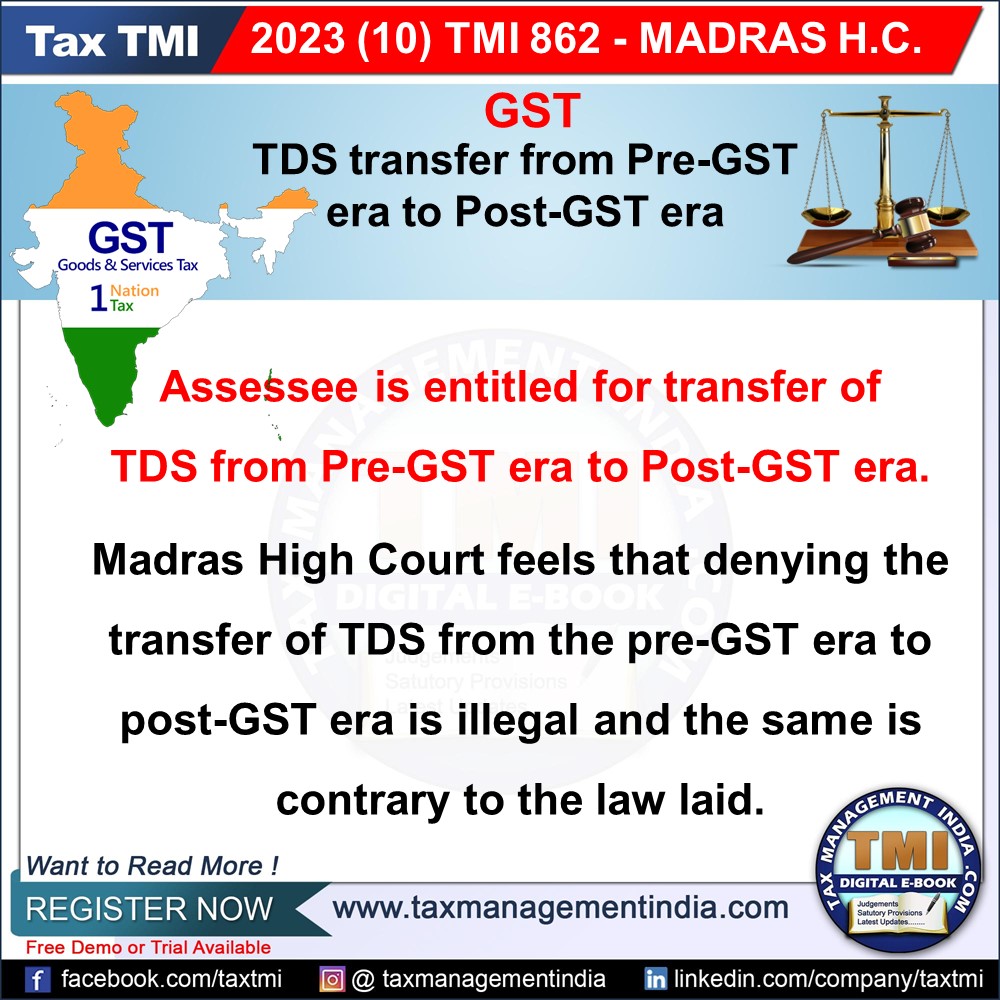

Transfer of TDS from Pre-GST era to Post-GST era - This Court ...

Court Rules Show Cause Notice Denying TDS Transfer from Pre-GST to Post-GST Era Illegal; Notice Quashed.

October 19, 2023

Case Laws GST HC

Transfer of TDS from Pre-GST era to Post-GST era - This Court feels that issuing the impugned show cause notice by denying the transfer of TDS from the pre-GST era to post-GST era is illegal and the same is contrary to the law laid down by this Court. - Show Cause Notice (SCN) quashed - HC

View Source