Special audit u/s. 142(2A) - Challenge on the ground that order ...

Court Upholds Special Audit u/s 142(2A) of Income Tax Act, Emphasizing Public Interest Over Subjective Satisfaction Claims.

October 13, 2023

Case Laws Income Tax HC

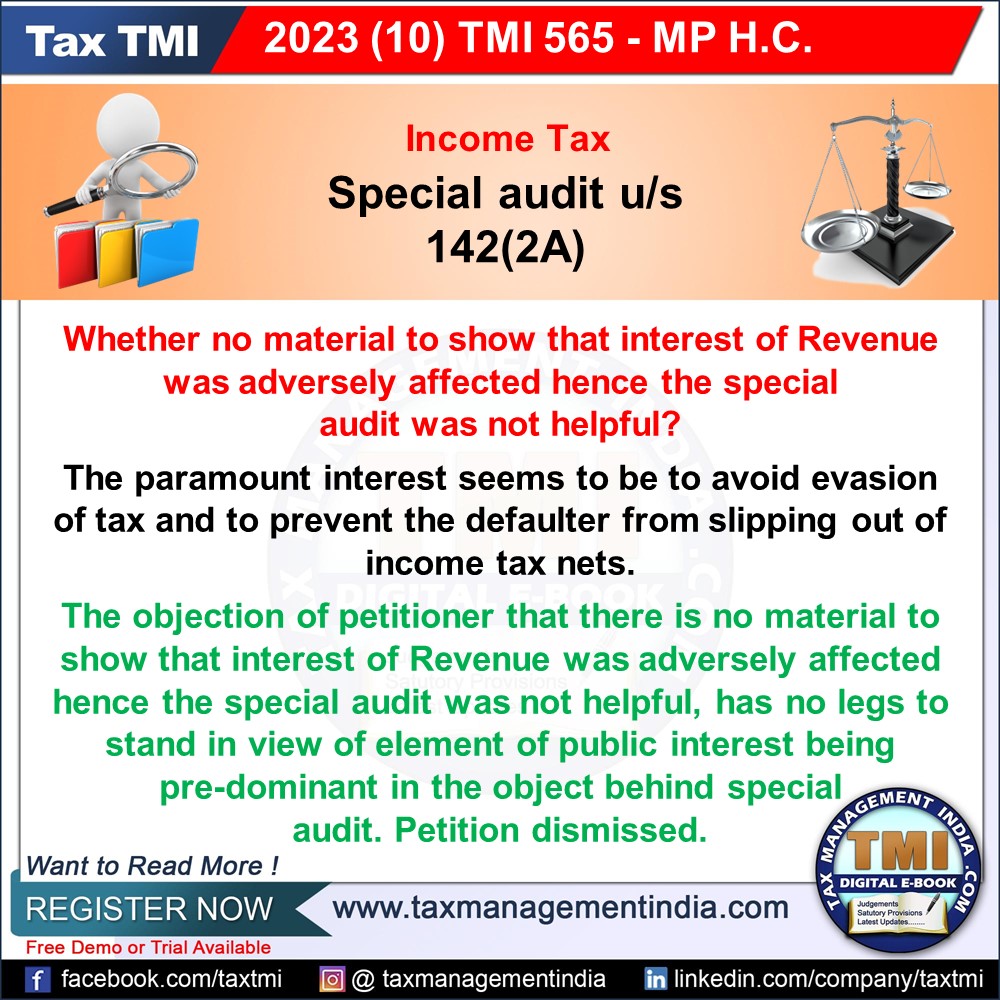

Special audit u/s. 142(2A) - Challenge on the ground that order is subjective satisfaction, is non-speaking and has been mechanically passed - The objection of petitioner that there is no material to show that interest of Revenue was adversely affected hence the special audit was not helpful, has no legs to stand in view of element of public interest being pre-dominant in the object behind special audit. - HC

View Source