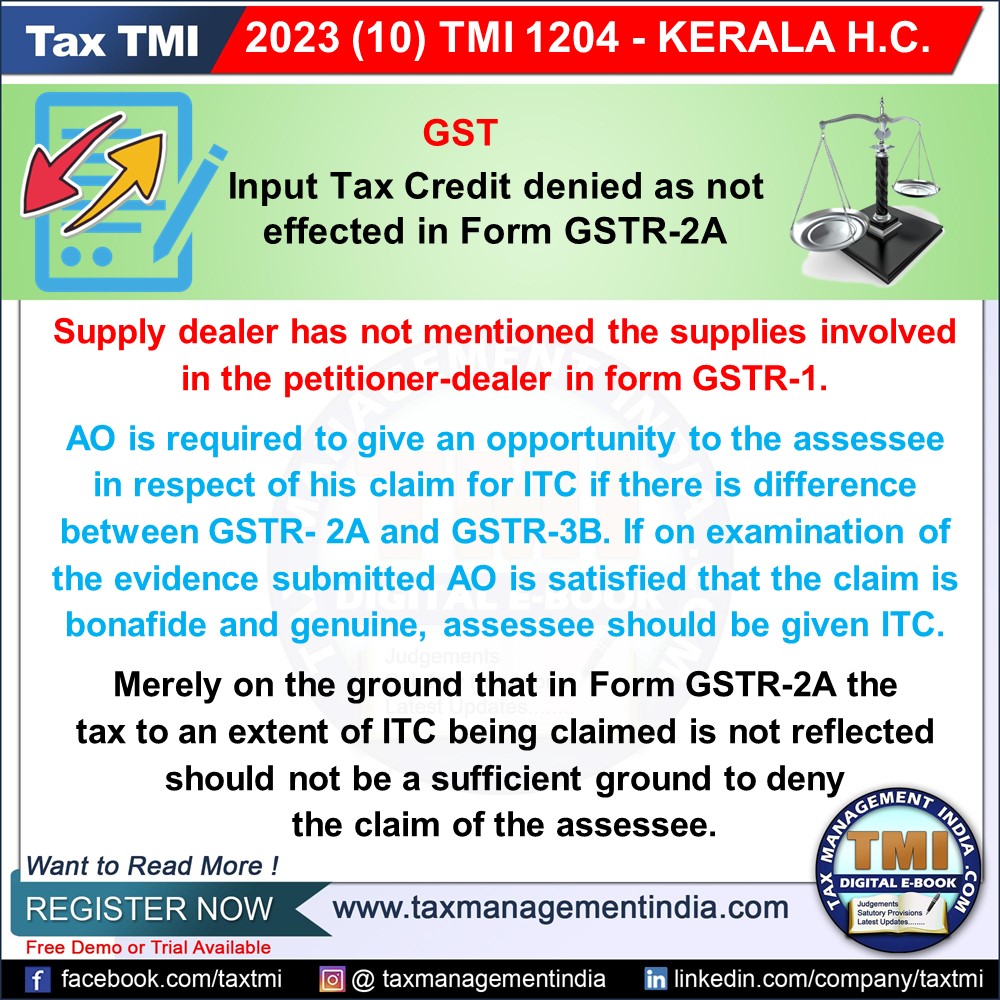

Input Tax Credit - credit was not effected in Form GSTR-2A - If ...

ITC Must Be Granted if Assessing Officer Satisfied, Even If Not in GSTR-2A, for Bona Fide Claims.

October 27, 2023

Case Laws GST HC

Input Tax Credit - credit was not effected in Form GSTR-2A - If on examination of the evidence submitted by the assessee, the assessing officer is satisfied that the claim is bonafide and genuine, the assessee should be given the Input Tax Credit. Merely on the ground that in Form GSTR-2A the tax to an extent of Input Tax Credit being claimed by the petitioner is not reflected should not be a sufficient ground to deny the claim of the assessee for Input Tax Credit. - HC

View Source