Cancellation of GST registration of the petitioner - non-filing ...

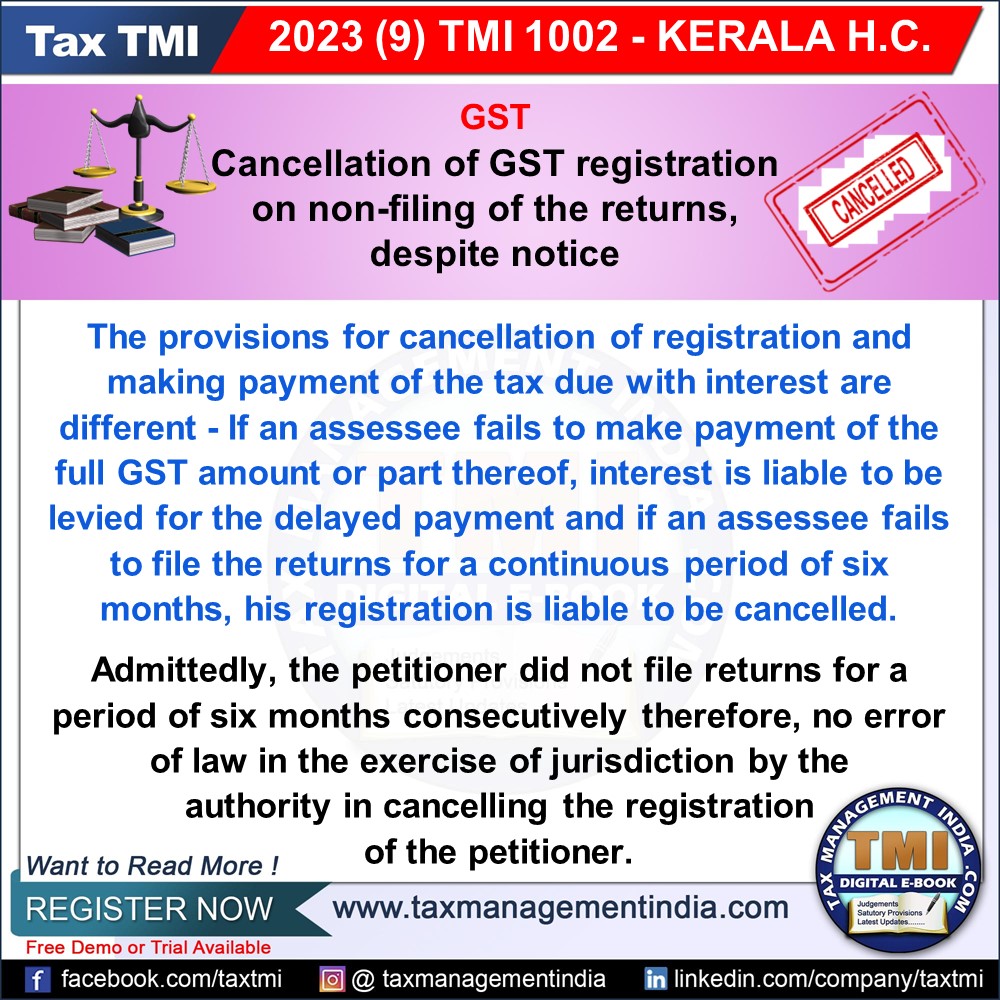

GST Registration Canceled for Non-Filing of Returns Over Six Months; No Jurisdictional Error Found by Authority.

September 22, 2023

Case Laws GST HC

Cancellation of GST registration of the petitioner - non-filing of the returns, despite notice - Admittedly, the petitioner did not file returns for a period of six months consecutively and therefore, the authority has no option than to cancel the registration - there are no error of law in the exercise of jurisdiction by the authority in cancelling the registration of the petitioner. - HC

View Source