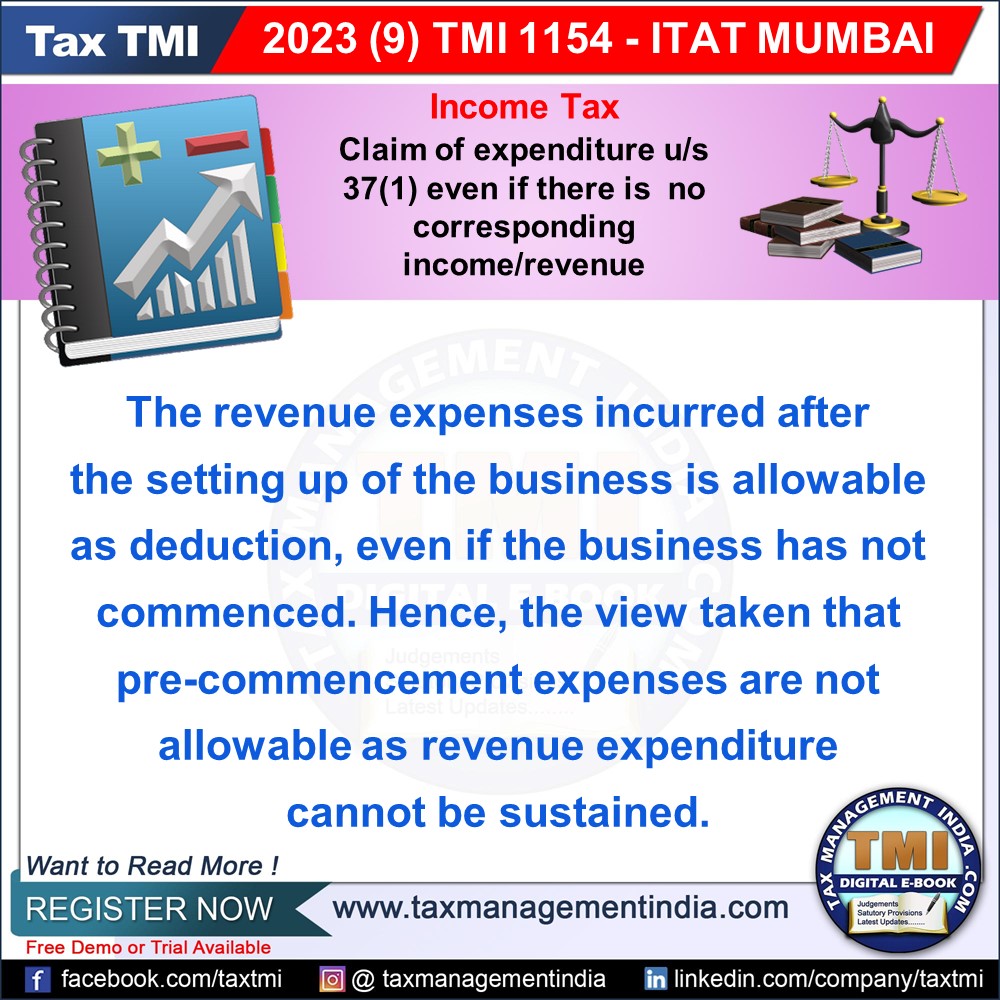

Claim of expenditure u/s 37(1) even if there is no corresponding ...

Tax Authorities Challenge Expenditure Deduction u/s 37(1) Due to Lack of Reported Sales, Legal Principles Support Deduction.

September 26, 2023

Case Laws Income Tax AT

Claim of expenditure u/s 37(1) even if there is no corresponding income / revenue - The tax authorities have also taken a view that the assessee has not shown any sales in the books of account. It is well settled proposition of law that, once the assessee has set up his business, all revenue expenses are allowable as deduction irrespective of the receipt of income. - AT

View Source