Reopening of assessment u/s 147 - reason to believe - Assessing ...

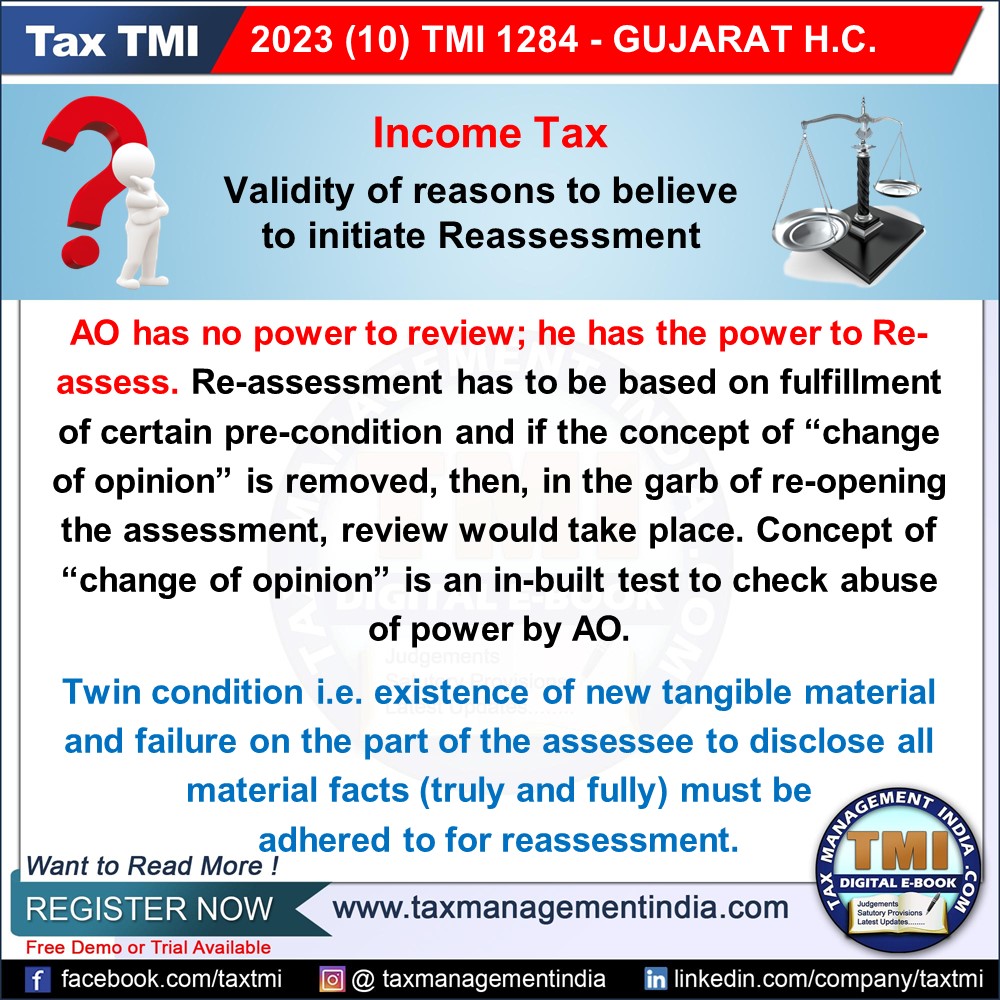

AO Cannot Use Section 147 for Unauthorized Review; "Change of Opinion" Prevents Misuse in Reassessment Process.

October 30, 2023

Case Laws Income Tax HC

Reopening of assessment u/s 147 - reason to believe - Assessing Officer has no power to review; he has the power to re-assess. But re-assessment has to be based on fulfillment of certain pre-condition and if the concept of “change of opinion” is removed, as contended on behalf of the Department, then, in the garb of re-opening the assessment, review would take place. One must treat the concept of “change of opinion” as an in-built test to check abuse of power by the Assessing Officer. - HC

View Source