| Article Section | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RESIDENTIAL STATUS PROVISIONS IMPACTING NRI TAXABILITY AS AMENDED BY FINANCE ACT, 2020 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

RESIDENTIAL STATUS PROVISIONS IMPACTING NRI TAXABILITY AS AMENDED BY FINANCE ACT, 2020 |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

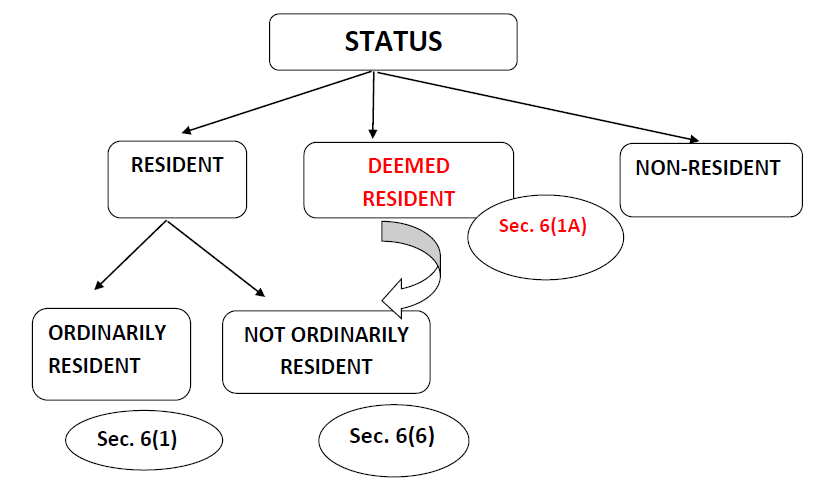

RESIDENTIAL STATUS PROVISIONS IMPACTING NRI TAXABILITY AS AMENDED BY FINANCE ACT, 2020 Taxability: - In the Income Tax Act, 1961, taxability in hands of a person depends on its status of residence

Impact of amendment – Increase in scope of Total Income Increase in scope of total Income: Income that accrues or arise outside India but is derived from business controlled in or profession set up in India to become chargeable to tax in India in the hands of such Individual.

Prior to Finance Act, 2020 Section 6 (Resident in India) (1) The individual is said to be resident if he fulfil any of condition as mentioned in section 6. The said provision is read as under:-

(a) is in India for 182 days or more during the Financial year; or

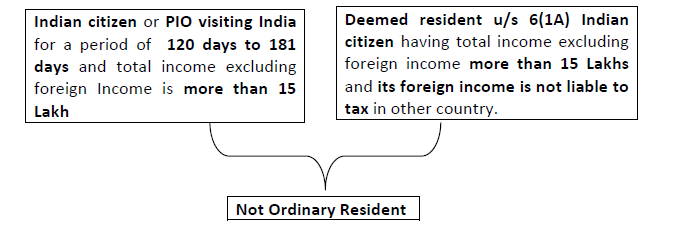

Explanation. 1-In the case of an individual,- In the following two cases the period of 60 days shall be substituted by 182 days. (a) being a citizen of India, who leaves India in any previous year as a member of the crew of an Indian ship or for the purposes of employment outside India. (b) being a citizen of India, or a person of Indian origin, who, being outside India, comes on a visit to India in any previous year. Note 1 :- Explanation 1(a) to section 6 An individual is said to be a resident in India if he fulfills any of the conditions 182 days or 60 days as mentioned in Section 6(1). The explanation 1(a) to section 6 talks about a citizen of India who lives in India as a member of crew of a Indian ship or for purpose of employment outside India. In that case the period of 60 days as mentioned in Section 6(1) was substituted by 182 days. There is no change in explanation 1 to clause a by Finance Act, 2020. Note2:- There is no change in explanation 1(a) in section 6 meaning thereby the period of 182 days shall prevail in case of Indian Citizen who leaves India as a member of crew of Indian ship or for the purpose of employment outside India. Note 3 :- Explanation 1(b) to section 6 An individual was said to be a resident in India up to Finance Act, 2019 if he fulfills any of the conditions 182 days or 60 days as mentioned in section 6(1). The explanation 1(b) to section 6 talks about a citizen of India or person of Indian origin who being outside India comes to visits in India. In that case the period of 60 days as mentioned in section 6(1) was substituted by 182 days. The amendment made by Finance Act, 2020 is as under:- An individual who is an Indian citizen or a person of Indian origin having total income, other than the income from foreign sources, exceeding ₹ 15 lakh in the said case the period for stay in India shall be 120 days. The said amendment is only made in explanation 1(b) to section 6 and only for those person whose total income other than income from foreign sources exceeds ₹ 15 Lakh. Example of income includible while examining the applicability of threshold of ₹ 15 Lakhs

Example of income not includible while examining the applicability of threshold of ₹ 15 Lakhs

Note 4 :- Introduction of Section 6(1A) deemed resident applicable if total income exceeds ₹ 15 lakhs. {Section 6(1A)} “Notwithstanding anything contained in clause (1), an individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding ₹ 15 Lakhs during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature. Therefore, if an Indian citizen having Indian Income more than ₹ 15 Lakh and he is liable to tax on its foreign income in other country then in that case he will be not considered as Deemed Resident.” * The intent of law is to tax such persons who were stateless. The categories of such persons are mainly filmstar or sportsman or other persons. e.g. Mr. A , an Indian Citizen, stayed 40 days in India, 130 days in Singapore, 110 days in England and 85 days in Dubai having Income from INDIA exceeding ₹ 15 lacs. He was not resident in any state due to his lesser stay in all countries. Hence, Stateless and will be covered by the provisions of 6(1A). Continuing this example if he was sportsman then he will be non-resident in India and was liable to special rate of 20% u/s 115BBA. But now as per sec. 6(1A) he will be considered as deemed resident and benefit of special rate of tax will not be available to him. Note 5:- Citizen of India can normally be judged from the passport. If the assessee is holding Indian passport then he is said to be Indian citizen. Stateless persons to be considered as deemed residents –w.e.f. FY 2020-21 • An individual, being a citizen of India, having total income, other than the income from foreign sources*, exceeding ₹ 15lakh rupees during the year shall be deemed to be resident in India in that year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.

• Memorandum to Finance Bill ,2020 explains the intent behind introduction of the provision as under : “The issue of stateless persons has been bothering the tax world for quite some time. It is entirely possible for an individual to arrange his affairs in such a fashion that he is not liable to tax in any country or jurisdiction during a year. This arrangement is typically employed by high net worth individuals (HNWI) to avoid paying taxes to any country/ jurisdiction on income they earn. Tax laws should not encourage a situation where a person is not liable to tax in any country.” • Objective of the provision is to tax such individuals who are stateless persons and are not liable to tax in any country by reason of his residence Section 6(6)- Not Ordinary Resident prior to Finance Act, 2020 Note 6:- (Provision related to not ordinary resident) Earlier an individual/HUF is said to be a not ordinary resident in India in previous year if he is covered by any of the following condition as laid down in Section 6(6). Condition 1:- Such individual or Karta of such HUF has been a non-resident in 9 out of 10 preceding years. or Condition 2:- Such Individual or Karta of such HUF has been in India for a period of less than 730 days during preceding 7 years. Further as per provision of section 5(1) a individual or HUF who has been given a status of not ordinary resident is not liable to pay tax in respect of Income which accrue or arise to him outside India during the relevant previous year. But the income accrue or arise to an individual/HUF outside India from the business/profession set up in India will be taxed in India in case of not ordinary resident. Amendment made in Section 6(6) (NOT ORDINARILY RESIDENT) by Finance Act, 2020. Two new clauses has been added in 6(6) and if Individual/HUF fulfills any of the condition then in that case the person shall be said to a not ordinary resident. The summary of the same is as under:- (a) Such individual or Karta of such HUF has been a non-resident in 9 out of 10 preceding years. or (b) Such Individual or Karta of such HUF has been in India for a period of less than 730 days during preceding 7 years;or (c) a citizen of India, or a person of Indian origin, living outside India and came on visit to India, such individual having total income (other than the income from foreign sources) exceeding ₹ 15 lakhs during the previous year and who has been in India for a period exceeding 120 days but less than 182 days. or (d) a citizen of India who is deemed to be a resident as per section 6(1A). Therefore, if every Indian citizen whose income in India excluding foreign income except income from business/Profession controlled from India exceeds ₹ 15 lakhs and he is not liable to tax on foreign income in any other country by reason of his domicile or any other criteria. For Example:-

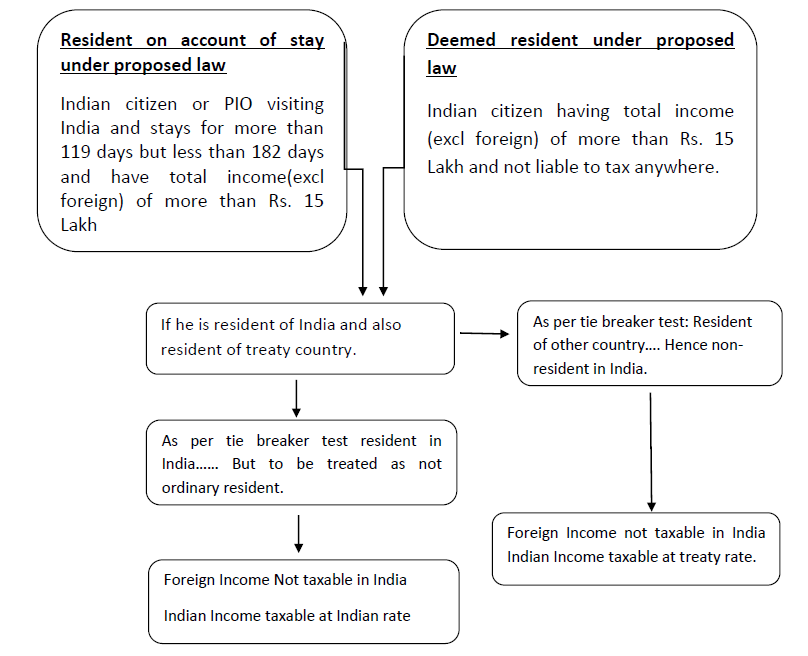

What is the importance of Section 6 with respect of Double Taxation Avoidance Agreement?

(Article 1)

Status of residence of an individual under DTAA – General Tie Breaker Rule.

As per section 90(4) provides that the non-resident to whom the agreement referred to in sec. 90(1) applies shall be allowed to claim relief under such agreement if TAX RESIDENCE CERTIFICATE obtained by him from the government of that country or specified territory, is furnished declaring his residence of the country outside India or specified territory outside India, as the case may be. Effect on tax by shifting status from Non Resident to Not Ordinary Resident

Note: - The definition of non-resident has been discussed in sec. 2(30) and as per the definition a non-resident means a person who is not a “resident”( and not for the purpose of sec. 92,93 and 168). Therefore the status of not ordinary resident will be covered under resident. However for applicability of transfer pricing provisions the not ordinary resident will come under the category of non-resident. Concessional tax rates available to non-residents under the Act:–

IMPACT OF PROPOSED AMENDMENT ON TWO CATEGORIES OF NRIs

Impact of amendments – summary Once an individual qualifies as not-ordinarily resident pursuant to the amendment, the following consequences will follow:

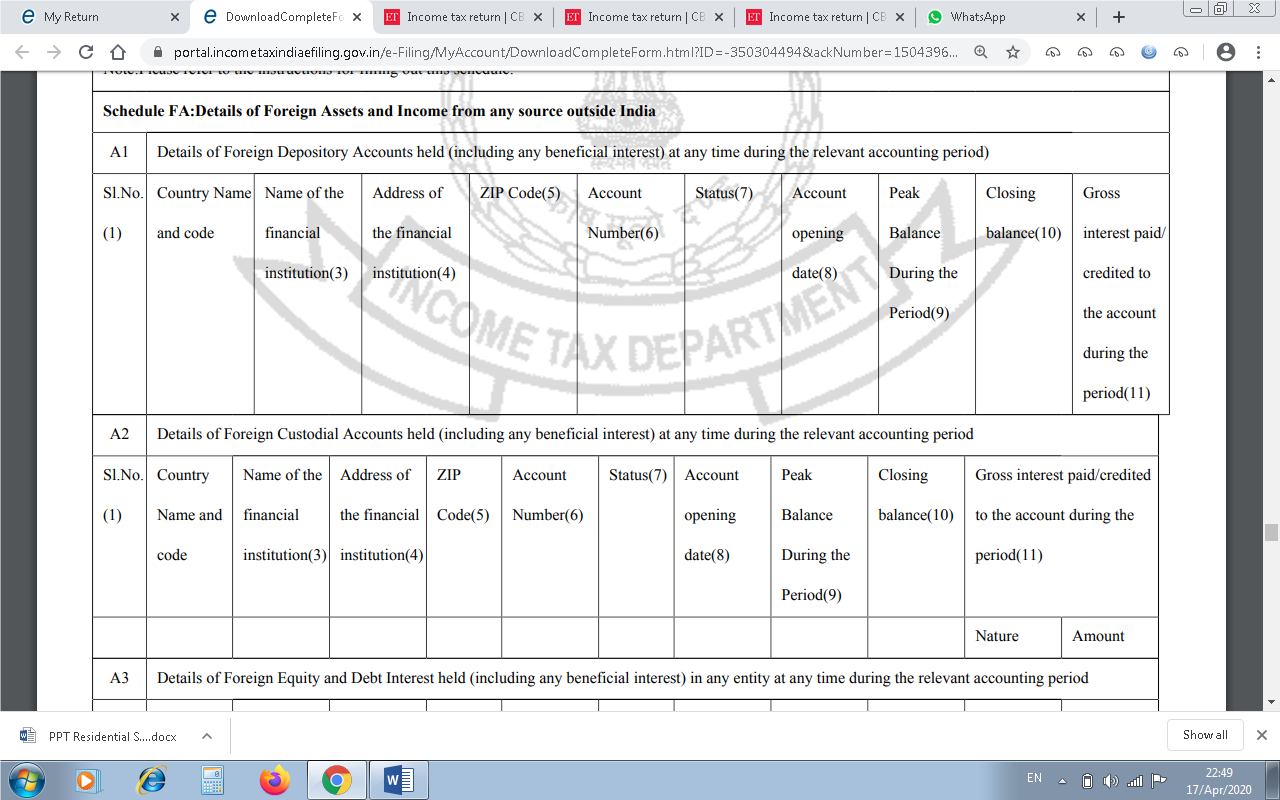

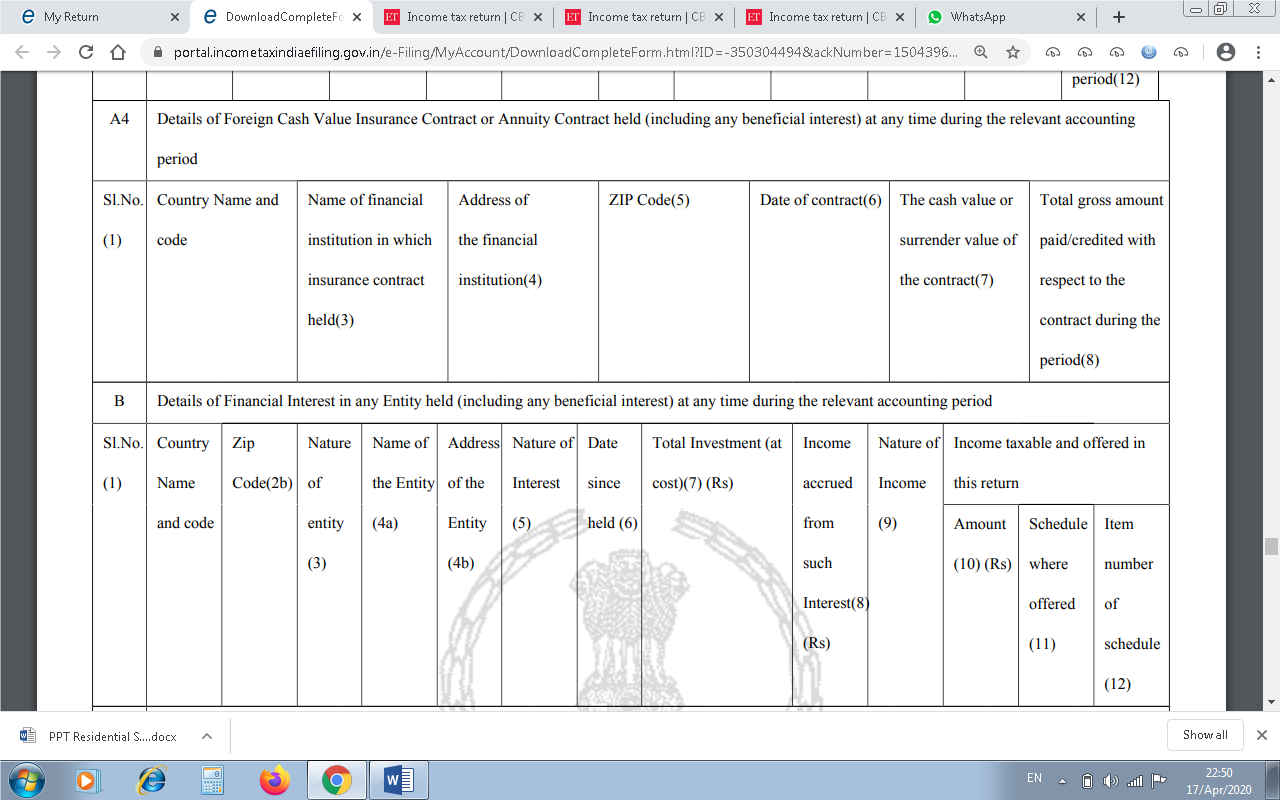

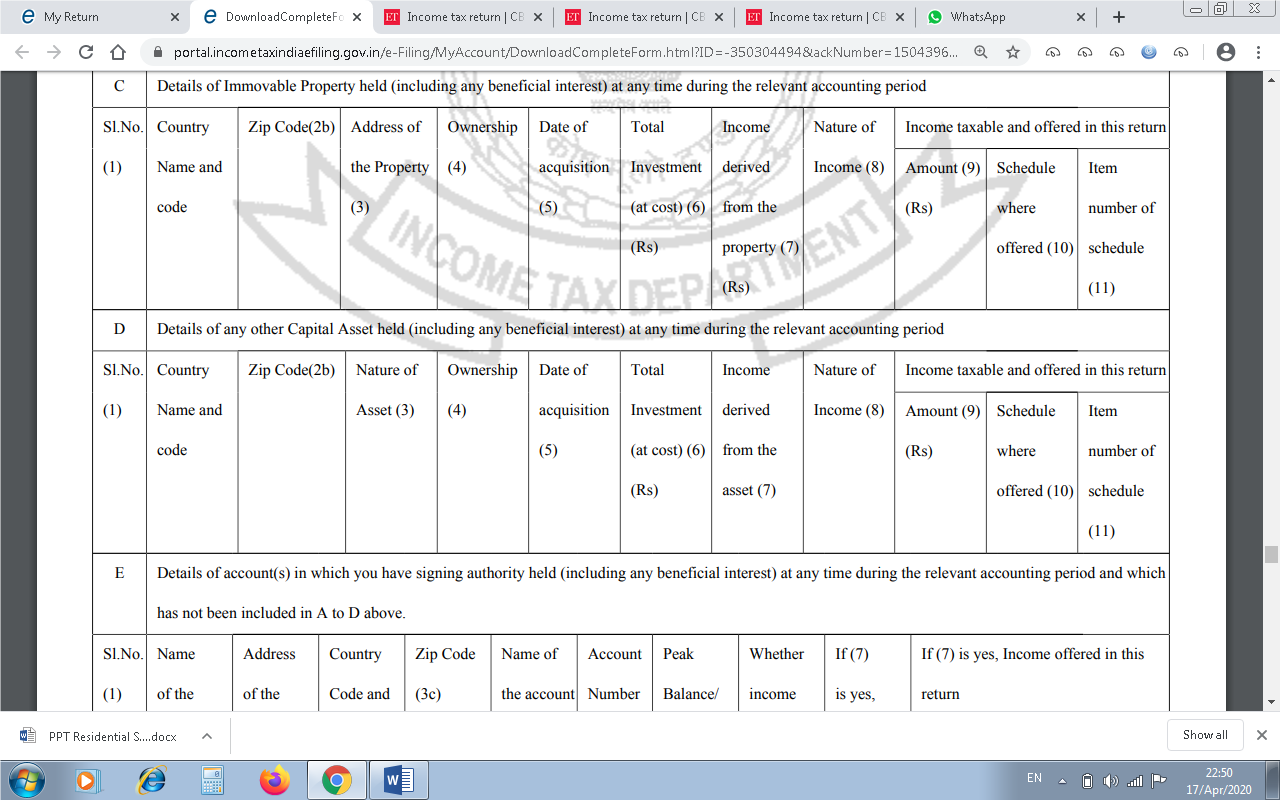

Note:- The most crucial points are that on becoming resident he has to disclose all his foreign assets. As per sec. 139(1) read with 4th proviso to sec 139(1), a person who (a) holds, as a beneficial owner or otherwise, any asset (including any financial interest in any entity) located outside India or has signing authority in any account located outside India; or (b) is a beneficiary of any asset (including any financial interest in any entity) located outside shall furnish, on or before the due date, a return in respect of his income or loss for the previous year in such form and verified in such manner and setting forth such other particulars as may be prescribed:” Now the scope of assessment for AO has been increased as he will now see all the foreign income must be from legitimate source. SCREENSHOT OF SCHEDULE OF FOREIGN ASSETS AS SHOWN IN ITR IS REPRODUCED HERE FOR YOUR READY REFERENCE:-

Issues due to COVID-19: Issue:- The persons who are forcefully locked down in India due to COVID-19, whether any benefit will be available to them? Answer:- As of now there is no notification from the government regarding this issue. However, in the Case of SURESH NANDA VERSUS ASSISTANT COMMISSIONER OF INCOME-TAX, CENTRAL CIRCLE-13(2012 (7) TMI 772 - ITAT DELHI), the assessee was allowed to take the benefit of forceful lock down under the provision of some other Act. In this case it is held that:- “Determination of assessee's Residential status - Held that:- Going abroad for the purpose of employment only means that the visit and stay abroad should not be for other purposes such as a tourist, or for medical treatment or for studies or the like. Going abroad for the purpose of employment therefore means going abroad to take up employment or any avocation which takes in self-employment like business or profession. Thus taking up own business by the assessee abroad satisfies the condition of going abroad for the purpose of employment covered by Explanation (a) to section 6(1)(c). Therefore the Tribunal has rightly held that for the purpose of the Explanation, employment includes self employment like business or profession taken up by the assessee abroad - The determinative test for the status of Non Resident being number of days of stay in India and in assessee's case in these three years, the days of stay being less than 182 days; the status to be applied in this case is to be held as Non Resident as claimed by assessee. Thus, the assessee will be liable to tax on income accrued in India only. The assessee's grounds in this behalf are allowed.” Assessee can take benefit of this case, but the same has to decided by judiciary.

By: ROHIT KAPOOR - April 22, 2020

Discussions to this article

Thanks Mr. Rohit Kapoor for such a good article. A few clarifications are required : (1) I think, Finance Ministry/ CBDT had clarified quite sometime back that only Resident who is ordinarily resident is required to disclose foreign assets. This obligation is not with Resident but not ordinarily resident. Your article says other wise. Could you please confirm? (2) Ref example cited in the article on residency abroad as provisioned in new section 6(1A). What if the so called 'Stateless person' earns income abroad which is taxable in that country say in your example, if the person earns salary in Singapore during his 130 days' stay there? Will he still be considered as 'deemed resident' in India even if he stayed for 40 days in India? Regards Debtosh Dey

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707

.jpg)