Nature of expenses - Allowable expenses u/s 37(1) - Interest and ...

Interest, Late Fees, and Penalty Charges Allowable u/s 37(1) of Income Tax Act, Not Disallowable as Penalties.

October 25, 2023

Case Laws Income Tax AT

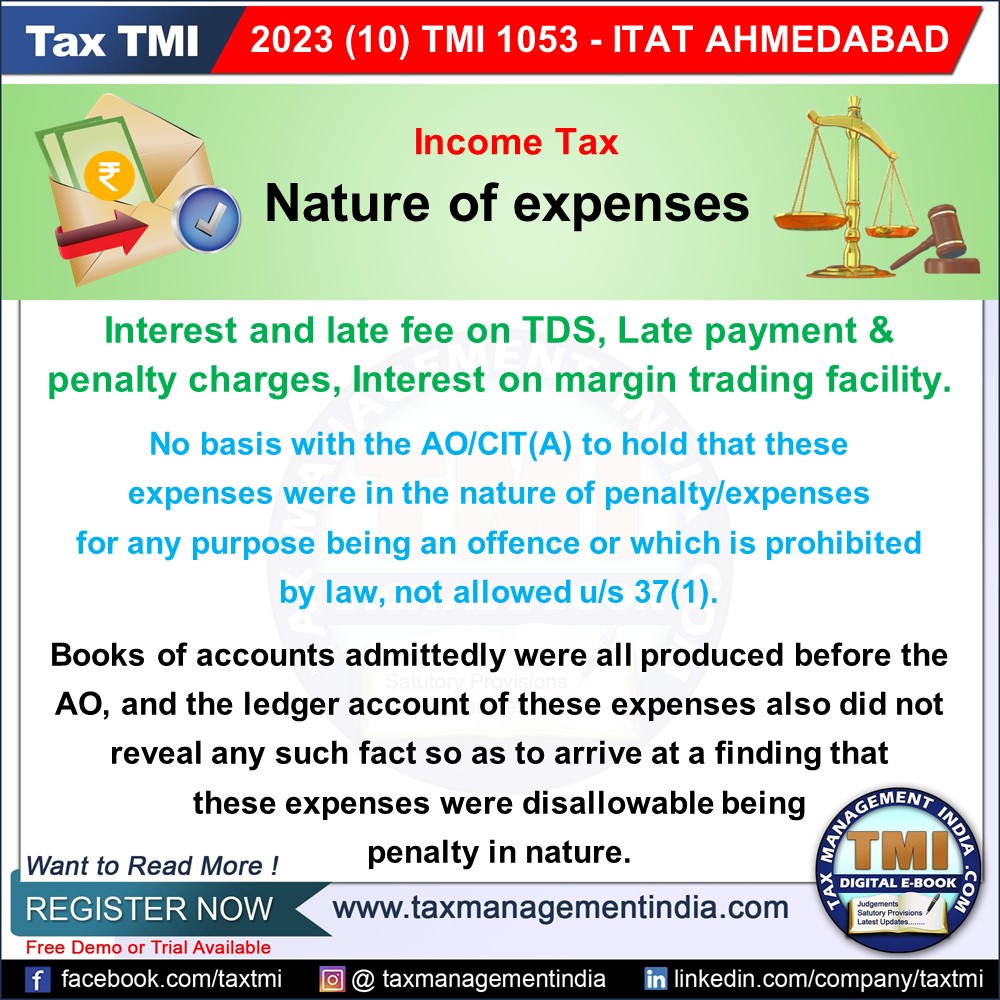

Nature of expenses - Allowable expenses u/s 37(1) - Interest and late fee on TDS, Late payment & penalty charges, Interest on margin trading facility - There was no basis with the AO/ld.CIT(A) to hold that these expenses were in the nature of penalty/expenses for any purpose being an offence or which is prohibited by law, not allowed in terms of Explanation to section 37(1) - AT

View Source