| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GST – CONCEPT & STATUS (Updated as on 01st December 2018) |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 5-12-2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GOODS AND SERVICE TAX (GST) CONCEPT & STATUS CENTRAL BOARD OF INDIRECT TAXES AND CUSTOMS (CBIC) DEPARTMENT OF REVENUE MINISTRY OF FINANCE GOVERNMENT OF INDIA AS ON 1st DECEMBER, 2018 The uniform system of taxation, which, with a few exceptions of no great consequence, takes place in all the different parts of the United Kingdom of Great Britain, leaves the interior commerce of the country, the inland and coasting trade, almost entirely free. The inland trade is almost perfectly free, and the greater part of goods may be carried from one end of the kingdom to the other, without requiring any permit or let-pass, without being subject to question, visit, or examination from the revenue officers. ……This freedom of interior commerce, the effect of uniformity of the system of taxation, is perhaps one of the principal causes of the prosperity of Great Britain; every great country being necessarily the best and most extensive market for the greater part of the productions of its own industry. If the same freedom, in consequence of the same uniformity, could be extended to Ireland and the plantations, both the grandeur of the state and the prosperity of every part of the empire, would probably be still greater than at present” – Adam Smith in ‘Wealth of Nations’ 1. INTRODUCTION: Whether it was uniformity of taxation and consequent free interior trade or possession of ‘the jewel in the crown’ at the root of prosperity of Britain is debatable, nonetheless the words of father of modern economics on the benefits of uniformity of system of taxation cannot be taken too lightly. Before implementation of Goods and Service Tax (GST), Indian taxation system was a farrago of central, state and local area levies. By subsuming more than a score of taxes under GST, road to a harmonized system of indirect tax has been paved making India an economic union. 2. CONSTITUTIONAL SCHEME OF INDIRECT TAXATION IN INDIA BEFORE GST : 2.1 Article 265 of the Constitution of India provides that no tax shall be levied or collected except by authority of law. As per Article 246 of the Constitution, Parliament has exclusive powers to make laws in respect of matters given in Union List (List I of the Seventh Schedule) and State Government has the exclusive jurisdiction to legislate on the matters containing in State List (List II of the Seventh Schedule). In respect of the matters contained in Concurrent List (List III of the Seventh Schedule), both the Central Government and State Governments have concurrent powers to legislate. 2.2 Before advent of GST, the most important sources of indirect tax revenue for the Union were customs duty (entry 83 of Union List), central excise duty (entry 84 of Union List), and service tax (entry 97 of Union List). Although entry 92C was inserted in the Union List of the Seventh Schedule of the Constitution by the Constitution (Eighty-eighth Amendment) Act, 2003 for levy of taxes on services, it was not notified. So tax on services were continued to be levied under the residual entry, i.e. entry 97, of the Union List till GST came into force. The Union also levied tax called Central Sales Tax (CST) on inter-State sale and purchase of goods and on inter-State consignments of goods by virtue of entry 92A and 92B respectively. CST however is assigned to the State of origin, as per Central Sales Tax Act, 1956 made under Article 269 of the Constitution. 2.3 On the State side, the most important sources of tax revenue were tax on sale and purchase (entry 54 of the State List), excise duty on alcoholic liquors, opium and narcotics (entry 51 of the State List), Taxes on luxuries, entertainments, amusements, betting and gambling (entry 62 of the State List), octroi or entry tax (entry 52 of the State List) and electricity tax ((entry 53 of the State List). CST was also an important source of revenue though the same was levied by the Union. 3. HISTORICAL EVOLUTION OF INDIRECT TAXATION IN POSTINDEPENDENCE INDIA TILL GST: 3.1 In post-Independence period, central excise duty was levied on a few commodities which were in the nature of raw materials and intermediate inputs, and consumer goods were outside the net by and large. The first set of reform was suggested by the Taxation Enquiry Commission (1953-54) under the chairmanship of Dr. John Matthai. The Commission recommended that sales tax should be used specifically by the States as a source of revenue with Union governments' intervention allowed generally only in case of inter-State sales. It also recommended levy of a tax on inter-State sales subject to a ceiling of 1%, which the States would administer and also retain the revenue. 3.2 The power to levy tax on sale and purchase of goods in the course of interState trade and commerce was assigned to the Union by the Constitution (Sixth Amendment) Act, 1956. By mid-1970s, central excise duty was extended to most manufactured goods. Central excise duty was levied on unit, called specific duty, and on value, called ad valorem duty. The number of rates was too many with no offsetting of taxes paid on inputs leading to significant cascading and classification disputes. 3.3 The Indirect Taxation Enquiry Committee constituted in 1976 under Shri L K Jha recommended, inter alia, converting specific rates into ad valorem rates, rate consolidation and input tax credit mechanism of value added tax at manufacturing level (MANVAT). In 1986, the recommendation of the Jha Committee on moving on to value added tax in manufacturing was partially implemented. This was called modified value added tax (MODVAT). In principle, duty was payable on value addition but in the beginning it was limited to select inputs and manufactured goods only with one-to-one correlation between input and manufactured goods for eligibility to take input tax credit. The comprehensive coverage of MODVAT was achieved by 1996-97. 3.4 The next wave of reform in indirect tax sphere came with the New Economic Policy of 1991. The Tax Reforms Committee under the chairmanship of Prof. Raja J Chelliah was appointed in 1991. This Committee recommended broadening of the tax base by taxing services and pruning exemptions, consolidation and lowering of rates, extension of MODVAT on all inputs including capital goods. It suggested that reform of tax structure must have to be accompanied by a reform of tax administration, if complete benefits were to be derived from the tax reforms. Many of the recommendations of the Chelliah Committee were implemented. In 1999-2000, tax rates were merged in three rates, with additional rates on a few luxury goods. In 2000-01, three rates were merged into one rate called Central Value Added Tax (CENVAT). A few commodities were subjected to special excise duty. 3.5 Taxation of services by the Union was introduced in 1994 bringing in its ambit only three services, namely general insurance, telecommunication and stock broking. Gradually, more and more services were brought into the fold. Over the next decade, more and more services were brought under the tax net. In 1994, tax rate on three services was 5% which gradually increased and in 2017 it was 15% (including cess). Before 2012, services were taxed under a ‘positive list’ approach. This approach was prone to ‘tax avoidance’. In 2012 budget, negative list approach was adopted where 17 services were out of taxation net and all other services were subject to tax. In 2004, the input tax credit scheme for CENVAT and Service Tax was merged to permit cross utilization of credits across these taxes. 3.6 Before state level VAT was introduced by States in the first half of the first decade of this century, sales tax was levied in States since independence. Sales tax was plagued by some serious flaws. It was levied by States in an uncoordinated manner the consequences of which were different rates of sales tax on different commodities in different States. Rates of sales tax were more than ten in some States and these varied for the same commodity in different States. Inter-state sales were subjected to levy of Central Sales Tax. As this tax was appropriated by the exporting State credit was not allowed by the dealer in the importing State. This resulted into exportation of tax from richer to poorer states and also cascading of taxes. Interestingly, States had power of taxation over services from the very beginning. States levied tax on advertisements, luxuries, entertainments, amusements, betting and gambling. 3.7 A report, titled "Reform of Domestic Trade Taxes in India", on reforming indirect taxes, especially State sales tax, by National Institute of Public Finance and Policy under the leadership of Dr. Amaresh Bagchi, was prepared in 1994. This Report prepared the ground for implementation of VAT in States. Some of the key recommendations were; replacing sales tax by VAT by moving over to a multistage system of taxation; allowing input tax credits for all inputs, including on machinery and equipment; harmonization and rationalization of tax rates across States with two or three rates within specified bands; pruning of exemptions and concessions except for a basic threshold limit and items like unprocessed food; zero rating of exports, inter-State sales and consignment transfers to registered dealers; taxing inter-State sales to non-registered persons as local sales; modernization of tax administration, computerization of operations and simplification of forms and procedures. 3.8 The first preliminary discussion on transition from sales tax regime to VAT regime took place in a meeting of Chief Ministers convened by the Union Finance Minister in 1995. A standing Committee of State Finance Ministers was constituted, as a result of meeting of the Union Finance Ministers and Chief Ministers in November, 1999, to deliberate on the design of VAT which was later made the Empowered Committee of State Finance Ministers (EC). Haryana was the first State to implement VAT, in 2003. In 2005, VAT was implemented in most of the states. Uttar Pradesh was the last State to implement VAT, from 1st January, 2008. 4. INTERNATIONAL PERSPECTIVES ON GST / VAT: 4.1 VAT and GST are used inter-changeably as the latter denotes comprehensiveness of VAT by coverage of goods and services. France was the first country to implement VAT, in 1954. Presently, more than 160 countries have implemented GST / VAT in some form or the other. The most popular form of VAT is where taxes paid on inputs are allowed to be adjusted in the liability at the output. The VAT or GST regime in practice varies from one country to another in terms of its technical aspects like ‘definition of supply’, ‘extent of coverage of goods and services’, ‘treatment of exemptions and zero rating’ etc. However, at a broader level, it has one common principle, it is a destination based consumption tax. From economic point of view, VAT is considered to be a superior system over sales tax of taxing consumption because the former is neutral in allocation of resources as it taxes value addition. Besides, there are certain distinct advantages of VAT. It is less cascading making the taxation system transparent and antiinflationary. From revenue point of view, VAT leads to greater compliance because of creation of transaction trails. 4.2 When compared globally, VAT structures are either overly centralized where tax is levied and administered by the Central government (Germany, Switzerland, Austria), or dual GST structure wherein both Centre and States administer tax independently (Canada) or with some co-ordination between the national and sub-national entities (Brazil, Russia). While a centralized structure reduces fiscal autonomy for the States, a decentralized structure enhances compliance burden for the taxpayers. Canada is a federal country with unique model of taxation in which certain provinces have joined federal GST and others have not. Provinces which administer their taxes separately are called ‘non- participating provinces’, whereas provinces which have teamed up with the Federal Government for tax administration are called ‘participating provinces’. 4.3 The rate of GST varies across countries. While Malaysia has a lower rate of 6% (Malaysia though scrapped GST in 2018 due to popular uproar against it), Hungary has one of the highest rate of 27%. Australia levies GST at the rate of 10% whereas Canada has multiple rate slabs. The average rate of VAT across the EU is around 19.5%. 5. NEED FOR GST IN INDIA: 5.1 The introduction of CENVAT removed to a great extent cascading burden by expanding the coverage of credit for all inputs, including capital goods. CENVAT scheme later also allowed credit of services and the basket of inputs, capital goods and input services could be used for payment of both central excise duty and service tax. Similarly, the introduction of VAT in the States has removed the cascading effect by giving set-off for tax paid on inputs as well as tax paid on previous purchases and has again been an improvement over the previous sales tax regime. 5.2 But both the CENVAT and the State VAT have certain incompleteness. The incompleteness in CENVAT is that it has yet not been extended to include chain of value addition in the distributive trade below the stage of production. Similarly, in the State-level VAT, CENVAT load on the goods has not yet been removed and the cascading effect of that part of tax burden has remained unrelieved. Moreover, there are several taxes in the States, such as, Luxury Tax, Entertainment Tax, etc. which have still not been subsumed in the VAT. Further, there has also not been any integration of VAT on goods with tax on services at the State level with removal of cascading effect of service tax. 5.3 CST was another source of distortion in terms of its cascading nature. It was also against one of the basic principles of consumption taxes that tax should accrue to the jurisdiction where consumption takes place. Despite remarkable harmonization in VAT regimes under the auspices of the EC, the national market was fragmented with too many obstacles in free movement of goods necessitated by procedural requirement under VAT and CST. 5.4 In the constitutional scheme, taxation powers on goods was with Central Government but it was limited upto the stage of manufacture and production while States have powers to tax sale and purchase of goods. Centre had powers to tax services and States also had powers to tax certain services specified in clause (29A) of Article 366 of the Constitution. This sort of division of taxing powers created a grey zone which led to legal disputes. Determination of what constitutes a goods or service is difficult because in modern complex system of production, a product is normally a mixture of goods and services. 5.5 As can be seen from the previous paragraphs, India moved towards value added taxation both at Central and State level, and this process was complete by 2005. Integration of Central VAT and State VAT therefore is nothing but an inevitable consequence of the reform process. The Constitution of India envisages a federal nature of power bestowed upon both Union and States in the Constitution itself. As a natural corollary of this, any unification of the taxation system required a dual GST, levied and collected both by the Union and the States. 6. GST : A HISTORICAL PERSPECTIVE: 6.1 The Kelkar Task Force on Fiscal Responsibility and Budget Management (FRBM) recommended in 2005 introduction of a comprehensive tax on all goods and service replacing Central level VAT and State level VATs. It recommended replacing all indirect taxes except the customs duty with value added tax on all goods and services with complete set off in all stages of making of a product. 6.2 An announcement was made by the then Union Finance Minister in Budget (2007-08) to the effect that GST would be introduced with effect from April 1, 2010 and that the EC, on his request, would work with the Central Government to prepare a road map for introduction of GST in India. After this announcement, the EC decided to set up a Joint Working Group in May 10, 2007, with the then Adviser to the Union Finance Minister and Member-Secretary of the Empowered Committee as its Co-conveners and four Joint Secretaries of the Department of Revenue of Union Finance Ministry and all Finance Secretaries of the States as its members. This Joint Working Group got itself divided into three Sub-Groups and had several rounds of internal discussions as well as interaction with experts and representatives of Chambers of Commerce & Industry. On the basis of these discussions and interaction, the Sub-Groups submitted their reports which were then integrated and consolidated into the report of Joint Working Group (November 19, 2007). 6.3 This report was discussed in detail in the meeting of the EC on November 28, 2007, and the States were also requested to communicate their observations on the report in writing. On the basis of these discussions in the EC and the written observations, certain modifications were considered necessary and were discussed with the Co-conveners and the representatives of the Department of Revenue of Union Finance Ministry. With the modifications duly made, a final version of the views of EC on the model and road map for the GST was prepared (April 30, 2008). These views of EC were then sent to the Government of India, and the comments of Government of India were received on December 12, 2008. These comments were duly considered by the EC (December 16, 2008), and it was decided that a Committee of Principal Secretaries/Secretaries of Finance/Taxation and Commissioners of Trade Taxes of the States would be set up to consider these comments, and submit their views. These views were submitted and were accepted in principle by the EC (January 21, 2009). Based on discussions within the EC and between the EC and the Central Government, the EC released its First Discussion Paper (FDP) on GST in November, 2009. This spelled out the features of the proposed GST and has formed the basis for discussion between the Centre and the States. 7. CHALLENGES IN DESIGNING GST: 7.1 In the discussion that preceded amendment in the Constitution for GST, there were a number of thorny issues that required resolution and agreement between Central Government and State Governments. Implementing a tax reform as vast as GST in a diverse country like India required the reconciliation of interests of various States with that of the Centre. Some of the challenging issues, addressed in the run up to GST, were the following: 7.2 Origin-based versus Destination-based taxation: GST is a destination based consumption tax. Under destination based taxation, tax accrues to the destination place where consumption of the goods or services takes place. The existing VAT regime was based on origin principle where Central Sales Tax was assigned to the State of origin where production or sale happened and not to the State where consumption happened. Many manufacturing States expressed concerns over the loss of revenue on account of shift from origin based taxation to destination based taxation. 7.2.1 An argument put forward on behalf of producing states in support of origin based taxation is that they need to collect at least some tax from inter-State sales in order to recover the cost of infrastructure and public services provided by the State Governments to the industries producing the goods which are consumed in other states. This line of reasoning is based on the assumption that in the absence of a tax on inter-State sales, the location of export industries within their jurisdiction would not contribute to the tax revenues of the exporting state. This view was missing the fact that any value addition in a jurisdiction necessarily means extra income in the hands of the residents of that jurisdiction. Spending of this income on consumer goods expands the sales tax base of the producing states and thereby contributes to their revenues. In fact, to the extent that consumer expenditures are dependent on the level of income of the residents of a State, it is the producing States that stand to gain the most in additional sales tax revenues (even under the destination basis of consumption taxes) from increased export output. 7.3 Rate Structure and Compensation: There was uncertainty about gains in revenue after implementation of GST. Though attempts were made to estimate a revenue neutral rate, nonetheless it remains an estimate only. It was difficult to estimate accurately as to how much the States will gain from tax on services and how much they will lose on account of removal of cascading effect and phasing out of CST. In view of this, States asked for compensation during the first five years of implementation of GST. 7.3.1 A Committee headed by the Chief Economic Adviser Dr. Arvind Subramanian on possible tax rates under GST suggested RNR (Revenue Neutral Rate). The term RNR refers to that single rate, which preserves revenue at desired (current) levels. This would differ from the standard rate, which is the rate that would apply to a majority of goods and services. In practice, there will be a structure of rates, but for the sake of analytical clarity and precision it is appropriate to think of the RNR as a single rate. It is a given single rate that gets converted into a whole rate structure, depending on policy choices about exemptions, what commodities to charge at a lower rate and what to charge at a very high rate. 7.3.2 The Committee recommended RNR of 15-15.5% (to be levied by the Centre and States combined). The lower rates (to be applied to certain goods consumed by the poor) should be 12%. Further, the sin or demerit rates (to be applied on luxury cars, aerated beverages, pan masala, and tobacco) should be 40%. 7.4 Dispute Settlement: A harmonized system of taxation necessarily required that all stakeholders stick to the decisions taken by the supreme body, which was later constituted as the Goods and Services Tax Council (the Council). However, the possibility of departure from the recommendations of such body cannot be completely ruled out. Any departure would definitely affect other stakeholders and in such circumstances there must be a statutory body to which affected parties may approach for dispute resolution. The nature of such dispute resolution body was a bone of contention. Under the Constitution (One Hundred Fifteenth Amendment) Bill, 2011, a Goods and Services Tax Dispute Settlement Authority was to be constituted for this purpose. This body was judicial in nature. The proposed constitution of this Authority was challenged because it’s powers would override the supremacy of the Parliament and the State Legislatures. The Constitution (One Hundred Twenty Second Amendment) Bill, 2014 departed from the previous GST amendment bill and proposed that the Goods and Services Tax Council may decide about the modalities to resolve disputes arising out of its recommendations. 7.5 Alcohol and Petroleum products: Alcoholic liquor for human consumption and petroleum products are major contributor to revenue of States. As States were uncertain about impact of GST on their finances and moreover loss of autonomy in collection of tax revenue, States unanimously argued for exclusion of these products from the ambit of GST. In the 115th Amendment Bill alcoholic liquor for human consumption and five petroleum products namely crude petroleum, high speed diesel, motor spirit or petrol, aviation turbine fuel and natural gas were kept out of GST. But in the 122nd Amendment Bill, only alcoholic liquor for human consumption was kept outside GST and above mentioned five petroleum products were proposed to be brought under GST from a date to be recommended by the Council. The Central Government has also retained its power to tax tobacco and tobacco products, though these are also under GST. Thus, to ensure smooth transition and provide fiscal buffer to States, it was agreed to keep alcohol completely out of the ambit of GST. 8. CONSTITUTIONAL AMENDMENT: 8.1 As explained above, unification of Central VAT and State VAT was possible in form of a dual levy under the constitutional scheme. Power of taxation is assigned to either Union or States subject-wise under Schedule VII of the Constitution. While the Centre is empowered to tax goods upto the production or manufacturing stage, the States have the power to tax goods at distribution stage. The Union can tax services using residuary powers but States could not. Under a unified Goods and Services Tax scheme, both should have power to tax the complete supply chain from production to distribution, and both goods and services. The scheme of the Constitution did not provide for any concurrent taxing powers to the Union as well as the States and for the purpose of introducing goods and services tax amendment of the Constitution conferring simultaneous power on Parliament as well as the State Legislatures to make laws for levying goods and services tax on every transaction of supply of goods or services was necessary. 8.2 The Constitution (115th Amendment) Bill, 2011, in relation to the introduction of GST, was introduced in the Lok Sabha on 11th March, 2011. The Bill was referred to the Standing Committee on Finance on 29th March, 2011. The Standing Committee submitted its report on the Bill in August, 2013. However, the Bill, which was pending in the Lok Sabha, lapsed with the dissolution of the 15th Lok Sabha. 8.3 The Constitution (122nd Amendment) Bill, 2014 was introduced in the 16th Lok Sabha on 19th December, 2014. The Constitution Amendment Bill was passed by the Lok Sabha in May, 2015. The Bill was referred to the Select Committee of Rajya Sabha on 12th May, 2015. The Select Committee submitted its Report on the Bill on 22nd July, 2015. The Bill with certain amendments was finally passed in the Rajya Sabha and thereafter by Lok Sabha in August, 2016. Further the bill was ratified by required number of States and received assent of the President on 8th September, 2016 and has since been enacted as Constitution (101st Amendment) Act, 2016 w.e.f. 16th September, 2016. 8.4 The important changes introduced in the Constitution by the 101st Amendment Act are the following:

9. GOODS & SERVICE TAX COUNCIL: 9.1 As provided for in Article 279A of the Constitution, the Goods and Services Tax Council (the Council) was notified with effect from 12th September, 2016. The Council is comprised of the Union Finance Minister (who will be the Chairman of the Council), the Minister of State (Revenue) and the State Finance/Taxation Ministers as members. It shall make recommendations to the Union and the States on the following issues:

9.2 The Council shall recommend the date on which the goods and services tax be levied on petroleum crude, high speed diesel, motor spirit (commonly known as petrol), natural gas and aviation turbine fuel. While discharging the functions conferred by this article, the Goods and Services Tax Council shall be guided by the need for a harmonized structure of goods and services tax and for the development of a harmonized national market for goods and services. 9.3 One half of the total number of Members of the Goods and Services Tax Council shall constitute the quorum at its meetings. The Goods and Services Tax Council shall determine the procedure in the performance of its functions. Every decision of the Goods and Services Tax Council shall be taken at a meeting, by a majority of not less than three-fourths of the weighted votes of the members present and voting, in accordance with the following principles, namely: - (a) the vote of the Central Government shall have a weightage of one-third of the total votes cast, and (b) the votes of all the State Governments taken together shall have a weightage of two-thirds of the total votes cast, in that meeting. 9.4 The Council has met for 30 times and no occasion has arisen so far that required voting to decide any matter. The following major recommendations have been made by the Council: (i) The threshold exemption limit would be ₹ 20 lakh. For special category States (except J&K) enumerated in article 279A of the Constitution, threshold exemption limit has been fixed at ₹ 10 lakh. (ii) Composition threshold shall be ₹ 1 Cr. As decided in the 23rd meeting of the Council, this limit shall be raised to ₹ 1.5 Cr after necessary amendments in the Act. Composition scheme shall not be available to interState suppliers, service providers (except restaurant service) and specified category of manufacturers. For special category States (except J&K and Uttarakhand) enumerated in article 279A of the Constitution, threshold exemption limit has been fixed at ₹ 75 lakh. (iii) Existing tax incentive schemes of Central or State governments may be continued by respective government by way of reimbursement through budgetary route. The schemes, in the present form, would not continue in GST. Further, 50% exemption of the CGST portion will be provided to CSD (Defense Canteens). (iv) Recommending GST laws, namely CGST Law, UTGST Law, IGST Law, SGST Law and GST Compensation Law paving the way for implementation of GST. (v) In order to ensure single interface, all administrative control over 90% of taxpayers having turnover below ₹ 1.5 crore would vest with State tax administration and over 10% with the Central tax administration. Further all administrative control over taxpayers having turnover above ₹ 1.5 crore shall be divided equally in the ratio of 50% each for the Central and State tax administration. (vi) Powers under the IGST Act shall also be cross-empowered on the same basis as under CGST and SGST Acts with few exceptions. (vii) Power to collect GST in territorial waters shall be delegated by Central Government to the States. (viii) Formula and mechanism for GST Compensation Cess has been finalized. (ix) Rules on composition, registration, input tax credit, invoice, determination of value of supply, accounts and records, returns, payment, refund, assessment and audit, advance ruling, appeals and revision, transitional provisions, anti-profiteering, E-way Bill, inspection, search and seizure, demands and recovery and offences and penalties have been recommended. (x) The following classes of taxpayers shall be exempted from obtaining registration:

(xi) The reverse charge mechanism under sub-section (4) of section 9 of the CGST Act, 2017 and under sub-section (4) of section 5 of the IGST Act, 2017 has been suspended till 30.09.2019. (xii) There shall be no requirement on payment of tax on advance received for supply of goods by all taxpayers. (xiii) Supply from GTA to unregistered persons has been exempted from tax. (xiv) TDS/TCS provisions to be implemented from 01.10.2018. Further, to provide some more time to TDS deductor to familiarize themselves with the new system, last date for furnishing return in FORM GSTR-7 for the months of October, November & December has been extended upto 31st January, 2019. Further, exemption from TDS for been made for supply made by PSU to PSU. (xv) E-Wallet Scheme shall be introduced for exporters from 01.04.2019 and till then relief for exporters shall be given in form of broadly existing practice. (xvi) All taxpayers are required to file return FORM GSTR-3B & pay tax on monthly basis. (xvii) Taxpayers with turnover upto ₹ 1.5 Cr are required to file information in FORM GSTR-1 on a quarterly basis. Other taxpayers would have to file FORM GSTR-1 on a monthly basis. (xviii) In order to facilitate trade, one-time extension for furnishing of FORM GSTR-1 has been granted. For the months from July, 2017 to September, 2018, FORM GSTR-1 can be furnished till 31st October, 2018. (xix) GST Council has once again allowed the migration process for taxpayers from erstwhile tax regimes. Due dates for furnishing return in FORM GSTR-3B & FORM GSTR-1 (for taxpayers with turnover more than ₹ 1.5 crore) for the months from July, 2017 to November, 2018 has been extended till 31st December, 2018. Similarly, FORM GSTR-1 (for taxpayers with turnover upto ₹ 1.5 crore) for the quarters falling under months from July, 2017 to September, 2018 has been extended till 31st December, 2018. (xx) Late fee for delayed filing of return in FORM GSTR-3B for the months of July, 2017 to September, 2017 has been waived. The amount of late fee already paid but subsequently waived off shall be re-credited to the Electronic Cash Ledger of registered person under “Tax” head instead of “Fee” head. (xxi) From October 2017 onwards, the amount of late fee for late filing of GSTR-3B payable by a registered person is as follows:

(xxii) Facility has been introduced for manual filing of refund application. (xxii) Supply of services to Nepal and Bhutan shall be exempted from GST even if payment has not been received in foreign convertible currency – such suppliers shall be eligible for input tax credit. (xxiii) Centralized UIN shall be issued to every Foreign Diplomatic Mission / UN Organization by the Central Government. (xxiv) Rate of interest on delayed payments and delayed refund has been recommended. (xxv) Migration window was opened one more time till 31.08.2018. (xxvi) A Group of Ministers has been constituted to look into the issues being faced by MSMEs and to provide solutions for the same. (xxvii) A Group of Ministers has been constituted to look into the matter of revenue mobilization. (xxviii) A Group of Ministers constituted for promoting digital payment has recommended to allow cashback to an amount equal to 20% of GST paid or ₹ 100, whichever is lower for cases where payment is made by BHIM or Rupay card. The necessary infrastructure is being developed and soon the scheme would be implemented on pilot basis in State of Assam and few other States which volunteer for the same. 9.5 In its 28th meeting held in New Delhi on 21.07.2018, the GST Council recommended certain amendments in the CGST Act, IGST Act, UTGST Act and the GST (Compensation to States) Act. These amendments have been passed by Parliament and have been enacted, after receiving the assent of the Hon’ble President of India on 29.08.2018, as the Central Goods and Services Tax (Amendment) Act, 2018, the Integrated Goods and Services Tax (Amendment) Act, 2018, the Union Territory Goods and Services Tax (Amendment) Act, 2018 and the Goods and Services Tax (Compensation to States) Amendment Act, 2018, respectively. The major amendments brought about by these Acts are as below: (i) Upper limit of turnover for opting for composition scheme to be raised from ₹ 1 Cr to ₹ 1.5 Cr. Present limit of turnover can now be raised on the recommendations of the Council. (ii) Composition dealers to be allowed to supply services (other than restaurant services), for up to a value not exceeding 10% of turnover in the preceding financial year, or ₹ 5 lakh, whichever is higher. (iii) Levy of GST on reverse charge mechanism on receipt of supplies from unregistered suppliers, to be applicable to only specified goods in case of certain notified classes of registered persons, on the recommendations of the GST Council. (iv) The threshold exemption limit for registration in the States of Assam, Arunachal Pradesh, Himachal Pradesh, Meghalaya, Sikkim and Uttarakhand to be increased to ₹ 20 Lakh from ₹ 10 Lakh. (v) Taxpayers may opt for multiple registrations within a State/Union territory in respect of multiple places of business located within the same State/Union territory. (vi) Mandatory registration is required for only those e-commerce operators who are required to collect tax at source. (vii) Registration to remain temporarily suspended while cancellation of registration is under process, so that the taxpayer is relieved of continued compliance under the law. (viii) The following transactions to be treated as no supply (no tax payable) under Schedule III: (a) Supply of goods from a place in the non-taxable territory to another place in the non-taxable territory without such goods entering into India; (b) Supply of warehoused goods to any person before clearance for home consumption; and (c) Supply of goods in case of high sea sales. (ix) Scope of input tax credit is being widened, and it would now be made available in respect of the following: (a) Most of the activities or transactions specified in Schedule III; (b) Motor vehicles for transportation of persons having seating capacity of more than thirteen (including driver), vessels and aircraft (c) Services of general insurance, repair and maintenance in respect of motor vehicles, vessels and aircraft on which credit is available; and (d) Goods or services which are obligatory for an employer to provide to its employees, under any law for the time being in force (x) Registered persons may issue consolidated credit/debit notes in respect of multiple invoices issued in a Financial Year. (xi) Amount of pre-deposit payable for filing of appeal before the Appellate Authority and the Appellate Tribunal to be capped at ₹ 25 Cr and ₹ 50 Cr respectively. (xii) Commissioner to be empowered to extend the time limit for return of inputs and capital sent on job work, upto a period of one year and two years, respectively. (xiii) Supply of services to qualify as exports, even if payment is received in Indian Rupees, where permitted by the RBI. (xiv) Place of supply in case of job work of any treatment or process done on goods temporarily imported into India and then exported without putting them to any other use in India, to be outside India. (xv) Recovery can be made from distinct persons, even if present in different State/Union territories. (xvi) The order of cross-utilisation of input tax credit is being rationalized. (xvii) The amount of IGST not apportioned to the Centre or the States/UTs may, for the time being, on the recommendations of the Council, be apportioned at the rate of fifty per cent. to the Central Government and fifty per cent. to the State Governments or the Union territories, as the case may be, on ad hoc basis and this amount shall be adjusted against the amount finally apportioned. (xviii) Fifty per cent of such amount, as may be recommended by the Council, which remains unutilised in the Compensation Fund, at any point of time in any financial year during the transition period shall be transferred to the Consolidated Fund of India as the share of Centre, and the balance fifty per cent. shall be distributed amongst the States in the ratio of their base year revenue. (xix) In case of shortfall in the amount collected in the Fund against the requirement of compensation to be released for any two months’ period, fifty per cent. of the same, but not exceeding the total amount transferred to the Centre and the States as recommended by the Council, shall be recovered from the Centre and the balance fifty per cent. from the States in the ratio of their base year revenue. In order to ensure that the changes in the Centre and the State GST laws are brought into force simultaneously, these amendments will be made effective from a date to be notified in the future. 9.6 GST Council in its 28th meeting held on 21.07.2018 in New Delhi, also approved the new return formats and associated changes in law. These changes have been carried out in the law vide the Central Goods and Services Tax (Amendment) Act, 2018. The main features of the new return filing format are as follows: (i) All taxpayers excluding small taxpayers and a few exceptions like ISD etc. shall file one monthly return. (ii) The return is simple with two main tables. One for reporting outward supplies and one for availing input tax credit based on invoices uploaded by the supplier. (iii) Invoices can be uploaded continuously by the supplier and can be continuously viewed and locked by the buyer for availing input tax credit. This process would ensure that very large part of the return is automatically filled based on the invoices uploaded by the buyer and the supplier. Simply put, the process would be “UPLOAD – LOCK – PAY” for most tax payers. (iv) Taxpayers would have facility to create his profile based on nature of supplies made and received. The fields of information which a taxpayer would be shown and would be required to fill in the return would depend on his profile. (v) NIL return filers (no purchase and no sale) shall be given facility to file return by sending SMS. (vi) There shall be quarterly filing of return for the small taxpayers having turnover below ₹ 5 Cr as an optional facility. Quarterly return shall be similar to main return with monthly payment facility but for two kinds of registered persons – small traders making only B2C supply or making B2B + B2C supply. For such taxpayers, simplified returns have been designed called Sahaj and Sugam. In these returns details of information required to be filled is lesser than that in the regular return. (vii) The new return design provides facility for amendment of invoice and also other details filed in the return. Amendment shall be carried out by filing of a return called amendment return. Payment would be allowed to be made through the amendment return as it will help save interest liability for the taxpayers. In order to ensure that the above changes in the Centre and the State GST laws are brought into force simultaneously, these amendments will be made effective from a date to be notified in the future. 10. THE DESIGN OF INDIAN GST: 10.1 Concurrent dual model of GST: India has adopted dual GST model because of its unique federal nature. Under this model, tax is levied concurrently by the Centre as well as the States on a common base, i.e. supply of goods or services or both. GST to be levied by the Centre would be called Central GST (Central tax / CGST) and that to be levied by the States would be called State GST (State Tax / SGST). State GST (State Tax / SGST) would be called UTGST (Union territory tax) in Union Territories without legislature. CGST & SGST / UTGST shall be levied on all taxable intra-State supplies. 10.2 The IGST Model: Inter-State supply of goods or services shall be subjected to integrated GST (Integrated tax / IGST). The IGST model is a unique contribution of India in the field of VAT. The IGST Model envisages that Centre would levy IGST (Integrated Goods and Service Tax) which would be CGST plus SGST on all inter-State supply of goods or services or both. The inter-State supplier will pay IGST on value addition after adjusting available credit of IGST, CGST, and SGST on his purchases. The Exporting State will transfer to the Centre the credit of SGST used in payment of IGST. The person based in the destination State will claim credit of IGST while discharging his output tax liability in his own State. The Centre will transfer to the importing State the credit of IGST used in payment of SGST. The relevant information will also be submitted to the Central Agency which will act as a clearing house mechanism, verify the claims and inform the respective governments to transfer the funds. The major advantages of IGST Model are: (i) Maintenance of uninterrupted ITC chain on inter-State transactions. (ii) No upfront payment of tax or substantial blockage of funds for the interState supplier or recipient. (iii) No refund claim in exporting State, as ITC is used up while paying the tax. (iv) Self-monitoring model. (v) Model takes ‘Business to Business’ as well as ‘Business to Consumer’ transactions into account. 10.3 Tax Rates: Owing to unique Indian socio-economic milieu, four rates namely 5%, 12%, 18% and 28% have been adopted. Besides, some goods and services are exempt also. Rate for precious metals is an exception to ‘four-tax slabrule’ and the same has been fixed at 3%. In addition, unworked diamonds, precious stones, etc. attracts a rate of 0.25%. A cess over the peak rate of 28% on certain specified luxury and demerit goods, like tobacco and tobacco products, pan masala, aerated water, motor vehicles is imposed to compensate States for any revenue loss on account of implementation of GST. The list of goods and services in case of which reverse charge would be applicable has also been notified. 10.4 Compensation to States: The Goods and Services Tax (Compensation to States) Act, 2017 provides for compensation to the States for the loss of revenue arising on account of implementation of the goods and services tax. Compensation will be provided to a State for a period of five years from the date on which the State brings its SGST Act into force. For the purpose of calculating the compensation amount in any financial year, year 2015-16 will be assumed to be the base year, for calculating the revenue to be protected. The growth rate of revenue for a State during the five-year period is assumed be 14% per annum. The base year tax revenue consists of the states’ tax revenues from: (i) State Value Added Tax (VAT), (ii) central sales tax, (iii) entry tax, octroi, local body tax, (iv) taxes on luxuries, (v) taxes on advertisements, etc. However, any revenue among these taxes arising related to supply of alcohol for human consumption, and five specified petroleum products, will not be accounted as part of the base year revenue. A GST Compensation Cess is levied on the supply of certain goods and services, as recommended by the GST Council to finance the compensation cess. 10.5 E-Way Bill System: The introduction of e-way (electronic way) bill is a monumental shift from the earlier “Departmental Policing Model” to a “SelfDeclaration Model”. It envisages one e-way bill for movement of the goods throughout the country, thereby ensuring a hassle free movement for transporters throughout the country. The e-way bill system has been introduced nation-wide for all inter-State movement of goods with effect from 1st April, 2018. As regards intra-State supplies, option was given to States to choose any date on or before 3rd June, 2018. All States have notified e-way bill rules for intra-State supplies last being NCT of Delhi where it was introduced w.e.f. 16th June, 2018. 10.6 Anti-Profiteering Mechanism: Implementation of GST in many countries was coupled with increase in inflation and the prices of the commodities. This happened in spite of the availability of the tax credit. This was happening because the supplier was not passing on the benefit to the consumer and thereby indulging in illegal profiteering. Any reduction in rate of tax or the benefit of increased input tax credit should have been passed on to the recipient by way of commensurate reduction in prices. 10.6.1 National Anti-profiteering Authority (NAPA) has been constituted under GST by the Central Government to examine the complaints of non-passing the benefit of reduced tax incidence. The Authority shall cease to exist after the expiry of two years from the date on which the Chairman enters upon his office unless the Council recommends otherwise. 10.6.2 The Authority may determine whether any reduction in the rate of tax or the benefit of input tax credit has been passed on to the recipient by way of commensurate reduction in prices. It can order reduction in prices, imposition of penalty, cancellation of registration and any other decision as may deem fit, after inquiry into the case. 10.7 Concept of Supply: GST would be applicable on supply of goods or services as against the present concept of tax on manufacture of goods or on sale of goods or on provision of services. It includes all sorts of activities like manufacture, sale, barter, exchange, transfer etc. It also includes supplies made without consideration when such supplies are made in certain specified situations. 10.8 Threshold Exemption: A common threshold exemption would apply to both CGST and SGST. Taxpayers with an annual turnover of ₹ 20 lakh (Rs. 10 lakh for special category States (except J&K) as specified in article 279A of the Constitution) would be exempt from GST. The GST Act has been amended to raise threshold exemption limit in case of six more special category States. The amendment shall be effective from a date to be notified in the future. The benefit of threshold exemption is not available in inter-State supplies of goods. 10.9 Composition Scheme: An optional composition scheme (i.e. to pay tax at a flat rate on turnover without credits) is available to small taxpayers (including to manufacturers other than specified category of manufacturers and service providers) having an annual turnover of up to ₹ 1 Cr (Rs. 75 lakh for special category States (except J&K and Uttarakhand) enumerated in article 279A of the Constitution). This limit has been raised to ₹ 1.5 Cr after necessary amendments in the GST Acts. The amendment shall be effective from a date to be notified in the future. 10.10 Zero rated Supplies: Export of goods and services are zero rated. Supplies to SEZs developers and SEZ units are also zero-rated. The benefit of zero rating can be taken either with payment of integrated tax, or without payment of integrated tax under bond or Letter of Undertaking. 10.11 Cross-utilization of ITC: IGST credit can be used for payment of all taxes. CGST credit can be used only for paying CGST or IGST. SGST credit can be used only for paying SGST or IGST. The credit would be permitted to be utilized in the following manner: (a) ITC of CGST allowed for payment of CGST & IGST in that order; (b) ITC of SGST allowed for payment of SGST & IGST in that order; (c) ITC of UTGST allowed for payment of UTGST & IGST in that order; (d) ITC of IGST allowed for payment of IGST, CGST & SGST/UTGST in that order. ITC of CGST cannot be used for payment of SGST/UTGST and vice versa. 10.12 Settlement of Government Accounts: Accounts would be settled periodically between the Centre and the State to ensure that the credit of SGST used for payment of IGST is transferred by the originating State to the Centre. Similarly, the IGST used for payment of SGST would be transferred by Centre to the destination State. Further the SGST portion of IGST collected on B2C supplies would also be transferred by Centre to the destination State. The transfer of funds would be carried out on the basis of information contained in the returns filed by the taxpayers. 10.13 Modes of Payment: Various modes of payment of tax available to the taxpayer including internet banking, debit/ credit card and National Electronic Funds Transfer (NEFT) / Real Time Gross Settlement (RTGS). 10.14 Tax Deduction at Source: Obligation on certain persons including government departments, local authorities and government agencies, who are recipients of supply, to deduct tax at the rate of 1% from the payment made or credited to the supplier where total value of supply, under a contract, exceeds two lakh and fifty thousand rupees. The provision for TDS has been operationalized wef 01st October 2018. Exemption from the provisions of TDS has been given to certain authorities under the Ministry of Defence. 10.15 Refunds: Refund of tax to be sought by taxpayer or by any other person who has borne the incidence of tax within two years from the relevant date. Refund of unutilized ITC also available in zero rated supplies and inverted tax structure. 10.16 Tax Collection at Source: Obligation on electronic commerce operators to collect ‘tax at source’, at such rate not exceeding two per cent of net value of taxable supplies, out of payments to suppliers supplying goods or services through their portals. The provision for TCS has not been operationalized wef 01st October 2018. 10.17 Self-assessment: Self-assessment of the taxes payable by the registered person shall be the norm. Audit of registered persons shall be conducted on selective basis. Limitation period for raising demand is three (3) years from the due date of filing of annual return or from the date of erroneous refund for raising demand for short-payment or non-payment of tax or erroneous refund and its adjudication in normal cases. Limitation period for raising demand is five (5) years from the due date of filing of annual return or from the date of erroneous refund for raising demand for short-payment or non-payment of tax or erroneous refund and its adjudication in case of fraud, suppression or willful mis-statement. 10.18 Recovery of Arrears: Arrears of tax to be recovered using various modes including detaining and sale of goods, movable and immovable property of defaulting taxable person. 10.19 Appellate Tribunal: Goods and Services Tax Appellate Tribunal would be constituted by the Central Government for hearing appeals against the orders passed by the Appellate Authority or the Revisional Authority. States would adopt the provisions relating to Tribunal in respective SGST Act. 10.20 Advance Ruling Authority: Advance Ruling Authority would be constituted by States in order to enable the taxpayer to seek a binding clarity on taxation matters from the department. Centre would adopt such authority under CGST Act. 10.21 Transitional Provisions: Elaborate transitional provisions have been provided for smooth transition of existing taxpayers to GST regime. 10.22 Subsuming of taxes, duties etc.: Among the taxes and duties levied and collected by the Union, Central Excise duty, Duties of Excise (Medicinal and Toilet Preparations), Additional Duties of Excise (Goods of Special Importance), Additional Duties of Excise (Textiles and Textile Products), Additional Duties of Customs (commonly known as CVD), Special Additional Duty of Customs (SAD), Service Tax and cesses and surcharges insofar as they related to supply of goods or services were subsumed. As far as taxes levied and collected by States are concerned, State VAT, Central Sales Tax, Purchase Tax, Luxury Tax, Entry Tax, Entertainment Tax (except those levied by the local bodies), Taxes on advertisements, Taxes on lotteries, betting and gambling, cesses and surcharges insofar as they related to supply of goods or services were subsumed. 11. GST LEGISLATIONS: 11.1. Four Laws namely CGST Act, UTGST Act, IGST Act and GST (Compensation to States) Act were passed by the Parliament and since been notified on 12th April, 2017. All the other States (except J&K) and Union territories with legislature have passed their respective SGST Acts. The economic integration of India was completed on 8th July, 2017 when the State of J&K also passed the SGST Act and the Central Government also subsequently extended the CGST Act to J&K. 11.2. In its 28th meeting held in New Delhi on 21.07.2018, the GST Council recommended certain amendments in the CGST Act, IGST Act, UTGST Act and the GST (Compensation to States) Act. These amendments have been passed by Parliament and have been enacted, after receiving the assent of the Hon’ble President of India on 29.08.2018, as the Central Goods and Services Tax (Amendment) Act, 2018, the Integrated Goods and Services Tax (Amendment) Act, 2018, the Union Territory Goods and Services Tax (Amendment) Act, 2018 and the Goods and Services Tax (Compensation to States) Amendment Act, 2018, respectively. In order to ensure that the above changes in the Centre and the State GST laws are brought into force simultaneously, these amendments will be made effective from a date to be notified in the future. 11.3. On 22nd June, 2017, the first notification was issued for GST and notified certain sections under CGST. Since then, 141 notifications under CGST Act have been issued notifying sections, notifying rules, amendment to rules and for waiver of penalty, etc. 15, 32 and 1 notifications have also been issued under IGST Act, UTGST Act and GST (Compensation to States) Act respectively. Further 70, 74, 70 and 9 rate related notifications each have been issued under the CGST Act, IGST Act, UTGST Act and GST (Compensation to States) Act respectively. Similar notifications have been issued by all the States under the respective SGST Act. Apart from the notifications, 78 circulars and 16 orders have also been issued by CBIC on various subjects like proper officers, ease of exports, and extension of last dates for filling up various forms, etc. 12. ROLE OF CBIC: 12.1 CBIC is playing an active role in the drafting of GST law and procedures, particularly the CGST and IGST law, which will be exclusive domain of the Centre. This apart, the CBIC has prepared itself for meeting the implementation challenges, which are quite formidable. The number of taxpayers has gone up significantly. The existing IT infrastructure of CBIC has been suitably scaled up to handle such large volumes of data. Based on the legal provisions and procedure for GST, the content of work-flow software such as ACES (Automated Central Excise & Service Tax) would require re-engineering. The name of IT project of CBIC under GST is ‘SAKSHAM’ involving a total project value of ₹ 2,256 Cr. 12.2 Augmentation of human resources would be necessary to handle large taxpayers’ base in GST scattered across the length and breadth of the country. Capacity building, particularly in the field of Accountancy and Information Technology for the departmental officers has to be taken up in a big way. A massive four-tier training programme has been conducted under the leadership of NACIN. This training project is aimed at imparting training on GST law and procedures to more than 60,000 officers of CBIC and Commercial Tax officers of State Governments. 12.3 CBIC would be responsible for administration of the CGST and IGST law. In addition, excise duty regime would continue to be administered by the CBIC for levy and collection of central excise duty on five specified petroleum products as well as on tobacco products. CBIC would also continue to handle the work relating to levy and collection of customs duties. 12.4 Director General of Anti-profiteering, CBIC has been mandated to conduct detailed enquiry on anti-profiteering cases and should give his recommendation for consideration of the National Anti-profiteering Authority. 12.5 CBIC has been instrumental in handholding the implementation of GST. It had set up the Feedback and Action Room which monitored the GST implementation challenges faced by the taxpayer and act as an active interface between the taxpayer and the Government. 13. GOODS & SERVICES TAX NETWORK: 13.1 Goods and Services Tax Network (GSTN) has been set up by the Government as a private company under erstwhile Section 25 of the Companies Act, 1956. GSTN would provide three front end services to the taxpayers namely registration, payment and return. Besides providing these services to the taxpayers, GSTN would be developing back-end IT modules for 27 States who have opted for the same. Infosys has been appointed as Managed Service Provider (MSP). GSTN has selected 73 IT, ITeS and financial technology companies and 1 Commissioner of Commercial Taxes (CCT, Karnataka), to be called GST Suvidha Providers (GSPs). GSPs would develop applications to be used by taxpayers for interacting with the GSTN. The diagram below shows the work distribution under GST.

13.2 Central Government holds 24.5 percent stake in GSTN while the state government holds 24.5 percent. The remaining 51 percent are held by nonGovernment financial institutions, HDFC and HDFC Bank hold 20%, ICICI Bank holds 10%, NSE Strategic Investment holds 10% and LIC Housing Finance holds 10%. The GST Council in its 27th meeting held on 04th May, 2018 has approved the change in shareholding pattern of GSTN. Considering the nature of ‘state’ function’ performed by GSTN, the GST Council felt that GSTN be converted into a fully owned Government company. Accordingly, the Council approved acquisition of entire 51 per cent of equity held by non-Governmental institutions in GSTN amounting to ₹ 5.1 Cr, equally by the Centre and the State Governments. 13.3 The design of GST systems is based on role based access. The taxpayer can access his own data through identified applications like registration, return, view ledger etc. The tax official having jurisdiction, as per GST law, can access the data. Data can be accessed by audit authorities as per law. No other entity can have any access to data available with GSTN. 14. GST: A GAME CHANGER FOR INDIAN ECONOMY: 14.1 GST will have a multiplier effect on the economy with benefits accruing to various sectors as discussed below. 14.2 Benefits to the exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive setoff of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. This will increase the competitiveness of Indian goods and services in the international market and give boost to Indian exports. The uniformity in tax rates and procedures across the country will also go a long way in reducing the compliance cost. 14.3 Benefits to small traders and entrepreneurs: GST has increased the threshold for GST registration for small businesses. Those units having aggregate annual turnover more than ₹ 20 lakh (10 lakh in case of North Eastern States) have be registered under GST. Unlike multiple registrations under different tax regimes earlier, a single registration is needed under GST in one State. An additional benefit under Composition scheme has also been provided for businesses with aggregate annual turnover upto ₹ 1 Cr. With the creation of a seamless national market across the country, small enterprises will have an opportunity to expand their national footprint with minimal investment. 14.4 Benefits to agriculture and Industry: GST will give more relief to industry, trade and agriculture through a more comprehensive and wider coverage of input tax set-off and service tax set-off, subsuming of several Central and State taxes in the GST and phasing out of CST. The transparent and complete chain of set-offs which will result in widening of tax base and better tax compliance may also lead to lowering of tax burden on an average dealer in industry, trade and agriculture. 14.5 Benefits for common consumers: With the introduction of GST, the cascading effects of CENVAT, State VAT and service tax will be more comprehensively removed with a continuous chain of set-off from the producer’s point to the retailer’s point than what was possible under the prevailing CENVAT and VAT regime. Certain major Central and State taxes will also be subsumed in GST and CST will be phased out. Other things remaining the same, the burden of tax on goods would, in general, fall under GST and that would benefit the consumers. 14.6 Promote “Make in India”: GST will help to create a unified common national market for India, giving a boost to foreign investment and “Make in India” campaign. It will prevent cascading of taxes and make products cheaper, thus boosting aggregate demand. It will result in harmonization of laws, procedures and rates of tax. It will boost export and manufacturing activity, generate more employment and thus increase GDP with gainful employment leading to substantive economic growth. Ultimately it will help in poverty eradication by generating more employment and more financial resources. More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market and give boost to Indian Exports. It will also improve the overall investment climate in the country which will naturally benefit the development in the states. Uniform CGST & SGST and IGST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighboring States and that between intra and inter-State supplies. Average tax burden on companies is likely to come down which is expected to reduce prices and lower prices mean more consumption, which in turn means more production thereby helping in the growth of the industries. This will create India as a “Manufacturing hub”. 14.7 Ease of Doing Business: Simpler tax regime with fewer exemptions along with reduction in multiplicity of taxes that are at present governing our indirect tax system will lead to simplification and uniformity. Reduction in compliance costs as multiple record-keeping for a variety of taxes will not be needed, therefore, lesser investment of resources and manpower in maintaining records. It will result in simplified and automated procedures for various processes such as registration, returns, refunds, tax payments. All interaction shall be through the common GSTN portal, therefore, less public interface between the taxpayer and the tax administration. It will improve environment of compliance as all returns to be filed online, input credits to be verified online, encouraging more paper trail of transactions. Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services will lend greater certainty to taxation system. 15. EXPERIENCE OF REGISTRATION,RETURN FILING & REVNUE: 15.1 Registration & Returns Snapshot:

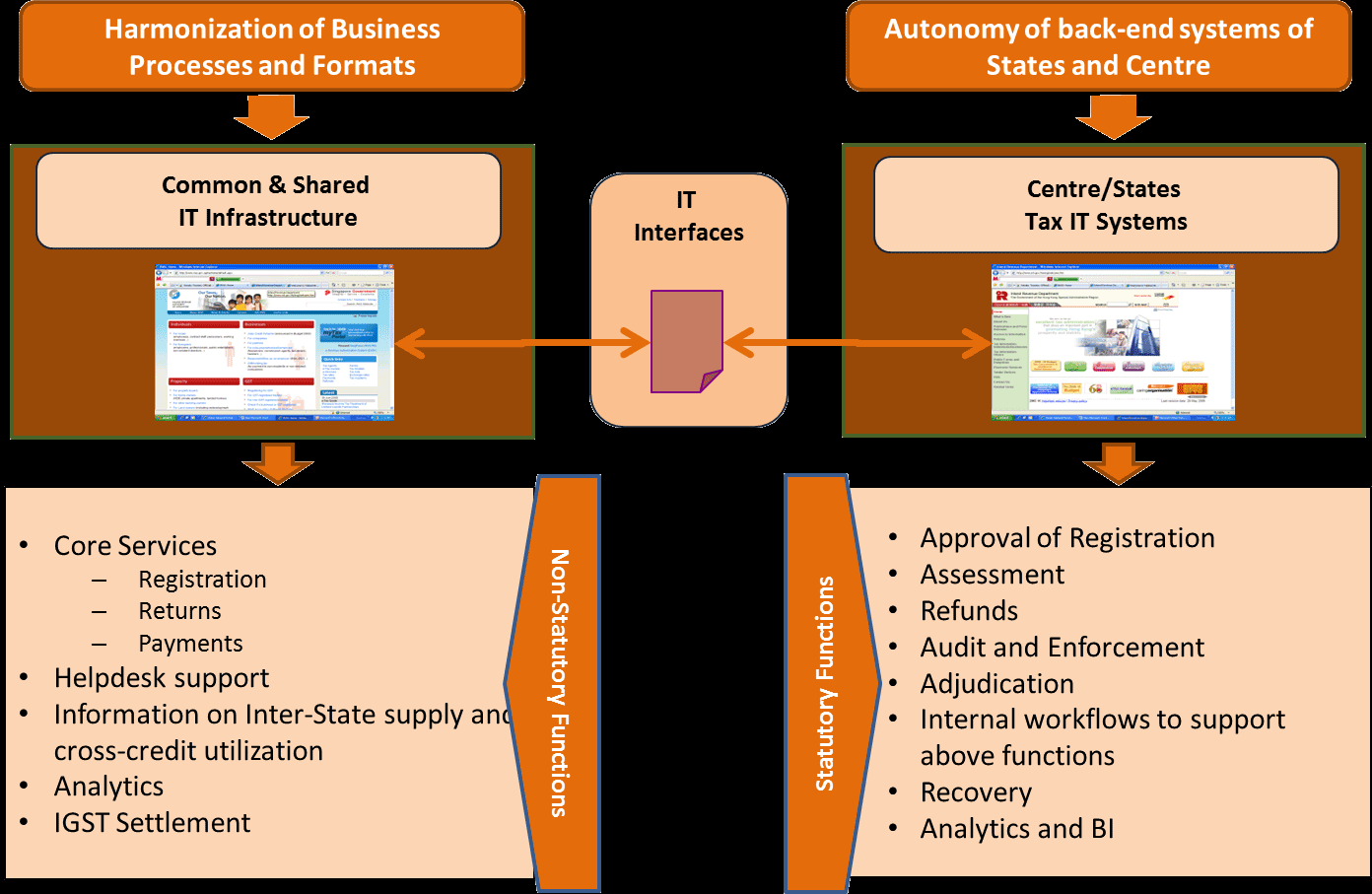

15.2 Revenue Collection Snapshot:

16. CHALLENGES & FUTURE AHEAD: 16.1 Any new change is accompanied by difficulties and problems at the outset. A change as comprehensive as GST is bound to pose certain challenges not only for the government but also for business community, tax administration and even common citizens of the country. Some of these challenges relate to the unfamiliarity with the new regime and IT systems, legal challenges, return filing and reconciliations, passing on transition credit. Lack of robust IT infrastructure and system delays makes compliance difficult for the taxpayers. Many of the processes in the GST are new for small and medium enterprises in particular, who were not used to regular and online filing of returns and other formalities. 16.2 Based on the feedback received from businesses, consumers and taxpayers from across the country, attempt has been made to incorporate suggestions and reduce problems through short-term as well as long-term solutions. After rectifying system glitches, E-way bill for inter-State movement of goods has been successfully implemented from 1st April 2018. As regards intra-State supplies, option was given to States to choose any date on or before 3rd June, 2018. All States have notified e-way bill rules for intra-State supplies last being NCT of Delhi where it was introduced w.e.f. 16th June, 2018. 16.3 NAPA has initiated investigation into various complaints of anti-profiteering and has passed orders in some cases to protect consumer interest. 16.4 To expedite sanction of refund, manual filing and processing of refunds has been enabled. Clarificatory Circulars and notifications have been issued to guide field formations of CBIC and States in this regard. The government has put in place an IT grievance redressal mechanism to address the difficulties faced by taxpayers owing to technical glitches on the GST portal. 16.5 The introduction of GST is truly a game changer for Indian economy as it has replaced multi-layered, complex indirect tax structure with a simple, transparent and technology–driven tax regime. It will integrate India into a single, common market by breaking barriers to inter-State trade and commerce. By eliminating cascading of taxes and reducing transaction costs, it will enhance ease of doing business in the country and provide an impetus to “Make in India” campaign. GST will result in “ONE NATION, ONE TAX, ONE MARKET”. ***** Note: This write-up is for education purposes only |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

9911796707

9911796707