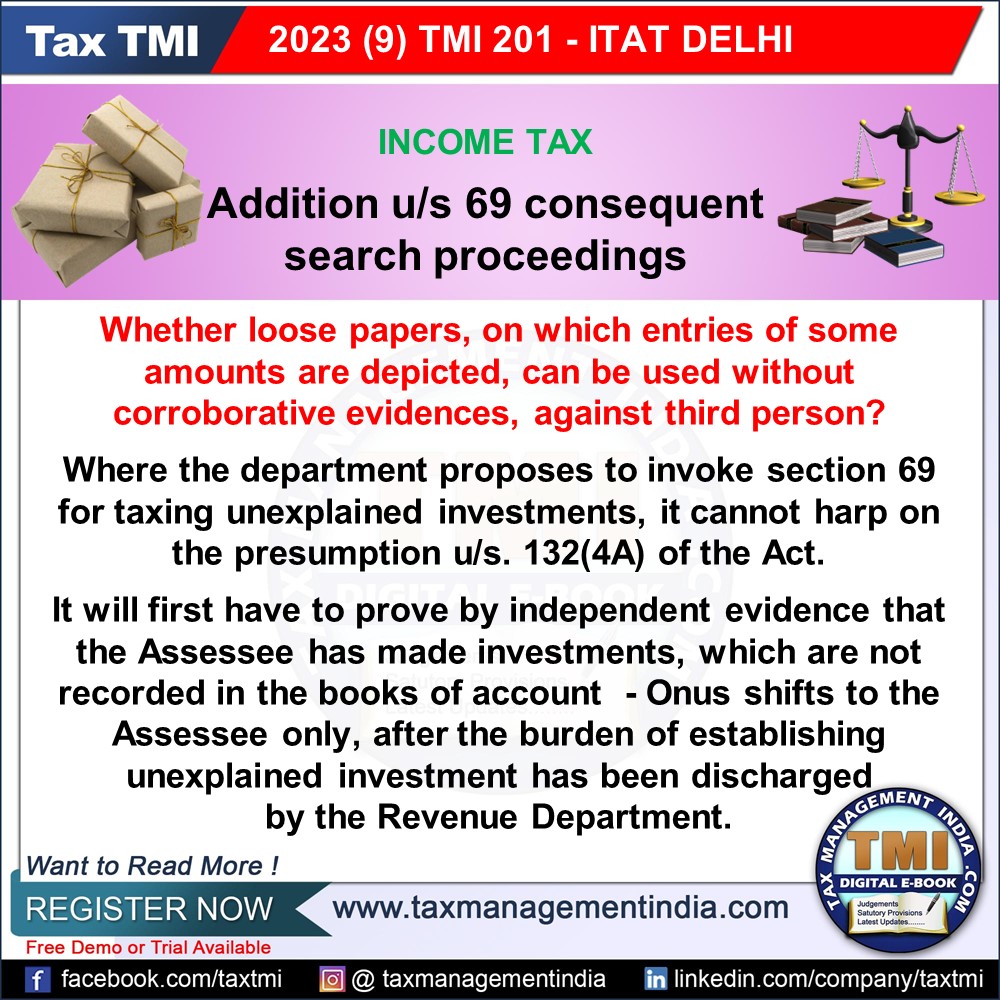

Search proceedings - Addition based on loose sheets found - ...

Loose Sheets Found in Tax Search Can't Imply Liability Without Corroboration u/ss 1324A & 292C.

September 5, 2023

Case Laws Income Tax AT

Search proceedings - Addition based on loose sheets found - presumption u/s 1324A and 292C cannot be drawn against third party from whose possession, no documents etc. found and seized and therefore in our considered view, such party is not under obligation to rebut the presumption. - The loose papers, on which entries of amounts are depicted, can not be used without corroborating evidences - AT

View Source