Revocation of the cancellation of his GST registration - The ...

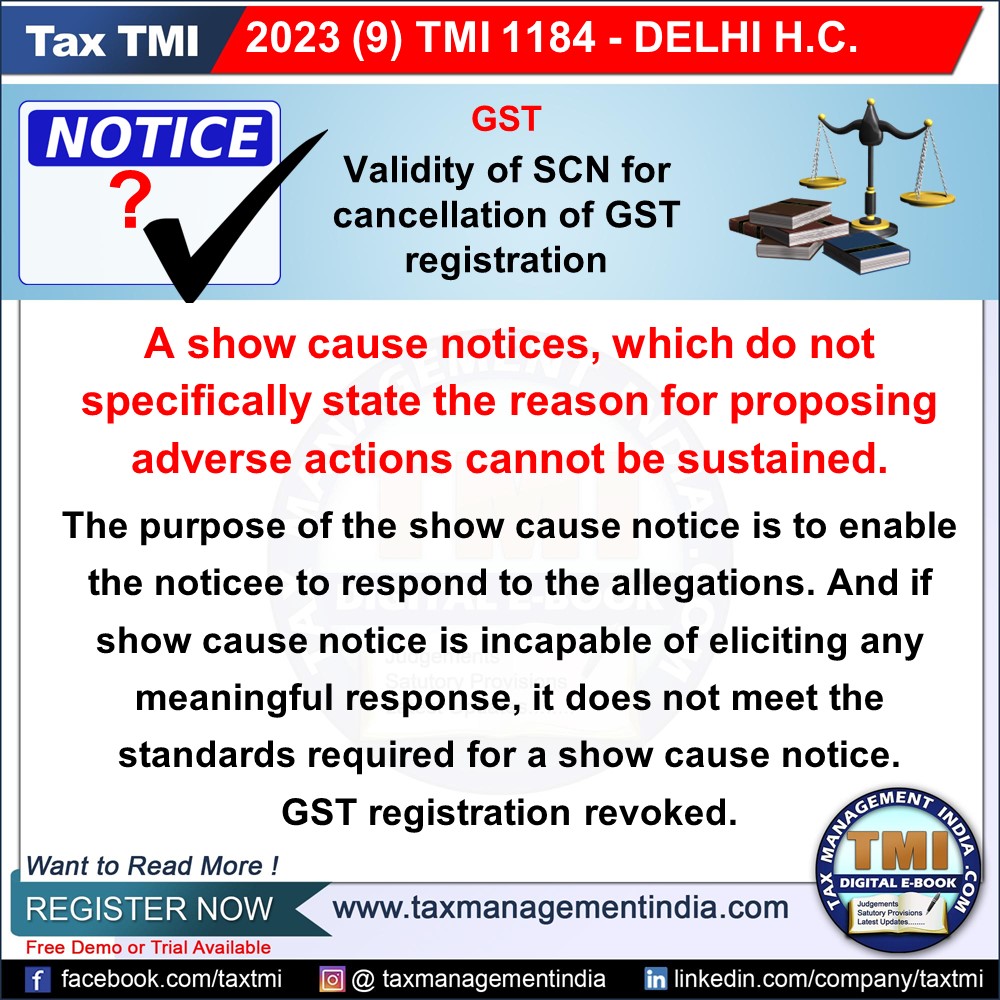

Cancellation of GST Registration Overturned Due to Lack of Reasoning and Violation of Natural Justice Principles.

September 27, 2023

Case Laws GST HC

Revocation of the cancellation of his GST registration - The impugned show notice dated 5.12.2021 fails to disclose the reason for proposing cancellation of the petitionerís GST registration and therefore, the impugned order cancelling the petitionerís registration falls foul of the principles of natural justice. - HC

View Source