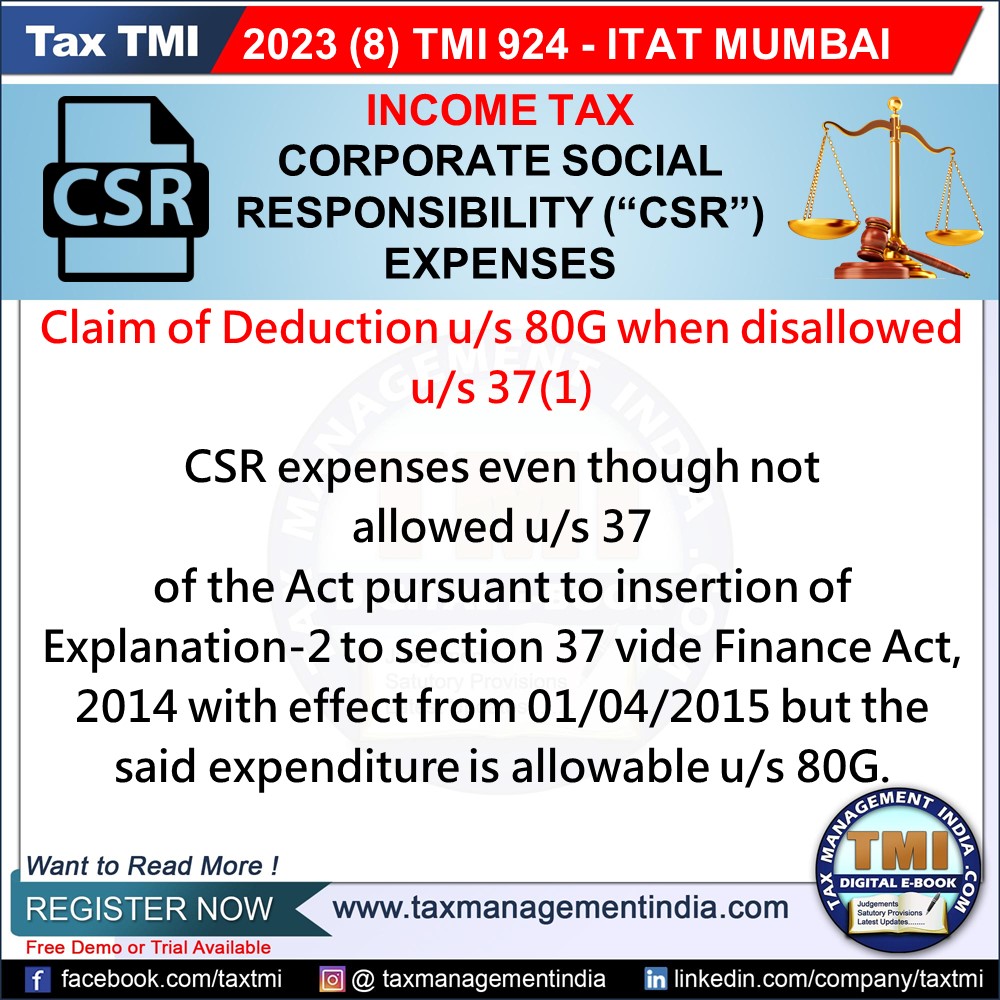

CSR Expenses Not Deductible u/s 37, But Eligible for Deduction u/s 80G of Income Tax Act.

August 21, 2023

Case Laws Income Tax AT

Corporate Social Responsibility (“CSR”) expenses - deduction claimed u/s 80G - the CSR expenses even though not allowed under section 37 of the Act pursuant to insertion of Explanation-2 to section 37 vide Finance Act, 2014 with effect from 01/04/2015. However, the said expenditure is allowable u/s 80G - AT

View Source