Levy of penalty - non availability of the delivery challan with ...

GST

October 14, 2023

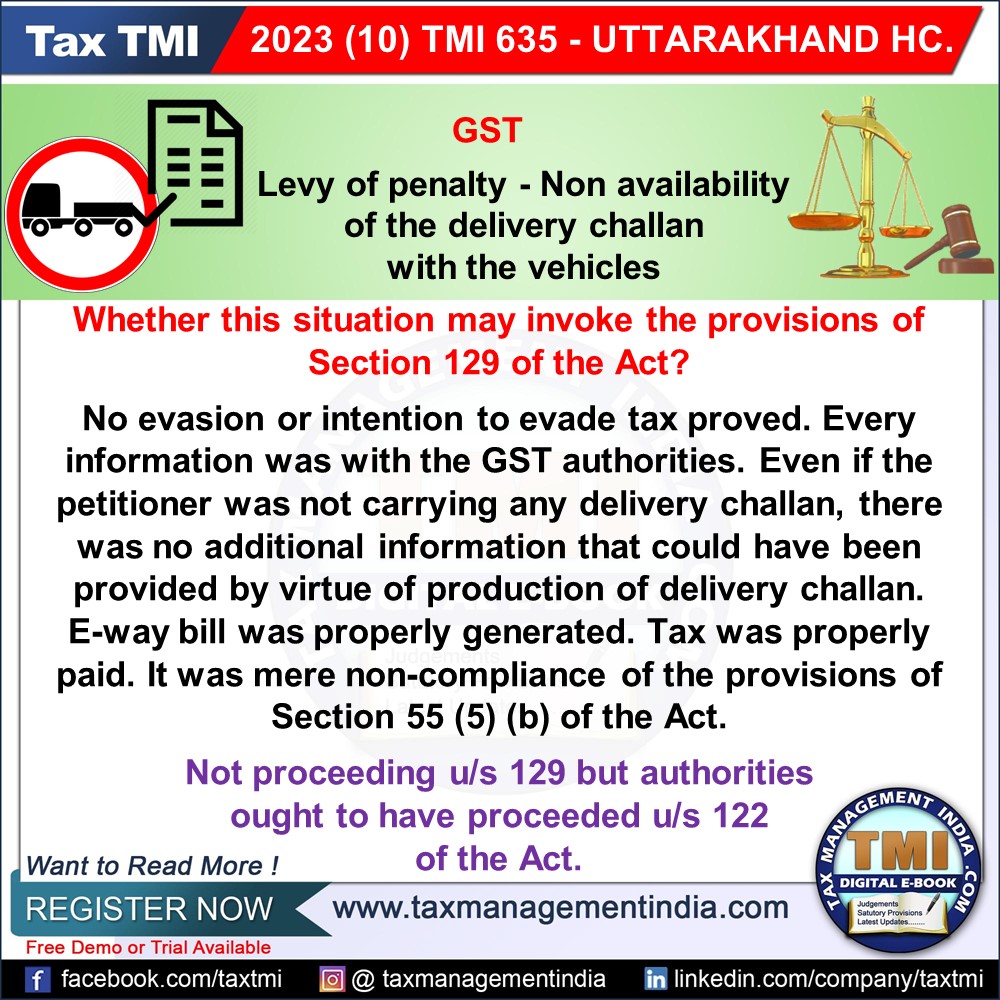

Levy of penalty - non availability of the delivery challan with the vehicles - In the instant case, there has been no evasion of tax. - E-way bill was properly generated. Tax was properly paid. It was mere non-compliance of the provisions of Section 55(5)(b) - Instead of proceeding u/s 129, the respondents authorities ought to have proceeded u/s 122. - Penalty order set aside - HC

View Source