Input Tax Credit - inputs and input services procured by the ...

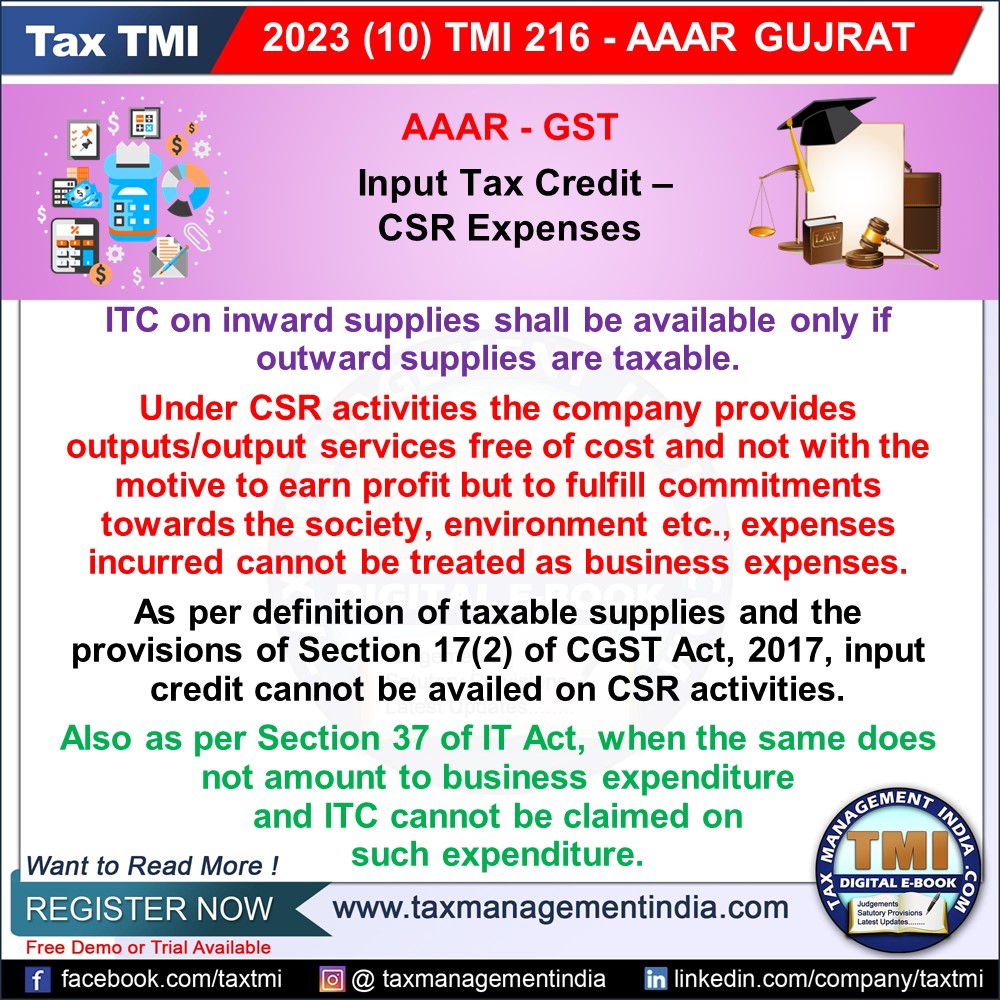

Input Tax Credit Denied for CSR Activities Under Companies Act, 2013 by AAAR Decision.

October 6, 2023

Case Laws GST AAAR

Input Tax Credit - inputs and input services procured by the appellant, in order to undertake the mandatory CSR activities as required under the Companies Act, 2013 - The legislature has clarified its intent to disallow input tax credit on goods or services or both which are to be used for activities relating to obligations under corporate social responsibility (CSR) - No ITC - AAAR

View Source