Deduction u/s 80IA in respect of profits from Rail System, ...

Income Tax

July 14, 2023

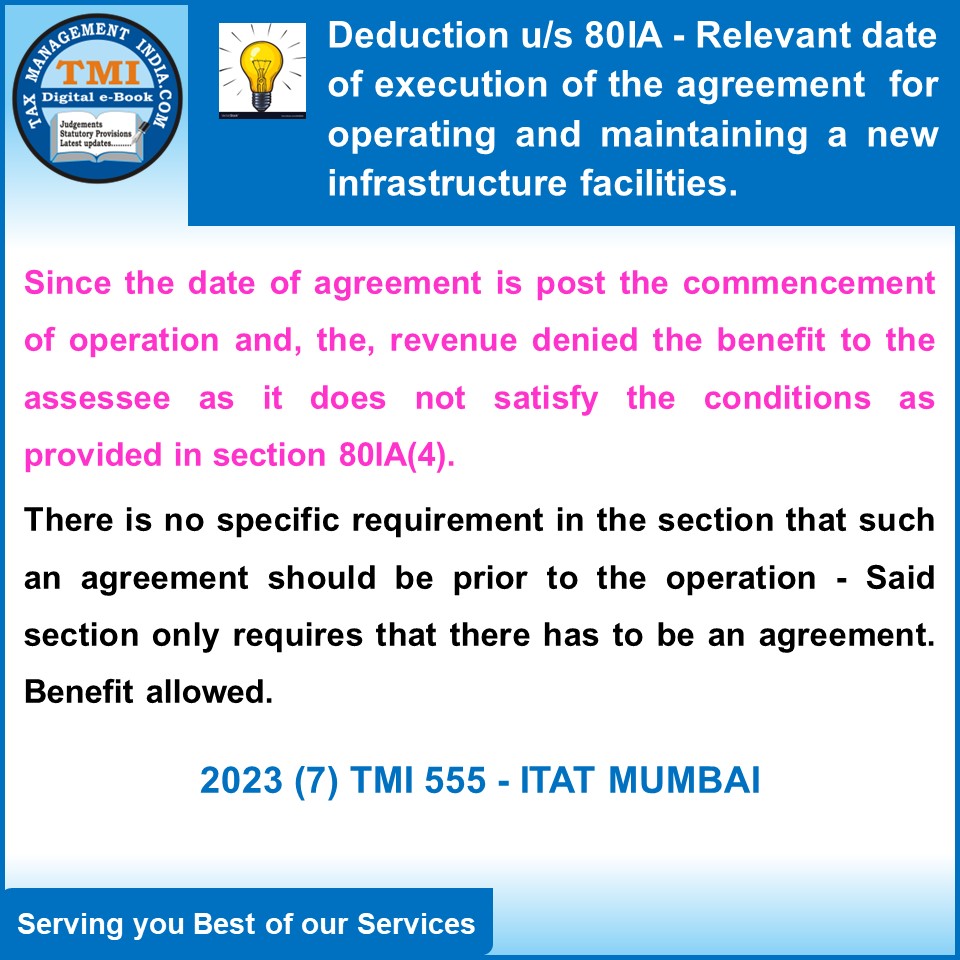

Deduction u/s 80IA in respect of profits from Rail System, Raipur, and Hotgi - No material has been brought on record to show that such an agreement does not exist in the present case and the only plea raised by the learned DR is that such an agreement is post the commencement of operation and, therefore, the assessee does not satisfy the conditions as provided in section 80IA(4) of the Act for availing the benefit of the said section. - However, there is no specific requirement in the section that such an agreement should be prior to the operation - Benefit of exemption / deduction cannot be denied. - AT

View Source