Scope of supply - subsidized canteen facility at factory - The ...

Factory Canteen Food Deduction Not a 'Supply' u/s 7 of CGST Act for Permanent Employees Only.

September 4, 2023

Case Laws GST AAR

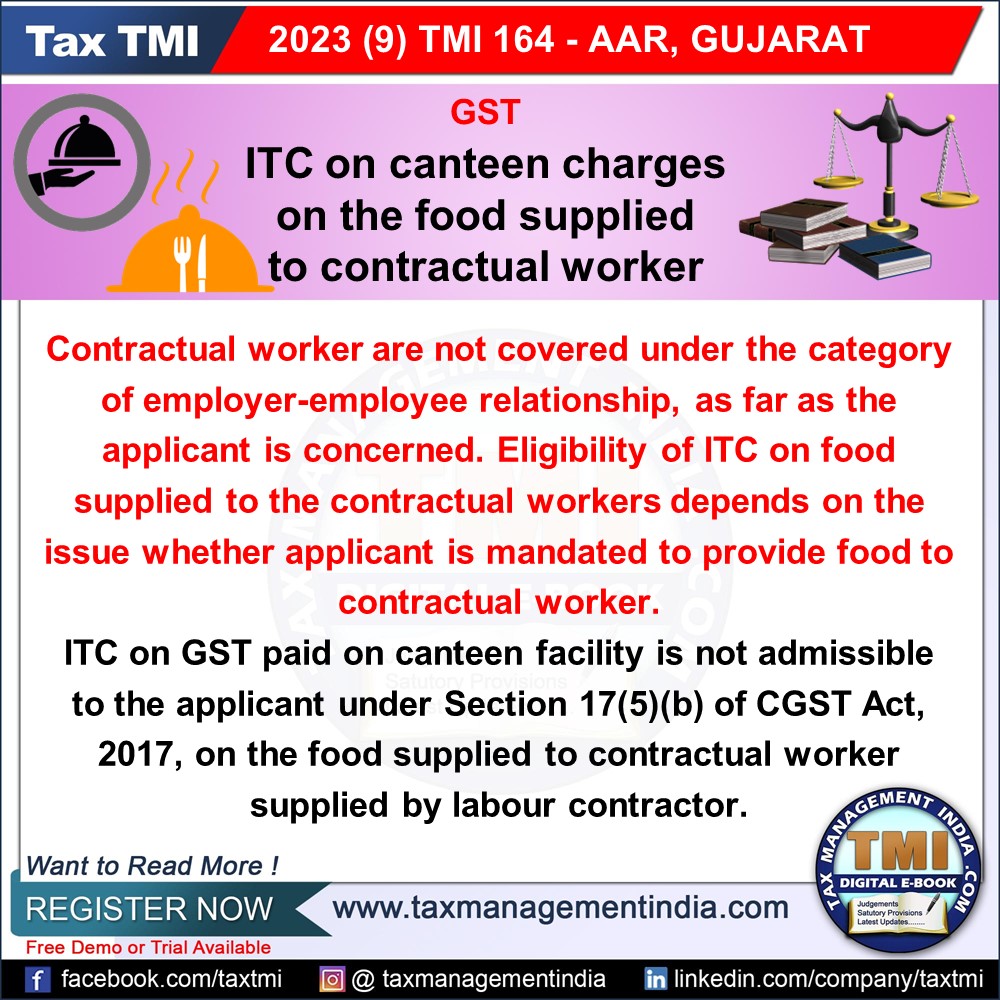

Scope of supply - subsidized canteen facility at factory - The subsidized deduction made by the applicant from the employees who are availing food in the factory would not be considered as a ‘supply’ under the provisions of section 7 of the CGST Act, 2017. However, the aforementioned finding is only in respect of employees i.e. permanent employees. - AAR

View Source