Cancellation of GST registration of petitioner - allegation of ...

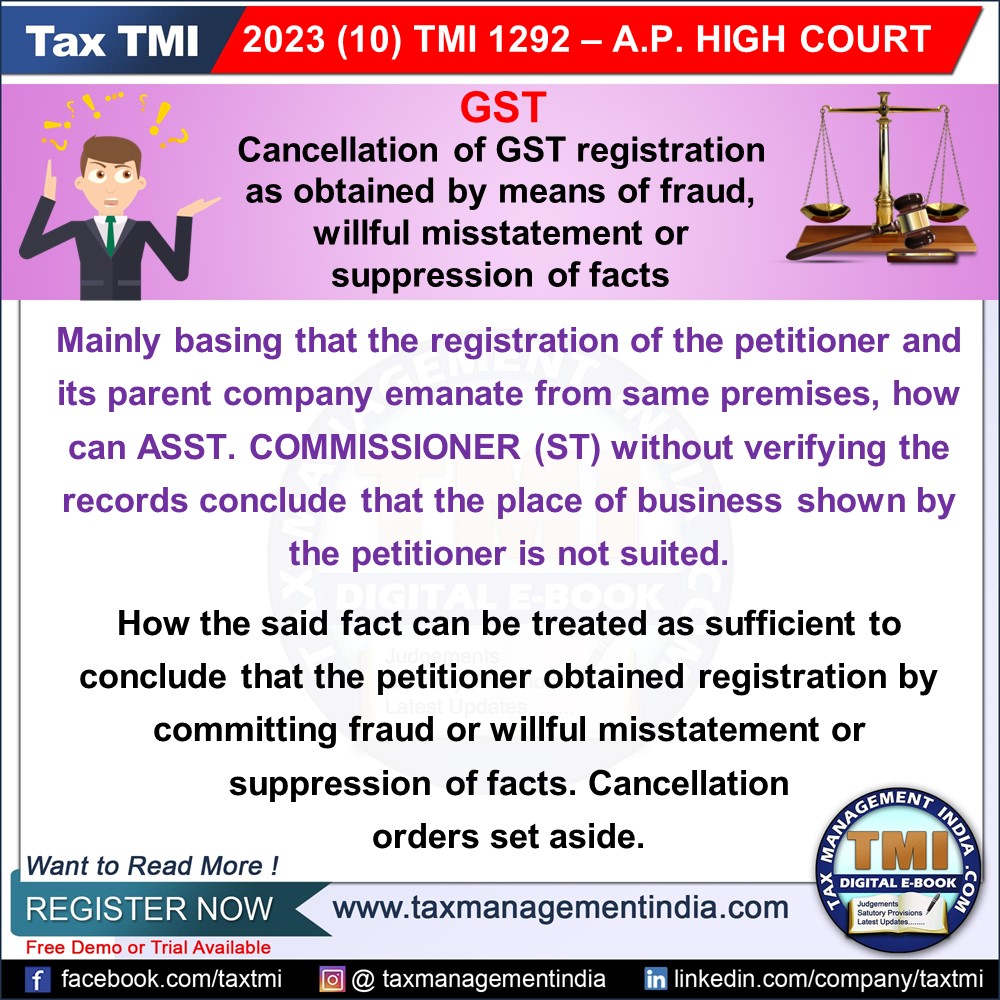

High Court Quashes GST Cancellation: Authorities Failed to Properly Investigate Alleged Fraud and Misstatements.

October 30, 2023

Case Laws GST HC

Cancellation of GST registration of petitioner - allegation of fraud, wilful misstatement or suppression of facts - In spite of the petitioner’s submission that the complete details of purchases and sales can be verified at any point of time, the 2nd respondent without resorting to such logical and legal exercise, simply carried away by the recommendations of the Inspecting Authority - Order of cancellation quashed - HC

View Source