Cancellation of the petitioner’s registration - Allegation that ...

GST

October 18, 2023

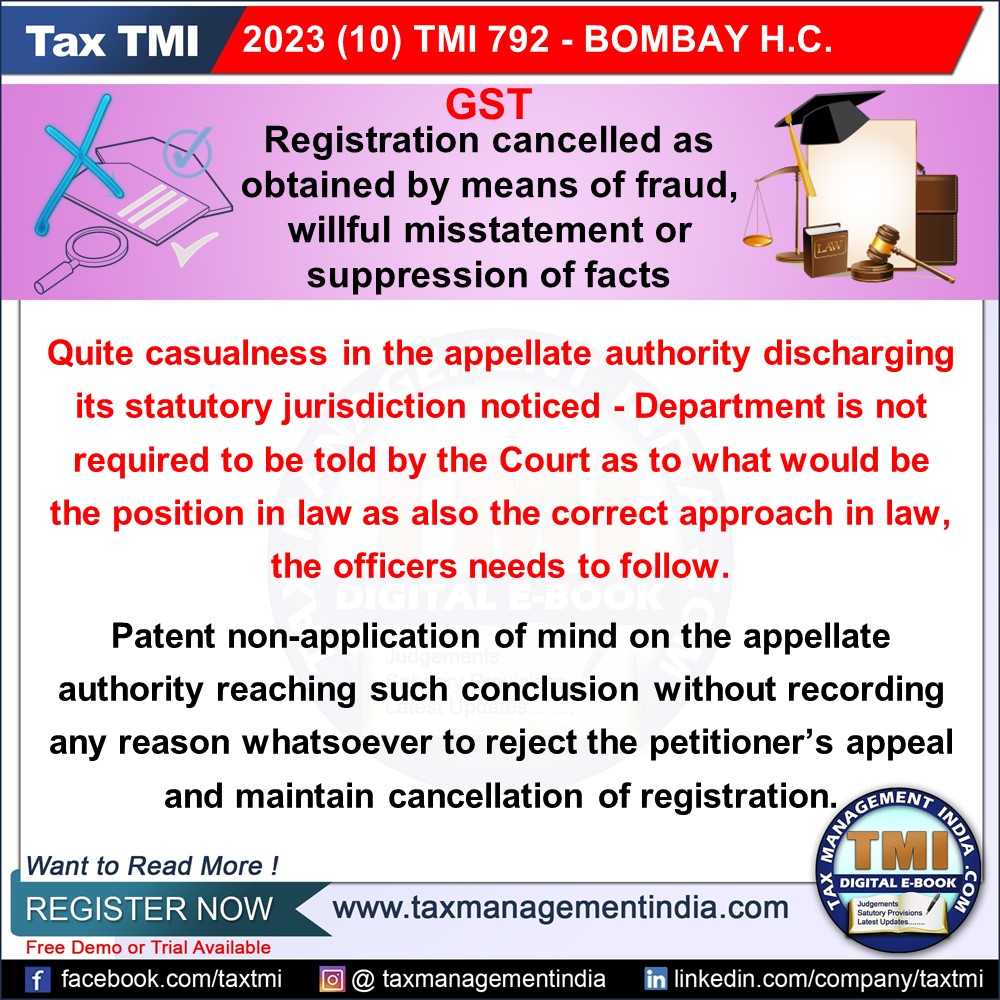

Cancellation of the petitioner’s registration - Allegation that registration obtained by means of fraud, willful misstatement or suppression of facts - time and again the department is not required to be told by the Court as to what would be the position in law as also the correct approach in law, the officers needs to follow - there are no manner of doubt that the impugned order would be required to be set aside. - HC

View Source