Beneficial provisions of the India-Mauritius DTAA in respect of ...

India-Mauritius Tax Treaty Offers Benefits for Short-Term Gains and Long-Term Loss Carry Forward u/s 74 & 90(2.

October 23, 2023

Case Laws Income Tax AT

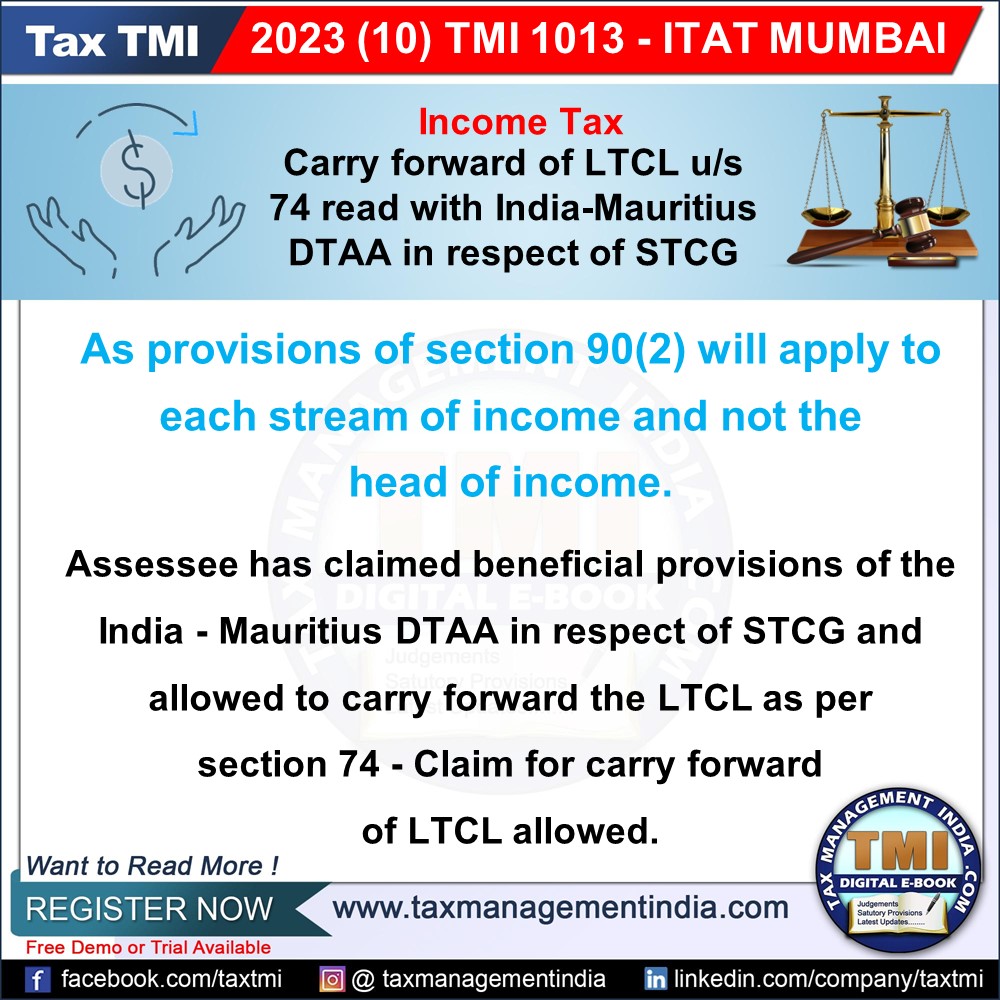

Beneficial provisions of the India-Mauritius DTAA in respect of STCG - carry forward the LTCL as per section 74 of the Act - Gains / losses arising from different transactions are distinct transactions and a separate source of income; accordingly, STCG / STCL and LTCG / LTCL are distinct and separate streams of income arising to an assessee. Section 90(2) of the Act provides the provisions of the Act or the provisions of the Treaty, whichever are beneficial, shall apply to the assessee. - AT

View Source