Denial of refund of the unutilized Input Tax Credit (ITC) - ...

GST

October 14, 2023

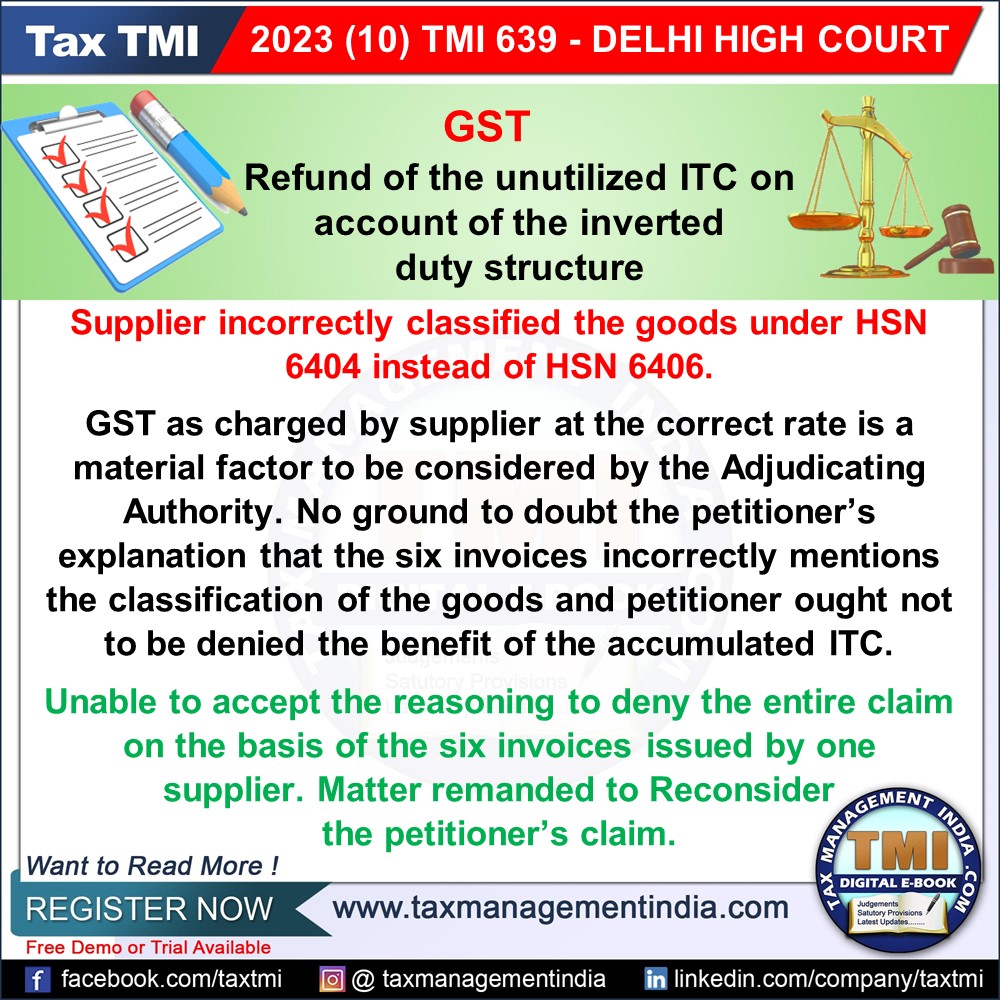

Denial of refund of the unutilized Input Tax Credit (ITC) - inverted duty structure - Denial on the ground that the one of the suppliers had erroneously mentioned HSN 6404 in respect of the goods supplied in its invoices notwithstanding that it had also furnished the certificate acknowledging the same - Matter restored back for fresh consideration - HC

View Source