| News | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

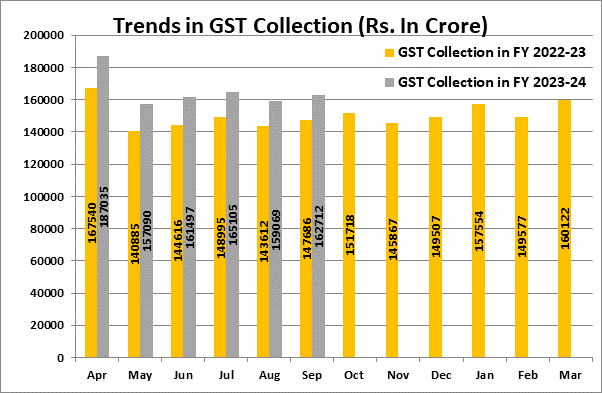

₹1,62,712 crore gross GST revenue collected during September 2023; records 10% Year-on-Year growth |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 3-10-2023 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

GST collection crosses ₹1.60 lakh crore mark for the fourth time in FY 2023-24

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

State/UT |

Sep-22 |

Sep-23 |

Growth (%) |

|

Jammu and Kashmir |

428 |

563 |

32% |

|

Himachal Pradesh |

712 |

784 |

10% |

|

Punjab |

1,710 |

1,866 |

9% |

|

Chandigarh |

206 |

219 |

6% |

|

Uttarakhand |

1,300 |

1,392 |

7% |

|

Haryana |

7,403 |

8,009 |

8% |

|

Delhi |

4,741 |

4,849 |

2% |

|

Rajasthan |

3,307 |

3,869 |

17% |

|

Uttar Pradesh |

7,004 |

7,844 |

12% |

|

Bihar |

1,466 |

1,397 |

-5% |

|

Sikkim |

285 |

315 |

11% |

|

Arunachal Pradesh |

64 |

81 |

27% |

|

Nagaland |

49 |

52 |

5% |

|

Manipur |

38 |

56 |

47% |

|

Mizoram |

24 |

27 |

14% |

|

Tripura |

65 |

73 |

13% |

|

Meghalaya |

161 |

165 |

2% |

|

Assam |

1,157 |

1,175 |

2% |

|

West Bengal |

4,804 |

4,940 |

3% |

|

Jharkhand |

2,463 |

2,623 |

7% |

|

Odisha |

3,765 |

4,249 |

13% |

|

Chhattisgarh |

2,269 |

2,684 |

18% |

|

Madhya Pradesh |

2,711 |

3,118 |

15% |

|

Gujarat |

9,020 |

10,129 |

12% |

|

Dadra and Nagar Haveli and Daman & Diu |

312 |

350 |

12% |

|

Maharashtra |

21,403 |

25,137 |

17% |

|

Karnataka |

9,760 |

11,693 |

20% |

|

Goa |

429 |

497 |

16% |

|

Lakshadweep |

3 |

2 |

-45% |

|

Kerala |

2,246 |

2,505 |

12% |

|

Tamil Nadu |

8,637 |

10,481 |

21% |

|

Puducherry |

188 |

197 |

5% |

|

Andaman and Nicobar Islands |

33 |

23 |

-30% |

|

Telangana |

3,915 |

5,226 |

33% |

|

Andhra Pradesh |

3,132 |

3,658 |

17% |

|

Ladakh |

19 |

35 |

81% |

|

Other Territory |

202 |

207 |

2% |

|

Center Jurisdiction |

182 |

196 |

8% |

Table-2: SGST & SGST portion of IGST settled to States/UTs

April-September (Rs. in crore)

|

|

Pre-Settlement SGST |

Post-Settlement SGST[2] |

||||

|

State/UT |

2022-23 |

2023-24 |

Growth |

2022-23 |

2023-24 |

Growth |

|

Jammu and Kashmir |

1,138 |

1,515 |

33% |

3,546 |

4,102 |

16% |

|

Himachal Pradesh |

1,150 |

1,314 |

14% |

2,770 |

2,778 |

0% |

|

Punjab |

3,846 |

4,216 |

10% |

9,215 |

10,869 |

18% |

|

Chandigarh |

300 |

335 |

12% |

1,002 |

1,147 |

15% |

|

Uttarakhand |

2,401 |

2,589 |

8% |

3,708 |

4,055 |

9% |

|

Haryana |

9,045 |

9,864 |

9% |

14,948 |

17,161 |

15% |

|

Delhi |

6,872 |

7,639 |

11% |

13,746 |

15,660 |

14% |

|

Rajasthan |

7,597 |

8,488 |

12% |

16,461 |

19,129 |

16% |

|

Uttar Pradesh |

13,711 |

16,069 |

17% |

32,540 |

36,109 |

11% |

|

Bihar |

3,567 |

4,092 |

15% |

11,497 |

12,679 |

10% |

|

Sikkim |

153 |

267 |

75% |

406 |

545 |

34% |

|

Arunachal Pradesh |

253 |

343 |

35% |

807 |

1,013 |

26% |

|

Nagaland |

108 |

155 |

43% |

474 |

539 |

14% |

|

Manipur |

143 |

177 |

24% |

681 |

566 |

-17% |

|

Mizoram |

93 |

147 |

58% |

419 |

491 |

17% |

|

Tripura |

206 |

258 |

25% |

696 |

790 |

13% |

|

Meghalaya |

227 |

311 |

37% |

711 |

860 |

21% |

|

Assam |

2,562 |

2,906 |

13% |

5,965 |

7,181 |

20% |

|

West Bengal |

10,751 |

11,960 |

11% |

18,786 |

20,949 |

12% |

|

Jharkhand |

3,661 |

4,462 |

22% |

5,352 |

6,043 |

13% |

|

Odisha |

7,206 |

8,068 |

12% |

9,096 |

10,869 |

19% |

|

Chhattisgarh |

3,720 |

4,136 |

11% |

5,292 |

6,454 |

22% |

|

Madhya Pradesh |

5,221 |

6,324 |

21% |

12,768 |

15,350 |

20% |

|

Gujarat |

18,628 |

20,839 |

12% |

27,226 |

31,106 |

14% |

|

Dadra and Nagar Haveli and Daman and Diu |

330 |

315 |

-5% |

566 |

508 |

-10% |

|

Maharashtra |

42,043 |

50,062 |

19% |

62,010 |

72,741 |

17% |

|

Karnataka |

17,196 |

20,097 |

17% |

31,076 |

36,162 |

16% |

|

Goa |

957 |

1,109 |

16% |

1,678 |

1,940 |

16% |

|

Lakshadweep |

5 |

14 |

192% |

16 |

60 |

283% |

|

Kerala |

6,014 |

6,986 |

16% |

14,594 |

15,827 |

8% |

|

Tamil Nadu |

17,712 |

20,158 |

14% |

28,345 |

31,778 |

12% |

|

Puducherry |

233 |

246 |

6% |

580 |

727 |

25% |

|

Andaman and Nicobar Islands |

101 |

111 |

10% |

247 |

271 |

10% |

|

Telangana |

8,184 |

9,790 |

20% |

17,685 |

20,023 |

13% |

|

Andhra Pradesh |

6,298 |

7,028 |

12% |

13,496 |

15,390 |

14% |

|

Ladakh |

63 |

98 |

55% |

245 |

300 |

23% |

|

Other Territory |

78 |

118 |

52% |

241 |

542 |

125% |

|

Grand Total |

2,01,771 |

2,32,606 |

15% |

3,68,888 |

4,22,713 |

15% |

[1]Does not include GST on import of goods

[2] Post-Settlement GST is cumulative of the GST revenues of the States/UTs and the SGST portion of the IGST settled to the States/UTs

9911796707

9911796707