PROVISIONS OF CHARITABLE TRUST AS AMENDED BY FINANCE ACT, 2020

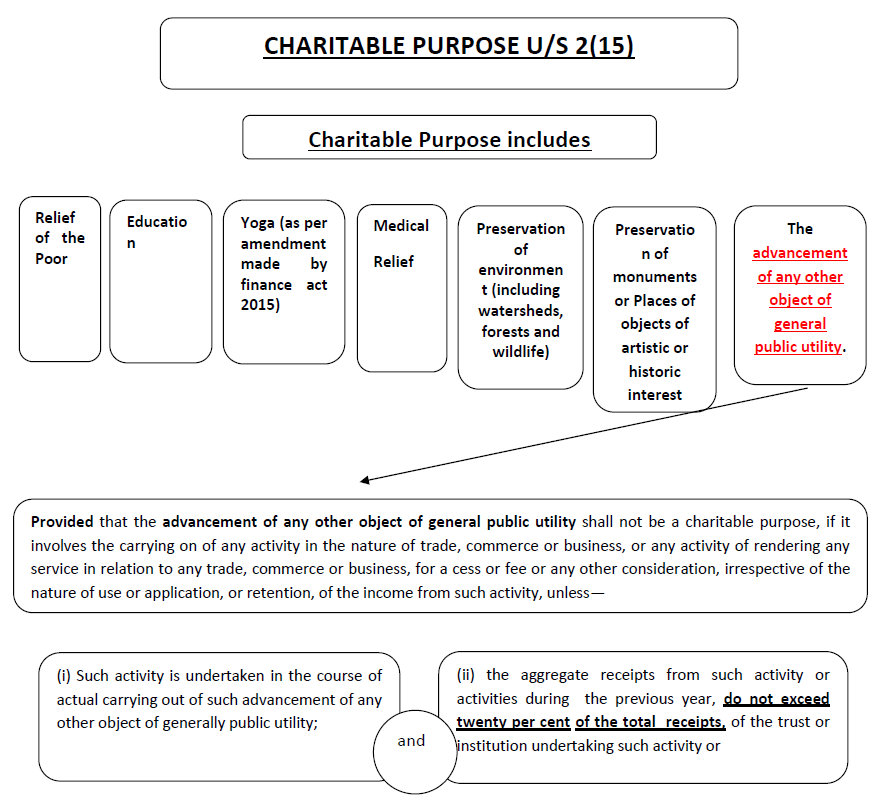

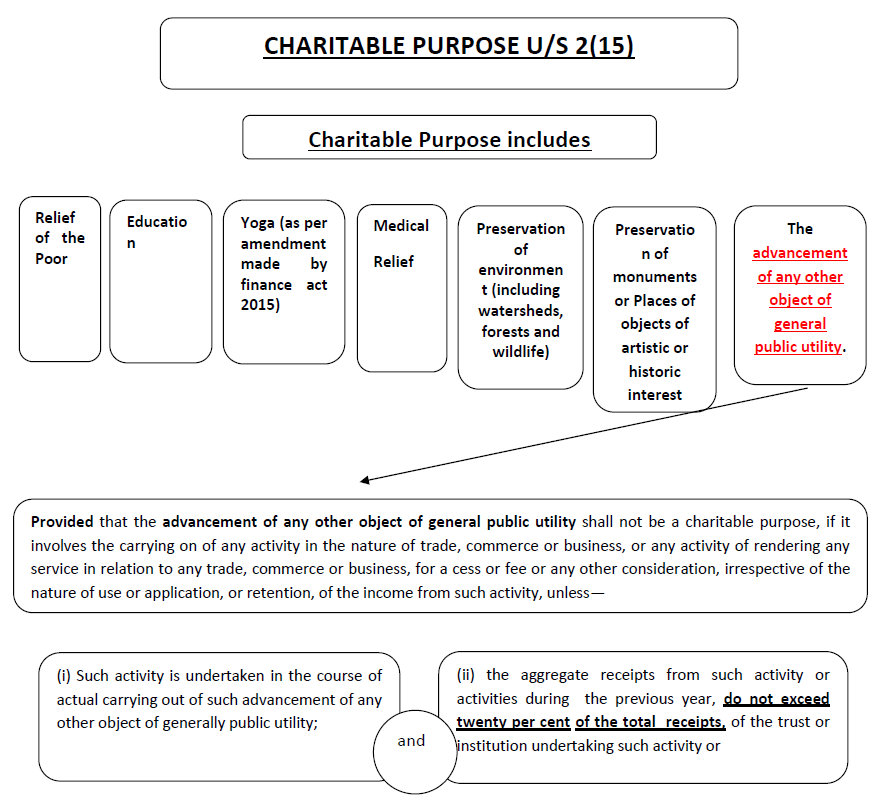

Note: Any institution for being recognized as public charitable institution should have its objects falling within the meaning of “CHARITABLE PURPOSE” as defined u/s 2(15) of Income Tax Act, 1961.

Note 1:- The promotion of sports and games is considered to be charitable purpose within the meaning of sec. 2(15). Therefore an association or institution engaged in promotion of sports and games can claim exemption u/s 11. The same view has been held by many courts. 2020 (1) TMI 565 (Gujarat High Court). The CIT(E) vs. Baroda Cricket Association, 2019(11) TMI 35 (Director of Income Tax Exemption vs. Gujarat Cricket Association)

Note 2:- The surplus cannot be taken as a base to establish that such an activity is in the nature of trade, commerce or business. The same view has been held by the apex court in the case of Queen’s Educational Society vs. CIT 2015 (3) TMI 619 - SUPREME COURT where it is held that:-

- Where an educational institution carries on the activity of education primarily for educating persons, the fact that it makes a surplus does not lead to the conclusion that it ceases to exist solely for educational purposes and becomes an institution for the purpose of making profit.

- The predominant object test must be applied - the purpose of education should not be submerged by a profit making motive.

- A distinction must be drawn between the making of a surplus and an institution being carried on "for profit". No inference arises that merely because imparting education results in making a profit, it becomes an activity for profit.

- If after meeting expenditure, a surplus arises incidentally from the activity carried on by the educational institution, it will not be cease to be one existing solely for educational purposes.

Note 2.1:- As per CBDT circular No. 21 dated 27.05.2016 “merely on the basis of excess receipt from commercial activity beyond the cut-off (20% of total receipts during the years, as of now), exemption u/s 12AA would not be cancelled.” The process for cancellation of registration to be initiated strictly to be in accordance with sec. 12AA(4). Therefore whatever surplus was generated by the societies the same cannot be held to be the commercial activities if the society’s objects are out of six limbs. But if the trust is merely engaged in commercial activities then exemption cannot be granted to that trust as held in case of Dawn Educational Charitable Trust v. Commissioner of Income-tax*(2014 (10) TMI 911 - SC ORDER) “Section 2(15), read with section 12A, of the Income-tax Act, 1961 - Charitable purpose (Education) - Assessee-trust filed an application for registration under section 12A and claimed exemption on ground that school ran by it was imparting education and, therefore, trust was meant for charitable purpose - High Court by impugned order held that since assessee-trust was running posh school for children of non-resident Indians on commercial lines under guise of charitable purpose, authorities were justified in rejecting application - Whether Special Leave Petition filed against impugned order was to be dismissed - Held, yes [Para 3] [In favour of revenue] “

Note 3:-The word advancement of general public utility does not mean for the benefit of entire mankind or all the persons of entire country or state. The benefit can be referred to a section of public. (Refer Ahmedabad Rana caste association 1971 (9) TMI 8 - SUPREME COURT.

However, the object should not be for the benefit of specified individuals. When the principal object of chamber of commerce is to promote and protect trade, commerce and industry in India or in any part of India, the said object can be treated to be for general public utility. 2002 (12) TMI 8 - SUPREME COURT (DIRECTOR OF INCOME-TAX VERSUS BHARAT DIAMOND BOURSE), CIT vs FICCI -1981 (4) TMI 9 - SUPREME COURT

Note 4:- The proviso given in sec. 2(15) does not apply in respect of first six limbs i.e. relief of the poor, Education, Yoga, Medical relief, Preservation of environment( including watersheds, forests and wildlife) and preservation of monuments. Therefore the purpose of a trust or institution is to provide relief of the poor, Education etc. , it will constitute “charitable purpose” even if it is incidentally involved carrying on commercial activity. The above restriction applies only to entities whose purpose is advancement of any other object of general public utility. This is as per Board’s circular no. 11/2008. The relevant case laws in this regard are as follows:-

- 2020 (3) TMI 694 - SC ORDER Commissioner of Income-tax, (Exemption) Delhi v. Delhi Bureau of Text Books* “Section 2(15), read with sections 11 and 12, of the Income-tax Act, 1961 - Charitable purpose (Education) - Assessment years 2006-07 to 2009-10 - Assessee society was exclusively engaged in printing, publication and distribution of text books to schools - Books were provided by assessee at subsidized rates or even free - Assessee claimed exemption under sections 11 and 12 - Assessing Officer denied exemption - High Court by impugned order held that since activity of preparation and distribution of text books certainly contributed to process of training and development of mind and character of students, same was connected to education, therefore, Assessing Officer was unjustified in holding that activities of assessee fell under 4th limb of section 2(15), i.e. advancement of any other object of general public utility and that its activity were not solely for purpose of advancement of education - It further held that merely because assessee had generated profits out of activity of publishing and distribution of school text books, it could not be concluded that it ceased to carry on charitable activity of education - Whether special leave petition filed against impugned order was to be dismissed as withdrawn due to low tax effect - Held, yes [Paras 22, 27 and 28][In favour of assessee] “

- Institute of Chartered Accountants of India v. Director General of Income-tax (Exemptions), Delhi “Section 2(15), read with 10(23C), 11 and 13 of the Income-tax Act, 1961 - Charitable/religious purpose - Charitable/religious institution [Registration] - Assessment years 2006-07 to 2011-12 - Whether, purport of first proviso to section 2(15) is not to exclude entities which are essentially for charitable purpose but are conducting some activities for a consideration or fee, but to exclude organizations which are carrying on regular business from scope of charitable purpose - Held, yes - Whether, therefore, where dominant objective of assessee-institute was to regulate profession of Chartered Accountancy in India, and conducting extensive educational program, conducting coaching classes and campus placements, for fees, could not be held as business, but only as in aid of its objects - Held, yes - Whether, where functions performed by assessee institute were in genre of public welfare and not for any private gain or profit, it could not be said that assessee was involved in carrying on any business, trade or commerce and therefore, registration under section 10(23C)could not be denied - Held, yes [Para 77] [In favour of assessee]”

- 2018 (11) TMI 653 - SC ORDER Director of Income-tax (Exemptions) v. Delhi Public Schools Society* “Assessee society was set up with main object to establish educational institutions - Assessee had been enjoying exemption under section 10(22) since assessment year 1977-78 and in view of substitution of section 10(22) with section 10(23C)(vi) with effect from 1-4-1999, assessee applied for approval of exemption under section 10(23C)(vi) for assessment year 2008-09 onwards - Additional Director rejected assessee's application on grounds that assessee had entered into franchise agreements for opening schools and franchisee fee received by it from satellite schools in lieu of its name, logo and motto amounted to a 'business activity' with a profit motive and no separate books of account were maintained by assessee for business activity as required under section 11(4A) - High Court by impugned order held that since assessee had maintained accounts in compliance to seventh proviso to section 10(23C)(vi) and section 11(4A) which was audited in detail and, further, surpluses accrued in form of franchisee fee from satellite schools were feedback into maintenance and management of assessee schools themselves, assessee had fulfilled requirements to qualify for exemption under section 10(23C)(vi) - Whether Special Leave Petition filed against impugned order was to be dismissed - Held, yes [Paras 30, 31 and 33] [In favour of assessee]”

- Commissioner of Income-tax (Exemptions) v. Pratham Institute for Literacy Education & Vocational Training* “Section 2(15), read with section 12AA of the Income-tax Act, 1961 - Charitable purpose (Objects of general public utility) - In course of appellate proceedings, Tribunal opined that primary object of assessee trust was to carry out work in area of research, studies, training, education, health etc. only for charitable purpose within meaning of section 2(15) - Tribunal thus allowed assessee's claim for registration under section 12AA - High Court confirmed order passed by Tribunal - Whether, on facts, SLP filed against order of High Court was to be dismissed - Held, yes [Para 2] [In favour of assessee] “

- 2019 (6) TMI 583 - ITAT CHANDIGARH M/S JIWAN DASS KARTAR SINGH CHARITABLE TRUST VERSUS THE CIT (E) CHANDIGARH. “Registration u/s 12AA - activity the assessee involved is obtaining a franchisee of Zee Learn Ltd for education - activity are in commercial nature OR Charitable - HELD THAT:- The trust is operating on a commercial basis in conducting of its affairs which consists mainly running of “Kid Zee”. There is no provision for any type of free or concessional education to the poor and needy students. Rather the clauses in the franchisee Agreement makes it binding on the trust not to offer any discounts or concessions as otherwise provided in the Agreement. As per the Clause C & D of the Agreement above the trust cannot even grant credit to the needy students in case of financial crisis and the interest is liable to be charged on day to day basis. Such type of activity cannot be considered as charitable activity.”

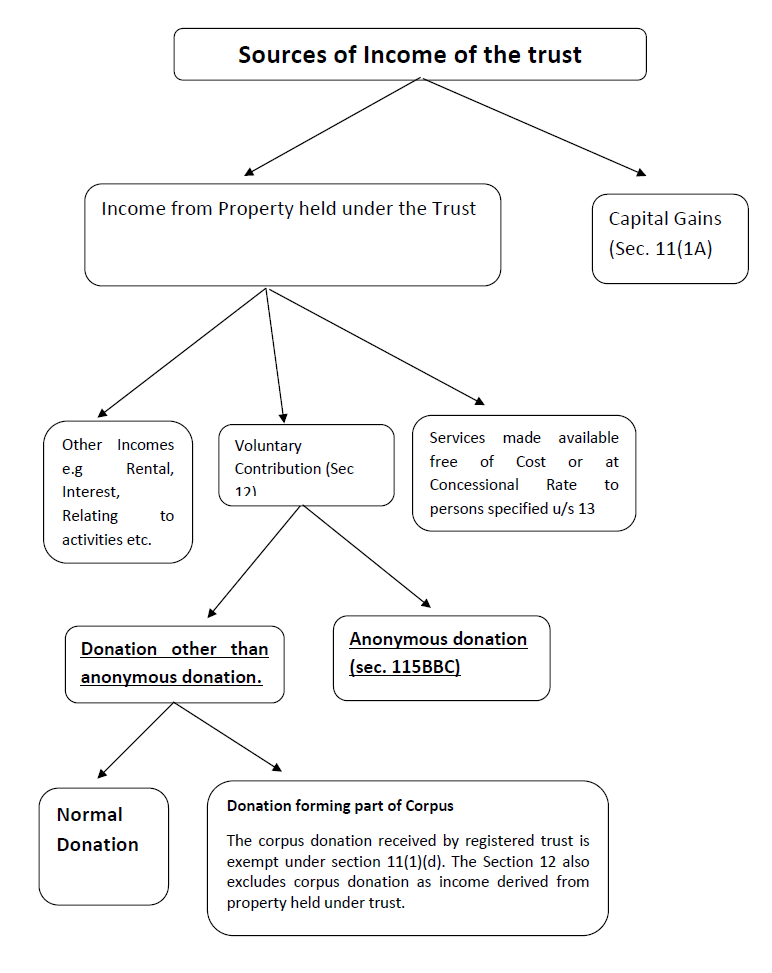

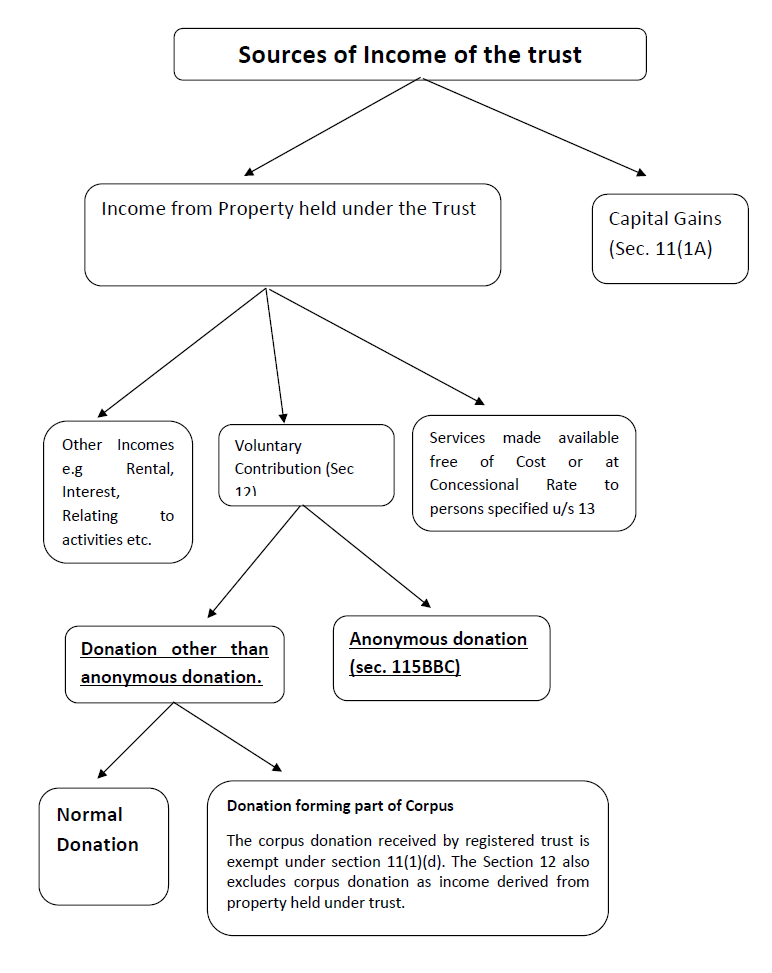

Section 2(24)(iia) Definition of Income

(iia) Voluntary contributions received by a trust created wholly or partly for charitable or religious purposes or by an institution established wholly or partly for such purposes or by an association or institution referred to in clause (21) or clause (23),or by a fund or trust or institution referred to in sub-clause (iv) or sub-clause (v) or by any university or other educational institution referred to in sub-clause (iiiad) or sub-clause (vi) or by any hospital or other institution referred to in sub-clause (iiiae) or sub-clause (via) of clause (23C) of section 10 or by an electoral trust. Explanation.-For the purposes of this sub-clause, "trust" includes any other legal obligation;

Note 1:- The voluntary contribution received by the assessee for specific purpose cannot be regarded as income u/s 2(24)(iia). So far as section 2(24)(iiá) is concerned, this section has to be read in the context of the introduction of the present section 12. It is significant that section 2(24)(iia) was inserted w.e.f. 01-04-1973 simultaneously with the present section 12. Section 12 makes it clear by the words appearing in parenthesis that contributions made with a specific direction that they should form a part of the corpus of the trust or institution shall not be considered as income of the trust. The same view has been affirmed by various Tribunals and high Courts. The said lacuna has been plugged by introducing sec. 56(2)(x) applicable from F.Y. 2017-18.

2020 (3) TMI 496 – (ITAT VISAKHAPATNAM) (ITO (EXEMPTIONS) , GUNTUR. VERSUS M/S. HOSANNA MINISTRIES)

2008 (7) TMI 984 - ITAT CHENNAI (PENTAFOUR SOFTWARE EMPLOYEES VERSUS ACIT)

2011 (1) TMI 1320 - ITAT DELHI (INCOME TAX OFFICER (EXEMPTIONS) , TRUST WARD II, DELHI VERSUS SMT. BASANTI DEVI & SHRI CHAKHAN LAL GARG EDUCATION TRUST)

Relevant Para 6.3:- Now, the question arises whether such corpus donation is taxable as Income or not, even in the cases in which the trust is not registered u/s.12AA of the I.T. Act because for those trusts which are registered u/s.12AA, exemption to corpus donation has been provided as per provisions of section 11(1)(d) For such trust to which registration u/s 12AA has not been provided, it's tax liability is required to be decided with reference to the scheme of the I.T. Act as held in the case of M/s.Pentafour Software Employees Welfare Foundation and further in the case of Smt Basantidevi and Shri Chakan Lala Garg Education Trust, by Delhi High Court in ITA No.5082/2010. In both the cases, it has been held that corpus donation being in the nature of capital receipt are not chargeable to income tax.

Capital Gain Taxability

ILLustration 1 – Showing treatment of capital gains

The following illustration clarifies the treatment of capital gains under section 11(1A).

The computation of capital gain deemed to have been applied for the purposes of section 11(1)(a) is as under :-

|

Cost of the Assets

|

₹ 40,000/-

|

|

Sales Proceeds/Net Consideration

|

₹ 1,00,000/-

|

|

Re-investment in Capital Assets

|

(i) ₹ 80,000/-

|

|

|

(ii)₹ 1,00,000/-

|

|

(i)

|

(ii)

|

(iii)

|

(iv)

|

|

(i)

|

Net consideration

|

1,00,000

|

1,00,000

|

|

(ii)

|

Cost of the Asset

|

40,000

|

40,000

|

|

(iii)

|

Capital gains

|

60,000

|

60,000

|

|

(iv)

|

Investment in New Asset

|

80,000

|

1,00,000

|

|

(v)

|

Capital gains deemed to have been applied for charitable purposes (iii) – (v) (EXCESS OF INVESTMENT OVER COST)

|

40,000

|

60,000

|

|

(vi)

|

Shortfall in re-investment (i) – (iv)

|

20,000

|

NIL

|

Section 11(Income from property held for charitable or religious purposes.)

|

Note 2:- The deemed application to the extent of 15% shall be calculated on the net income from such property.

|

|

Charitable receipts (A)

|

50,00,000

|

|

Corpus donation Sec. 11(1)(d)

|

10,00,000

|

|

Incidental Expenses (B)

|

40,00,000

|

|

Voluntary donation 2(24)(iia)

|

5,00,000

|

|

Dividend Income from mutual funds

|

1,00,000

|

|

Agriculture income

|

60,000

|

|

Net Income after incidental expenses (A-B)

|

10,00,000

|

|

Voluntary donation

|

5,00,000

|

|

Dividend Income from mutual funds

|

1,00,000

|

|

Income from property held under trust (Sec. 12)

|

16,00,000

|

|

Deemed deduction @ 15% *1600000 (Sec. 11(1)(a))

|

90,000

|

|

Furthermore the corpus donation is not to be considered for calculation of 15% and is exempt as per section 11(1)(d) and also refer sec. 2(24)(iia).The agricultural income u/s 10(1) and 10(46) are only exempt for trustas per sec. 11(7) and all the other incomes falling u/s 10 are taxable in the hands of trust.

|

This provision is applicable upto 31-03-2020.

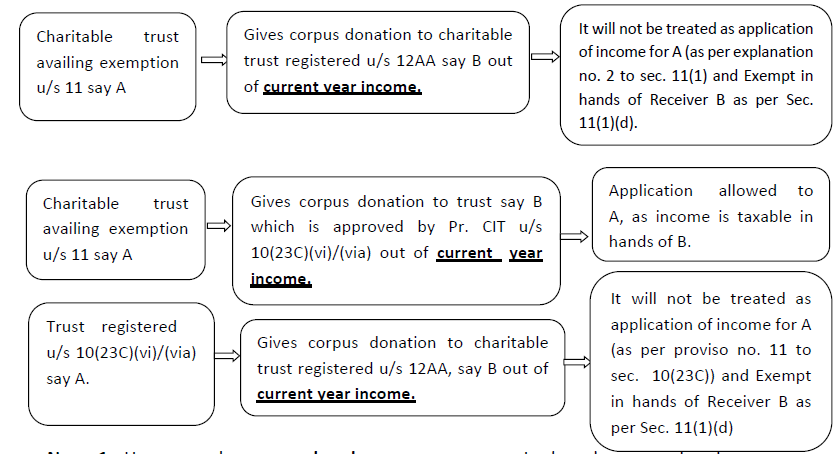

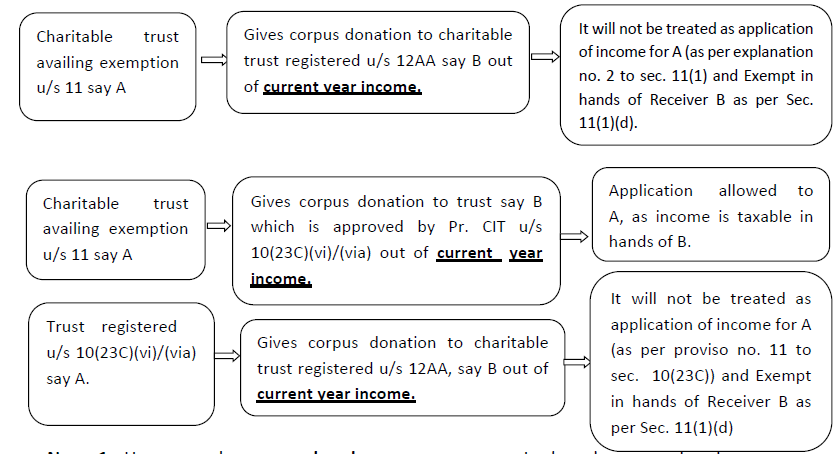

Explanation 2 to section 11(1)

Any amount credited or paid, out of income referred to in clause (a) or clause (b) read with Explanation 1, to any other trust or institution registered under section 12AA, being contribution with a specific direction that they shall form part of the corpus of the trust or institution, shall not be treated as application of income for charitable or religious purposes.”

Note 1: However, the accumulated amounts are required to be spent by the institution on its own and it cannot be Given by way of donations (corpus or otherwise) to any trust registered u/s 12AA or any other institution claiming exemption u/s 10(23C).

Note 2:- The charitable trust is not allowed to apply its income by making donation to non charitable trust.

Note 3:- There were two routes available to the assessee engaged in educational/ hospitals institutions that to opt exemption u/s 10(23C)(vi)/ 10(23C)(via) or to seek registration u/s 12A. In both the routes, there is a difference which is explained as per table given below:-

|

Upto 31.03.2020

|

|

Particulars

|

10(23C)(iv)/(v)/(vi)/(vi-A)

|

11/12

|

|

Return

|

139(4A)

|

139(4C)

|

|

Corpus Donation Received

|

Taxable

|

Exempt 11(1)(d)

|

|

Deemed application of amount not received or any other reason (Sec 11(1)(a) Read with Explanation 1)

|

Not allowed

|

Allowed i.e Not expended due to

Reason that amount was not received or any other reason.

|

|

Application In respect of Corpus

Donation Paid to Registered trust

under section 12 AA

|

Application Not allowed as per 12th proviso as per amendment made by Finance act 2017

|

Application Not allowed as per explanation 2 to section 11 as per

amendment made by Finance act 2017

|

|

Application In respect Corpus Donation Paid to Approved trust under section 10(23C)

|

Allowed because Income in hands of Recipient

|

Allowed because Income in hands of Recipient

|

|

Registration

|

Ist & 2nd Proviso to section 10(23C)

|

12AA

|

|

Assessment

|

The approval granted can be withdrawn if the AO intimate to the CIT to withdraw the exemption. The AO can’t himself withdraw the same.

|

AO can independently deny exemption under this section during assessment proceedings.

|

|

Audit

|

10BB

|

10B

|

|

Tax on accretion Sec. 115TD

|

Not Applicable

|

Applicable

|

Finance Act 2020

Assessee can either obtain registration u/s 12AB or obtain approval u/s 10(23C), but he cannot adopt both as per proviso to Sec. 11(7)

|

Sr. No.

|

Particulars

|

10(23C)(iv)/(v)/(vi)/(vi-A)

|

11

|

|

1

|

Return

|

139(4A)

|

139(4C)

|

|

2

|

Corpus Donation Received

|

Exempt as per Explanation added in 3Rd proviso to section 10(23C)

|

Exempt 11(1)(d)

|

|

3

|

Deemed application of amount not received or any other reason

|

Not allowed

|

Allowed

|

|

4

|

Application In respect of Corpus Donation paid to Registered Trust under Section 12AA

|

Not allowed as per 12th proviso as per amendment made by Finance Act, 2017.

|

Not allowed as per Explanation 2 to Section 11 as per amendment made by Finance Act, 2017.

|

|

5

|

Application in respect corpus Donation paid to Approved trust under Section 10(23C)

|

Application not allowed as per 12th proviso as per amendment made by Finance act, 2020.

|

Application not allowed as per amendment made by Finance Act, 2020 in explanation 8.

|

|

6

|

Registration

|

Ist & 2nd Proviso to Section 10(23C) as substituted by Finance Act, 2020.

|

12A(1)(ac) and 12AB

|

|

7

|

Assessment

|

The approval granted can be withdrawn if the AO intimate to the CIT to withdraw the exemption. The AO can,t himself withdraw the same.

|

AO can independently deny exemption under this section during assessment proceedings.

|

|

8

|

Audit

|

10BB

|

10B

|

|

9

|

Tax on accretion u/s 115TD

|

Not applicable

|

Applicable

|

|

10

|

Tenure

|

5 Years

|

5 Years

|

CORPUS DONATION

- Corpus donations refer to the donations made by a donor to a trust with a specific direction that they shall form part of the corpus of the recipient trust.

- The donor alone can give a specific direction that the donation made by him shall form part of the corpus of the trust. Trustees have no power to treat in their discretion any donation as corpus donation. Such direction may preferably be given by the donor in writing by a letter addressed to the trust. If he has not done so, trustees may request him to give such directions in writing.

- If any contribution is made with a specific direction, that it shall be treated as the capital of the trust for carrying out a particular charitable activity, it satisfies the definition part of the corpus.

- Corpus donations being capital receipt in the hands of the recipient trust are not income of the trust.

- Section 11(1)(d) expressly grants exemption to corpus donations Contributions to corpus fund kept in fixed deposit cannot be taxed as income even if corpus fund is misused .

CIT v Sri Durga Nimishambha Trust 2011 (9) TMI 576 - KARNATAKA HIGH COURT.

Exemption of income from property held under - Assessee received certain amount as contribution towards corpus fund which was kept in fixed deposit - Revenue treated said contribution towards corpus fund as income and levied tax - Tribunal, however, held that contribution made towards corpus fund could not be treated as income for purpose of levying of tax - Whether even if corpus fund was misused, it could not be treated as income and no income-tax could be levied thereon - Held, yes - Whether in such a situation, only cause open for revenue was to seek cancellation of registration granted under section 12A - Held, yes - Whether, in view of aforesaid, impugned order passed by Tribunal was to be upheld - Held, yes [In favour of assessee]

Note:-Manner of Corpus Donation:

The donor alone can give a specific direction that the donation made by him shall form part of the corpus of the trust. Trustees have no power to treat in their discretion any donation as corpus donation. Such direction may preferably be given by the donor in writing by a letter addressed to the trust. If he has not done so, trustees may request him to give such directions in writing. If any contribution is made with a specific direction, that it shall be treated as the capital of the trust for carrying out a particular charitable activity, it satisfies the definition part of the corpus.

Explanation 3 to section 11(1)

Note 1: 30 % of the expenditure will be disallowed when charitable trust was suppose to deduct TDS & it was not deducted and has to be applied for claiming the exemption.

Note 2: No deduction shall be allowed in respect expenditure if payment done by trust exceeds ₹ 10000 & it is done otherwise than by an account payee cheque drawn on a bank or account payee bank draft.

Note 3: Also if expenditure is claimed in particular year & payment is made in subsequent year, & payment exceeding ₹ 10000 is done otherwise than by an account payee cheque drawn on a bank or account payee bank draft then the expenditure will be deemed as income under the head “profits and gains of business or profession” in year of payment.

Note 4: This explanation shall be applicable from 01.04.2019 i.e. w.e.f A.Y. 2019-20.

Section 11(2)

Note 1: The assessee is not able to spend 85% of income or has not opted for deemed application, than in that case, the assessee can still claim exemption u/s 11(2) by furnishing a statement in form 10 and specify the purpose for which such income is accumulated. The maximum period foe accumulation shall not exceed 5 years.

Note 2: The money so accumulated shall be invested as per section 11(5).

Note 3: The form 10 shall be filed before the due date u/s 139.

Note 4: There will be no application of income if the amount so accumulated is used for making donation to any trust registered u/s 12AA or to the institution as mentioned in 10(23C)(v)/(vi)/(via). The same is as per Explanation to section 11(2). The donation here means whether voluntary or corpus donation.

Explanation.-Any amount credited or paid, out of income referred to in clause (a) or clause (b) of sub-section (1), read with the Explanation to that sub-section, which is not applied, but is accumulated or set apart, to any trust or institution registered under section 12AA or to any fund or institution or trust or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of clause (23C) of section 10, shall not be treated as application of income for charitable or religious purposes, either during the period of accumulation or thereafter.

Sec. 11(3):- Withdrawal of Exemption granted to Income accumulated u/s 11(2)

The income which is accumulated or set apart in accordance with the provision of Section 11(2), shall become taxable if-

- It is applied to purpose other than charitable or religious purposes;

- It ceases to remain invested in the specified form or modes of deposit; or

- It is not utilized for charitable or religious purposes within the specified accumulation period (which shall not exceed 5 years in respect of income accumulated); or

- It is paid or credited to any trust/institution registered u/s12AA or to any fund/institution/trust/university/other educational institution/hospital/any other medical institution referred to in clauses (iv), (v), (vi), and (via) of Section 10(23C).

Under any of the aforesaid circumstances, the amount involved shall be deemed to be income of the previous year in which it is so misapplied or ceases to be so accumulated or ceases to remain invested or is credited or paid or the previous year immediately following the expiry of the specified accumulation period, as the case may be.

Sec. 11(4): Charitable Trust Carrying on a Business

There is no prohibition on a charitable trust carrying on a business. A charitable trust can claim exemption in respect of property held under trust including a business undertaking. The income from such business shall also qualify for exemption provided the other conditions of sections11 and 12 are fulfilled.

- The income of such business shall be determined in accordance with the provisions of the Act. i.e Section 28 to 44 DB by the AO if a claim is made that income of any such undertaking shall not be included in income of person receiving it.

- Where the income from such business as determined by the Assessing Officer is found to be in excess of the income shown in the accounts, then such excess shall be deemed to have been applied to non-charitable or non-religious purposes and such excess income shall not qualify for exemption.

- As per sec 11(4) income of any business held in trust for charitable purpose shall be eligible for exemption

Sec 11(4A): Any income of a trust being profits and gains of business, shall not qualify for exemption unless the business is incidental to the attainment of the objects of the trust and separate books of account are maintained in respect of such business.

The Supreme Court in the case of Asst. CIT vs. Thanthi Trust 2001 (1) TMI 80 - SUPREME COURT has held that all that is required for the business income of a trust or institution to be exempt from tax is that the business should be incidental to the attainment of objective of the trust or institution. A business whose income is utilised by the trust or the institution for the purposes of achieving the objectives of the trust or the institution is a business which is incidental to the attainment of the objectives of the trust or institution.

Hon’ble Supreme Court in the case of DIT vs. Bharat Diamond Bourse 2002 (12) TMI 8 - SUPREME COURT has held that if the primary or dominant purpose of the institution is charitable and another which by itself, may not be charitable, but is merely ancillary or incidental to the primary or dominant object, it would not prevent the institution from validly being recognized as a charity. The test to be applied is, whether the object which is said to be non- charitable is the main or primary object of the trust or institution or it is ancillary or incidental to the dominant object which is charitable.

Note 1:- A new section 56(2)(x) was introduced by Finance Act 2017 and is applicable from F.Y. 2017-18. As per the provision of this section, if any person receives in any previous year from any person any sum without consideration the aggregate value of which exceeds ₹ 50,000, any immovable property without consideration or for an inadequate consideration(the difference between registered value and stamp duty value is greater than 10% or Rs. 50,000 whichever is higher) or any property other than immovable property without consideration or for inadequate consideration exceeding ₹ 50,000, then in that case the amount shall be taxable in the hands of receiver. The said clause shall not be applicable-

Proviso to sec. 56(2)(x)

VI) from any fund or foundation or university or other educational institution or hospital or other medical institution

or any trust or institution referred to in clause (23C) of section 10; or

- From or by any trust or institution registered u/s 12A or sec. 12AA or sec. 12AB.

- by any fund or trust or institution or any university or other educational institution or any hospital or other medical institution referred to in sub-clause (iv) or sub-clause (v) or sub-clause (vi) or sub-clause (via) of clause (23C) of section 10; or

Meaning there by if any contribution is received by registered charitable trust it will be covered by the above clause. The difficulty will arise in case of all the other charitable trust which are not registered u/s 12A/12AA/12AB/10(23C).

The next question arise that if the amount received by non registered trust is with a specific direction that the same will form part of corpus, in that case the provision of sec. 56(2)(x) may apply

|

Donating forming part of corpus

|

|

Particulars

|

Sec.

10(23C)(iv)(v)(vi)(via)(Registered)

|

Trust claiming exemption Sec.

11(Registered)

|

Sec. 10(23C)(iiiad)(iiiae)

|

Not registered charitable or religious trust

|

|

Corpus donation received from individual

|

Exempt as per explanation added by Finance Act 2020 in third proviso. 56(2)(x) not applicable covered by Proviso VIII

|

Exempt as per

sec. 11(1)(d)

56(2)(x) not applicable covered by Proviso VII

|

Exempt, being part of Income as the Aggregate Receipts are below ₹ 1 crore.

Note 1:-However, the corpus donation received will not be considered for calculation of annual receipts of ₹ 1 crore by relying upon the various judgment of courts.

Note 2:- The AO will try to invoke sec. 56(2)(x) and the same will be treated as income and will be Exempt as annual Receipts are below ₹ 1 crore, being all Incomes Exempt.

|

Will be plugged u/s 56(2(x) provided donation excceds ₹ 50000/-.

(The reliance on the case laws that it will not form part of income u/s 2(24)(iia) are not relevant after Finance Act 2017.)

|

|

Corpus donation received from registered trust u/s 12AA

|

Exempt as per explanation added by Finance Act 2020 in third proviso.

56(2)(x) not

|

Exempt as per sec. 11(1)(d) 56(2)(x)not applicable covered by Proviso VII

|

Note1:-The corpus donation will not be considered for calculation of annual receipts of ₹ 1 crore by relying upon the various judgment of courts.

Note 2:- The same is covered by proviso (VII) to sec. 56(2)(x) and will not form part of Income.

|

Sec. 56(2)(x) will not be applicable as per proviso (VII) to sec. 56(2)(x). Moreover, it will not form part of income otherwise also, as Corpus Donations are not covered u/s

|

|

Corpus donation received from Institution approved under sec.

10(23C)(iv)(v)(vi)(via)

|

Exempt as per explanation added by Finance Act 2020 in third proviso.

56(2)(x) not applicable covered by Proviso VI/VIII

|

Exempt as per sec. 11(1)(d)

56(2)(x)not applicable covered by Proviso VI/VII

|

Being covered by Proviso VI to Section 56(2)(x) will not form part of Income.

Note 1:-Moreover, the corpus donation received will not be considered for calculation of annual receipts of ₹ 1 crore by relying upon the various judgment of courts.

|

Sec. 56(2)(x) will not be applicable as per proviso (VI) to sec. 56(2)(x).

Moreover, it will not form part of income otherwise also, as Corpus Donations are not covered u/s 2(24)(iia).

|

|

Voluntary Donation Received from other than 10(23C) or 12AA trusts/institutions

|

Income due to 2(24)(iia). Application required Covered by proviso VIII to 56(2)(x)

|

Income due to 2(24)(iia). Application required Covered by proviso VII to 56(2)(x)

|

Income due to 2(24)(iia), but exempt as gross receipts less than 1 crore.

Note :-The voluntary donation will not be considered for calculation of annual receipts of ₹ 1 crore by relying upon the various judgment of courts.

|

The same is treated as income as per 2(24)(iia).

|

In case of PARAM HANS SWAMI UMA BHARTI MISSION VERSUS ASSISTANT COMMISSIONER OF INCOME-TAX. REWARI (2013 (1) TMI 496 - ITAT DELHI), where it is held that:-

“Exemption u/s 10(23)(iiiad) – Whether interest on FDR can be consider as a part of aggregate annual receipt for claiming exemption u/s 10(23C)(iiiad) - Receipts of the assessee during A.Y. 2006-07 including interest on FDRs exceeded Rs. One crore – Society besides income from running of a school is having other sources of income also - Held that:- From the plain reading of section 10(23C) (iiiad), it emerges that legislature had in its mind annual receipts of school or university as the case may be for consideration of exemption limit and not that of total income of society running that school or university.

The income from interest on FDRs is an additional income of society and it cannot be considered to be part of annual receipts of the school for claiming exemption u/s 10(23C)(iiiad) in respect of school. - assessee was eligible for exemption u/s 10(23)(iiiad) as annual school receipts did not exceed Rs. One crore. - In favour of assessee”

Other Case laws on the said matters are as follows:-

- SHRI JAWAHAR SHIKSHAN AVAM PRASHIKSHAN SANSTHAN VERSUS DEPUTY COMMISSIONER OF INCOME TAX, CIRCLE- BHARATPUR (2016 (5) TMI 873 - ITAT JAIPUR)

- THE COMMISSIONER OF INCOME TAX VERSUS MADRASA E-BAKHIYATH-US-SALIHATH ARABIC COLLEGE (2014 (8) TMI 565 - MADRAS HIGH COURT) “Exemption u/s 10(23C)(iiiad) – Sale of bonds and property – Capital receipt or non-recurring receipt - Whether the Tribunal was right in holding that the receipt from the sale of bonds and property had to be excluded from the aggregate receipts received during the year by treating the receipts as capital receipt and non-recurring receipt in nature and thereby arriving at the aggregate receipts of less than 1 Crore and consequently holding that assessee is entitled to exemption under Section 10(23C)(iiiad) – Held that:- CIT(A) while accepting the plea of the assessee that the sale proceeds of land and bonds is capital in nature and not recurring income, 85% of the sale proceeds have been expended by the assessee in furtherance of the object of the Trust – CIT(A) has rightly classified the annual receipts during the financial year 2003-04 being the annual and recurring income of the assessee - The sale proceeds of land and bonds which are capital receipts in nature, are not recurring and are once in a lifetime - The key emphasis is on the words annual receipts - The sale proceeds of land and bonds cannot be equated to annual receipts as stated u/s 10(23C) of the Act - The sale is in the nature of conversion of a capital asset from one form to another no substantial question of law arises for consideration – Decided against Revenue.”

- ASSISTANT COMMISSIONER OF INCOME TAX, CIRCLE-1, ALWAR. VERSUS M/S PUBLIC ROSE SHIKSHA SAMITI,(2015 (9) TMI 129 - ITAT JAIPUR) “Eligibility for exemption U/s 10(23C)(iiiad) - whether annual credit receipt is more than one crore is not eligible for exemption U/s 10(23C)(iiiad) ? - CIT(A) found that total receipts were less than Rs. One crore and allowed exemption - Held that:- On verification of the total receipt mentioned by the Assessing Officer there was a transaction of sale of land for ₹ 47,90,000/-. The Hon’ble Madras High Court has considered the issue of annual receipts as envisaged in Section 10(23C)(iiiad) of the Act in the case CIT Vs. Madrasa EBakhiyath -Us-Salihath Arabic College (2014 (8) TMI 565 - MADRAS HIGH COURT ) wherein the annual receipt, the sale proceed of land and Bond held not to be equated to annual receipts as stated U/s 10(23C)(iiiad) of the Act. If the sale of land to the tune of ₹ 47,90,000/- reduced from the total receipt, it comes within the limit prescribed U/s 10(23C)(iiiad) of the Act. Further the Hon’ble Jurisdictional High Court and Hon'ble Supreme Court’s decision referred by the Assessing Officer has been considered by the Hon’ble Gujarat High Court in the case of Gujarat State Co-operative Union Vs. CIT [1992 (2) TMI 74 - GUJARAT High Court] wherein it has been held that word education was not used in a wide or extended sense so as to include addition to the knowledge of a visitor to a zoo or museum, the High Court held that the museum cannot be taken to be an educational institution existing solely for educational purposes. The object of the samiti as mentioned by the Assessing Officer in his assessment order supports the assessee’s claim that it is an educational institution. The Coordinate Bench has allowed the assessee’s registration U/s 12AA of the Act in financial year 2000-01. - Decided in favour of assessee.

|

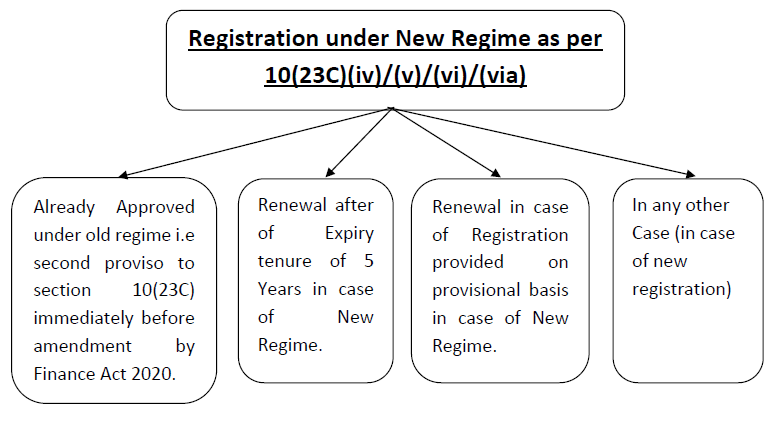

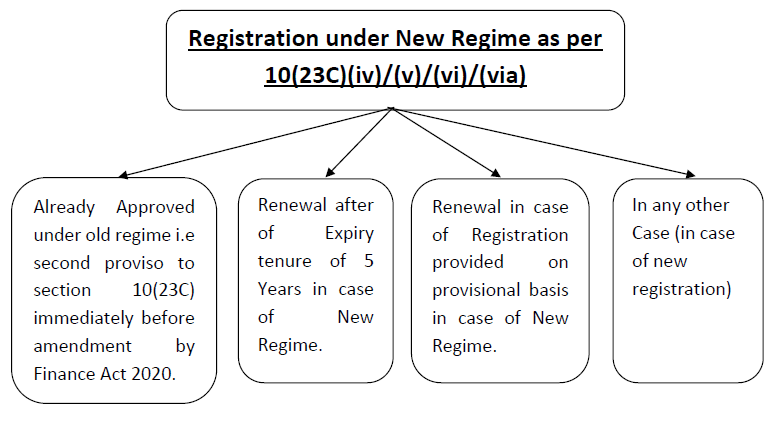

Sr. No

|

Particulars

|

Already Approved under old regime i.e second proviso to section 10(23C) immediately before amendment by Finance Act 2020.

|

Renewal after of Expiry tenure of 5 Years in case of New Regime.

|

Renewal in case of registration provided on provisional basis in case of New Regime

|

In any other Case (in case of

new registration)

|

|

1

|

Period to apply for registration

|

The said institution shall make an application at any time w.e.f. 1st June, 2020 but before 31st August, 2020. There is no extension of this period till now due to COVID 19 as same was not time barred by 30th June 2020.

{As per clause (i) to First Proviso to section 10(23C)}

|

The application shall be made at least 6 months prior to expiry of the said period. Therefore, if registration is granted on 20th September 2020 and the said registration will get expired on 31st March 2025. Therefore, the application for renewal shall be made before 30th September 2024 from 01.04.2025 for 5 years.

{As per clause (ii) to First Proviso to section 10(23C}

|

The application shall be made within 6 months prior to expiry of provisional registration or within 6 months from commencement of activities, whichever is earlier.

The trust applied for registration in the month of Nov 2020 and the registration was granted within 1 month from the end of the month in which application is made. Therefore, the registration must have been granted by 31st Dec 2020. The said provisional registration shall be valid for AY 2021-22, 2022-2023 and 2023-2024. The society commences its activities on 01.08.2021. In the given case the registration has to be applied before 31.01.2022 as per the following calculation.

Case 1: 30.09.2022

Case2: 31.01.2022, whichever is earlier

{As per clause (iii) to First Proviso to section

10(23C}

|

The application shall be made at least one month prior to the commencement of the previous year relevant to the- assessment year from which the said approval is sought. That is any time before 28th Feb of relevant year.

There is a drafting error in this provision, as the word previous year should not be there. E.g

for a trust created on June, 2020, as per current provision, the time period for claiming exemption for P.Y 2020-2021 expires on 28 Feb, 2020, whereas it should be 28 Feb, 2021.

{As per clause (iv) to First Proviso to section 10(23C}

|

|

2

|

Period of

Validity

|

The registration shall be valid for a period of 5 years.

{As per clause (i) to second Proviso to section 10(23C) }

|

The PCIT/CIT shall grant or reject the application. The registration if granted, it shall be valid for a period of 5 years.

{As per clause (ii) sub clause (b) to second Proviso of section 10(23C),}

|

The PCIT/CIT shall grant or reject the application. The registration if granted, it shall be valid for a period of 5 years.

{As per clause (ii) sub clause (b) to second Proviso of section 10(23C),}

|

The PCIT/ CIT will grant provisional registration for a period of 3 years from the assessment year from which the registration is sought.

{As per clause (iii) to Second Proviso of section 10(23C),}

|

|

3

|

Documents to be submitted or not?

|

No additional documents required as per the section. The said application is to be filed online and the copy of registration/trust deed can be required to submit it online.

Note 1: To simplify the compliance, it is to make the process of registration completely electronic under which a Unique Registration Number (URN) shall be issued to all new and existing charity institutions.

Note 2: If the trust doesn’t possess the original certificate but have only the registration number than it can file RTI for getting the copy of original certificate.

Note 3: As per Principle of Estoppel even if the institution or trust apply to department for true copy the department cannot deny the same on the principle of estoppel.

|

The PCIT/ CIT shall call the documents or information and can make such inquiry in order to satisfy himself about the genuineness of the activities of trust and can ask for compliance of such requirements under any other law which are material for the purpose of achieving its objects.

As per clause (ii) to Second Proviso to

section 10(23C).

|

The PCIT/ CIT shall call the documents or information and can make such inquiry in order to satisfy himself about the genuineness of activites the trust and can ask for compliance of such requirements under any other law which are material for the purpose of achieving its objects.

As per clause (ii) to Second Proviso to section 10(23C).

|

No documents required as per the section. However, when the forms will be available on the online portal then it may be possible that some attachment like trust deed etc. will be required.

|

|

4

|

Validity of

Registration provided?

|

The registration granted shall be deemed to be valid from the assessment year from which approval was earlier granted to it.

{As per clause (i) to eighth Proviso to section 10(23C)}

|

The registration granted shall be valid from the assessment year immediately following the financial year in which such application is made.”

{As per clause (iii) to eighth

Proviso to section 10(23C)}

|

The registration granted shall be deemed to be valid from the first of the assessment years for which it was provisionally approved.

As per clause (ii) to eighth Proviso to section 10(23C)}

|

The registration granted shall be valid from the assessment year immediately following the financial year in which such application is made.”

{As per clause (iii) to eighth Proviso to section 10(23C)}

|

|

5

|

In how much

period will PCIT/ CIT will grant the exemption?

|

The order for granting

exemption shall be passed within 3 months from the end of the month in which application for registration is received by PCIT/ CIT.

As per Ninth Proviso to section 10 (23C)

|

The order for granting

exemption shall be passed within 6 months from the end of the month in which application for registration is received by PCIT/ CIT.

As per Ninth Proviso to section

10 (23C)

|

The order for granting exemption

shall be passed within 6 months from the end of the month in which application for registration is received by PCIT/ CIT.

As per Ninth Proviso to section 10

(23C)

|

The order for granting

exemption within 1 month from the end of the month in which application for registration is received by PCIT/ CIT.

As per Ninth Proviso to section 10 (23C)

|

Note: The due date for filing of return from AY 2021-22 will be 30th October and audit report has to be uploaded by 30th September

Note: The registrations granted up to 31st May, 2020 will have to make fresh application under new regime. However, the registrations which are pending as on 1st June, 2020 shall be deemed to be application filed under new regime as per proviso 18 to section 10(23C) substituted by finance act 2020 and the registration shall be granted on provisional basis as per clause (iv) of first proviso. That is the registration shall be granted provisionally for 3 Years.

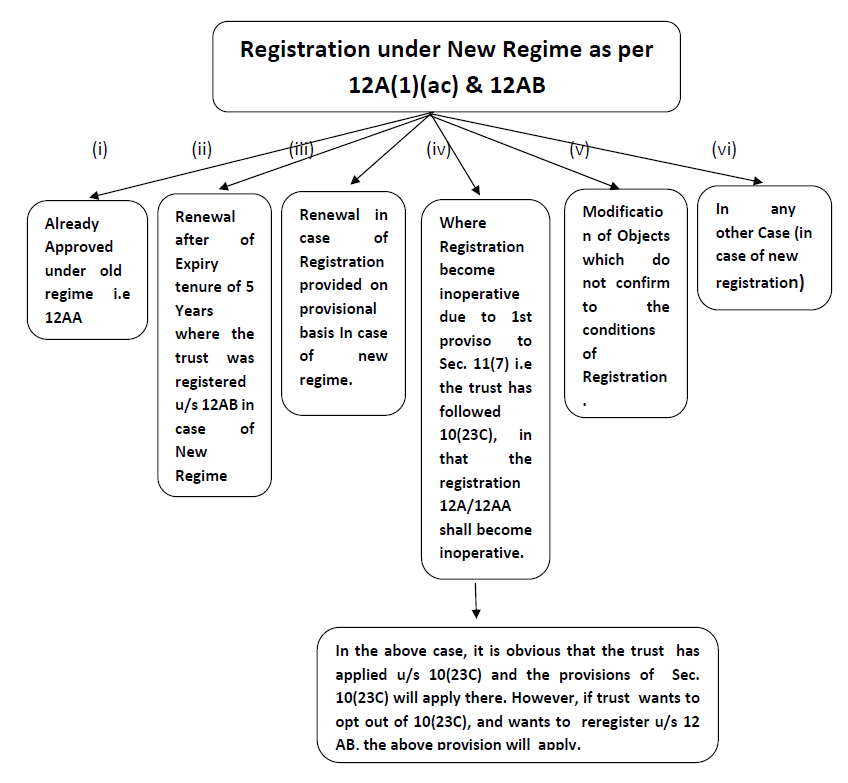

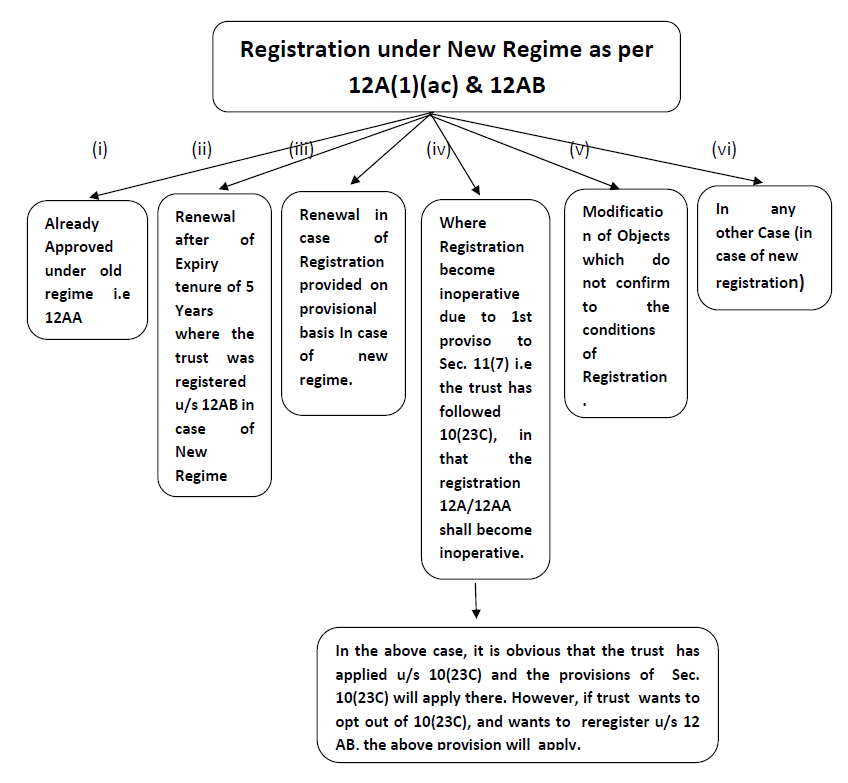

Note 1:- The provisions of Educational Institution as discussed in Sec. 10 (23C ) shall exactly apply in case of (i), (ii), (iii) and (vi) and are not reproduced here in order to avoid duplication.

Note 2:- In the case of (iv) & (v), the PCIT/ CIT shall call the documents or information and can make such inquiry in order to satisfy himself about the genuineness of the activities of trust and can ask for compliance of such requirements under any other law which are material for the purpose of achieving its objects.

Note 3:- The application shall be made in clause (iv), at least Six months prior to commencement of A.Y. for which Registration is sought. i.e Before 30th September and the PCIT shall grant the registration within a period of 6 months calculated from end of the month in which application is received.

Note 4:- The application shall be made in clause (v), within 30 days from the date of modification and the PCIT shall grant the registration within a period of 6 months calculated from end of the month in which application is received.

Note 5 :- There is substitution in sec. 12A(3) which earlier talks about the assessment which were pending at the time of grant of registration. The benefit of section 11 & 12 will be allowed for that assessment year too. This law was applicable up to Finance Act 2019 . However, the amendment has been made in Finance Act 2020 that the benefit of sec. 11 & 12 shall not be allowed for earlier years.

Note 6:- No action u/s 147 shall be taken by AO for any assessment year preceding the A.Y. for non registration of trust.

Cancellation of Registration provided under New Regime

- Any registration granted u/s 12AB(1)(a) or u/s 12AB(1)(b) can be cancelled subsequently if the Principal Commissioner or the Commissioner is satisfied that -

- the activities of the trust or institution are not genuine; or

- are not carried out as per the objects of the trust or institution; or

- the trust or institution has not complied with the requirement of any other law for the time being in force as is material for the purpose of achieving its objects and the order or direction or decree, by whatever name called, holding that such non-compliance has occurred has attained finality or has not been disputed, after giving a reasonable opportunity of being heard to the trust or the institution.

- The enabling provision empowering the Principal Commissioner or the Commissioner to cancel the registration of a Trust or institution in the new section 12AB is on the same line of the existing section 12AA.

MISCELLANEOUS ISSUES

Miscellaneous: Issue No. 1 Are Charitable Trusts allowed to carry forward their losses/deficits of the earlier years for set-off against their incomes of subsequent years?

Ans: The SC in the case of CIT(E) vs Subros Education society that excess expenditure of the earlier years would be allowed to be setoff against income of subsequent years.

2018 (4) TMI 1622 -COMMISSIONER OF INCOME TAX (EXEMPTION) NEW DELHI VERSUS SUBROS EDUCATIONAL SOCIETY

The following question raised in the instant appeal which was not the subject matter of those earlier appeals:

“(a) Whether any excess expenditure incurred by the trust/charitable institution in earlier assessment year could be allowed to be set off against income of subsequent years by invoking Section 11 of the Income Tax Act, 1961?”

To this extent, Mr. K. Radhakrishnan, learned senior counsel appearing on behalf of the applicant/appellant is correct. Therefore, we have heard him on the aforesaid question of law as well but did not find any merit therein. The miscellaneous application is dismissed.

Issue No. 2: Whether investment in fixed deposits would be regarded as utilization for accqisition of new capital asset?

Ans: The board in its CBDT instruction no. 883 dated 24.09.1975 has stated that where the period of FDR is more than 6 months, it would be regarded as utilization of net consideration for acquisition of new capital asset as per Section 11(1A).

Issue No. 3: Whether depreciation and cost of capital asset purchased can be claimed simultaneously as utilization of income?

Ans: The same has been restricted by finance act 2014 by introducing sec 11(6). Therefore, no depreciation is allowed if cost of new asset purchased is claimed as utilization of income or vice-versa.

Issue No. 4: Whether loan raised from bank and acquired capital asset out of it, can application be taken for capital asset so acquired?

Ans: For example if loan raised from bank was 5 crores and self investment by the trust is 2 crores. The total capital asset acquired was 7 crores. In the given case the application can only be made for 2 crores. Besides this, the repayment of loan and interest paid to bank can be separately claimed as utilization.

Issue No. 5: Amount to be carried forward in case of deficit. Example: the total receipts of the trust were 3 crores as against the total utilization of 4 crores. The deemed utilization to the extent of 15% as per section 11(1a) comes to 45 lakhs.

Ans: The amount to be carried forward is 1 crore and not 1.45 crores.

Issue No. 6:- Whether the assessee was entitled for exemption u/s 10(23C) when gross receipts of the assessee society exceeded ₹ 1 Crore from all the four educational Institution?

Ans. As per ruling of Hon’able Court in case of Commisssioner of Income Tax and another vs. Children’s Educational Society (2013 (7) TMI 519- KARNATAKA HIGH COURT) we are of the view that the aggregate annual receipts of each educational institution means, total annual receipts of each educational Institution. Thus assessee can avail exemption u/s 10(23C).

Similar view has been taken in following judgments:-

Anonymous Donations:

Anonymous donations to be taxed in certain cases.

115BBC. (1) Where the total income of an assessee, being a person in receipt of income on behalf of any university or other educational institution referred to in sub-clause (iiiad) or sub-clause (vi) or any hospital or other institution referred to in sub- clause (iiiae) or sub-clause (via) or any fund or institution referred to in sub-clause (iv) or any trust or institution referred to in sub-clause (v) of clause (23C) of section 10 or any trust or institution referred to in section 11, includes any income by way of any anonymous donation, the income-tax payable shall be the aggregate of-

36[(i) the amount of income-tax calculated at the rate of thirty per cent on the aggregate of anonymous donations received in excess of the higher of the following, namely:-

- five per cent of the total donations received by the assessee; or

- one lakh rupees, and

(ii) the amount of income-tax with which the assessee would have been chargeable had his total income been reduced by the aggregate of anonymous donations received.]

The following clause (ii) shall be substituted for the existing clause (ii) of sub-section (1) of section 115BBC by the Finance

(No. 2) Act, 2014, w.e.f. 1-4-2015:

(ii) the amount of income-tax with which the assessee would have been chargeable had his total income been reduced by the aggregate of anonymous donations received in excess of the amount referred to in sub-clause (A) or sub-clause (B) of clause (i), as the case may be.

(2) The provisions of sub-section (1) shall not apply to any anonymous donation received by-

Note 1: The anonymous donation received by the trust established wholly for religious purpose shall be applied in the same manner as voluntary contributions are applied i.e. such income shall become part of income from property held under trust. Therefore, all the provisions of section 11 shall apply.

Note 2: If anonymous donation is received by an university or educational institution or hospitals referred to in section 10(23C)

(iiiad)/(iiiae)/(iv)/(v)/(vi), in that case the following amount of donation shall be taxed @30%.

Higher of the below:

1. 5% of the total donation received by the trust

2. 1,00,000

Note 3: If anonymous donation is received by the trust wholly for religious and charitable purposes, in that case the taxability shall be same as voluntary contribution and the provisions of section 115BBC(1) shall not apply.

Basic Provision of Section 115TD

-

- Trust or institution registered u/s 12AA & 12ab enjoy tax exemption on its income

- Section 115TD provides for charging tax on “accreted income” (past exempted income) of such trust or institution on happening of event.

- The measurement of accreted income is FMV of assets less book value of liabilities on Specified Date.

- Tax on accreted income is to be paid at Maximum Marginal rate (30% currently)

Event: if any of the following event occurs, then section 115TD will be applicable and Trust/institution has to pay tax on accreted income

Case 1: Trust/Institution is converted into any FORM, which is not eligible for grant of registration u/s 12AA. It consist of following 2 situations:-

Case 1(a) Registration under section 12AA/12AB has been cancelled.

Case 1(b) Trust/Institution has undertaken modification of its object, which do not confirm to conditions of registration and

Case 1(b)(i) – has not applied for fresh registration u/s 12AA /12AB( with in a period of 30 days from the date of modification as per section 12A(1)(ab))

Case 1(b)(ii) – has applied for fresh registration u/s 12AA/12AB but application has been rejected

Case 2: Trust/Institute has merged with any other entity, other than entity registered u/s 12AA/12AB and has its object similar to trust/institution

Case 3: Trust/Institution has been dissolved but failed to transfer its assets and liabilities to either Trust/institution registered u/s 12AA/12AB or other institution registered u/s 10(23C)((iv)/(v)/(vi/(via), within period of 12 months from the end of the month in which dissolution take place

|

Previous year in which accreted income is taxable, specified date for computing accreted Income, Payment of tax on accreted income

|

|

Case

|

Situation

|

PY in which accreted Income is

Taxable

|

Specified date for computing

accreted income

|

Date of Payment of Tax (max time)

|

|

1(a)

|

No appeal has been filed against cancellation order.

|

FY in which order is passed by Commissioner cancelling the registration

|

Date of order of Commissioner

cancelling the registration

|

74 (60+14) days from the date, on

which order of Commissioner cancelling the registration is received

|

|

1(a)

|

Appeal is filed but cancellation of registration is confirmed in appellate proceedings

|

FY in which appellate order is

Received

|

Date of order of Commissioner

cancelling the registration

|

14 days from the date on which appellate order is received.

|

|

1(b)(i)

|

Has not applied for fresh registration u/s

12AA/12AB on modification of objects

|

FY in which modification of object is Done.

|

Date on which modification of

object is done.

|

14 days from the end of the previous year in which modification of object is done.

|

|

1(b)(ii)

|

No appeal is filed against order rejecting

Aapplication.

|

FY in which order is passed by Commissioner rejecting the

application.

|

Date on which modification of

object is done

|

74 days from the date, on which order of Commissioner rejecting the application is received.

|

|

Case 1

|

Appeal is filed but rejection of registration in confirmed in appellate

Proceedings

|

FY in which appellate order is

Received.

|

Date of order of Commissioner rejecting the application.

|

14 days from the date on which appellate order is received

|

|

Case 2

|

Trust/Institute has merged with any other entity, other than entity registered u/s 12AA/12AB

|

FY in which merge is done

|

Date of Merger

|

14 days from the date of merger

|

|

Case 3

|

Trust/Institution has been dissolved but

failed to transfer its assets and liabilities with in 12 Months from end of month from which dissolution takes place

|

FY in which 12 months from end of

month in which dissolution take place falls.

|

Date of dissolution.

|

14 days from the date on which said period of 12 months expires.

|

|

Example-1

- Registration of Trust is cancelled on 01/03/2018 and such order is received on 05/03/2018

- No appeal is filed against such order

|

|

PY in which accreted income is taxable

|

Specified Date

|

Date of Payment of tax

|

|

PY 19-20 (FY in which ITAT order is passed received)

|

01/03/2018 (date of order cancelling

registration)

|

14 days from 15/05/2019

|

|

Example-2

Registration of Trust is cancelled on 01/03/2018, appeal is file against said order with ITAT,ITAT confirm cancellation by an order dated 01/05/2019 and order is received on 15/05/2019. No further appeal is filed

|

|

PY in which accreted income is taxable

|

Specified Date

|

Date of Payment of tax

|

|

PY 19-20 (FY in which ITAT order is passed received)

|

01/03/2018 (date of order cancelling

registration)

|

14 days from 15/05/2019

|

|

Example- 3

- Modification of objects of trust is done on 1/2/2018 , which do not confirm to condition of registration u/s 12AA

- No application is made for fresh registration u/s 12AA

|

|

PY in which accreted income is taxable

|

Specified Date

|

Date of Payment of tax

|

|

PY 17-18 (FY in which modification of object is done)

|

01/02/2018 (date of modification of object)

|

14 days from 31/3/2018 (14 days from the

end of the PY in which modification of object is done)

|

|

Example – 4

Modification of objects of trust is done on 1/2/2018, which do not confirm to condition of registration u/s 12AA.

- Application is made for fresh registration u/s 12AA on 1/3/2018

- Order is passed by commissioner rejecting the application on 30/9/18 and order is received on 4/10/2018 and appeal is not filed before ITAT

|

|

PY in which accreted income is taxable

|

Specified Date

|

Date of Payment of tax

|

|

PY 18-19 (FY in which application for fresh registration is rejected)

|

01/02/2018 (date of modification of object)

|

74 days from 04/10/2018.

|

|

Example- 5

- Modification of objects of trust is done on 1/2/2018, which do not confirm to condition of registration u/s 12AA

- Application for registration is rejected; appeal is filed before ITAT, which confirm rejection. ITAT passed the order on 1/6/2019 and order is received on 10/6/2019. No further appeal is filed

|

|

PY in which accreted income is taxable

|

Specified Date

|

Date of Payment of tax

|

|

PY 19-20 (FY in which ITAT order is received)

|

01/02/2018 (date of modification of object)

|

14 days from 10/06/2018.

|

Special point relating to computation of accreted income:-

- Accreted income is FMV of assets and Liabilities of trust/institution as on specified date

- In computing FMV of assets, following assets shall not be included:-

- Assets, which have been acquired directly out of agriculture income referred to in section 10(1).

- Assets which have been acquired between the period beginning from the date on which trust in created and ending on the date on which registration u/s 12AA become effective, if no benefit u/ 11 and 12 is given during said period.

- In case of dissolution of trust , the assets which have been transferred to either Trust/institution registered u/s 12AA or other institution registered u/s 10(23C)((iv)/(v)/(vi/(via), within period of 12 months from the end of the month in which dissolution take place.