| Article Section | |||||||||||

|

Home |

|||||||||||

GST COLLECTIONS DEFY ECONOMIC SLOW DOWN |

|||||||||||

|

|||||||||||

GST COLLECTIONS DEFY ECONOMIC SLOW DOWN |

|||||||||||

|

|||||||||||

The opposition parties, mainly Congress have claimed that GDP for the Q3 of financial year 2019-20 is going to be further down, given the state of economy. India’s economic growth, GDP, has slipped to slab 5% level @ 4.5% in July – September quarter, which is a six year low. India’s GDP grew by 4.5% in the three months ending September, the lowest since March 2013, which comes after the 5% GDP growth in June quarter. It highlights the current economic crises, created by factors- both structural and cyclical, as well as domestic and global. The slowdown is evident across all sectors- manufacturing, select services and agriculture. India was the world’s fastest growing economy until last year, posting quarterly growth rates of as high of 9.4% in 2016. A crisis among shadow banks – a key source of funding for small businesses and consumers – weak rural spending, lack of infrastructure and a global slowdown have since conspired to bring down growth steadily to this level. The people in Government are still claiming that there is a slowdown in economy but it cannot be termed as recession. This will be over come in Q3 but how? The answers are not there. We are witnessing for the first time, a series of measures in tranches, here and there covering only a few industries. Government has slashed corporate taxes, setup a special real – estate fund, merged banks and announced the biggest privatization driven in more than a decade. The Reserve Bank of India (RBI) has already cut interest rates by 135 basis points this year to the lowest since 2009. There is no comprehensive review of situation and problems on hand. Our Finance Minister says that ‘we are willing to hear, willing to react, willing to give interventions when necessary’, but such scattered and random hands-on approach is actually not working. Even the Home Minister is now talking of economy stating that Government is taking the required initiatives. Passing the buck and making just announcements or statements won’t help. Taking action and seeing that such actions are bringing in the desired results would help. What is required is identification of problem areas and issues and fixing them by taking right kind of policy decisions. The impact may take some times but concrete and comprehensive steps are required to boost both, consumption as well as production. With GST in, consumers are important stakeholders and the most affected lot. They are hit by both, higher taxes (direct as well as indirect) and non-availability of any input tax benefit. If we address the issue of consumption, demand will suo moto pick up requiring more production and industrial activity. Increasing domestic consumption, disposable incomes in hands of citizens, creating employment opportunities and enhancing production, all are inter-linked and have a multiplier effect. It is also imperative that the Government goes out and listen to economists, industry, professionals and other stakeholders and use that collective wisdom for public good. It if but not happening GST is one example where Government has failed in achieving the desired results. Corporate India is working hard but right kind of policy deficit is a bottleneck. It can sail through provided the Government supports and is keen in coming out of this ‘slowdown’ mess. We can’t every time look at past and say that 2019 is better than 2014. We have to ensure that future is promising and businesses as well as country prospers. There is no clear policy on GST except that it will continue. How will it improve, nobody talks on that. Look at the number of man hours wasted due to faulty implementation of GST over last 30 months. Business and professionals are just doing compliances, not much of value addition. However, stock markets have been behaving as if they are decoupled with the economic growth. While BSE sensex has breached 41K mark and Nifty has breached 12K mark last week, it appears that stock indices have nothing to do with economic parameters. The questions confronting every one’s mind are manifold, viz,

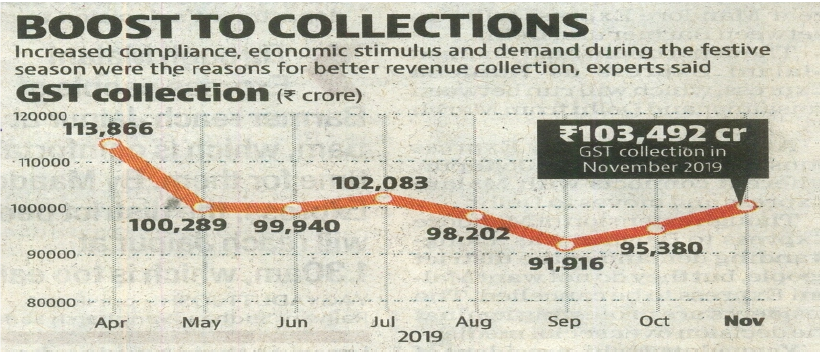

GST Revenue Amidst the gloomy state of economy, 6% growth in GST collection for the month of November, 2019 has come as a ventilator to the depressing economic sentiments. Once again, for eighth time in last 30 months of GST regime, the GST revenue collection has breached one lakh rupees mark in November, 2019. While the Government may attribute this to enhanced voluntary compliances and recent stimulus provided to various sectors, a hard fact is that this growth is majorly due to October being a festive month in India witnessing enhanced commercial activities and spending. Anti evasion measures could also have facilitated compliances and hence rise in taxes. The Goods and Services Tax (GST) collection has bounced back to the ₹ 1 lakh mark in November, 2019 after a gap of three months at ₹ 1,03,492 crore, which is 6% year on year growth. Out of the gross GST revenue collected in November, the amount under CGST was ₹ 19592 crore, SGST ₹ 27,144 crore IGST ₹ 49,028 crore (including ₹ 20,948 crore collected on imports) and cess is ₹ 7,727 crore (including ₹ 869 crore collected on imports).

(Source: Hindustan Times) According to Ministry of Finance, based on a study, it is revealed that Indian household are saving, on average, a monthly ₹ 320 each on consumption of staples such as cereals, edible oil and sugar as well as snacks and sweets under the Goods and Services Tax (GST) regime. = = = = = = = = = = = =

By: Dr. Sanjiv Agarwal - December 4, 2019

|

|||||||||||

| |

|||||||||||

9911796707

9911796707