| Article Section | |||||||||||

|

Home |

|||||||||||

What are the circumstances where GST is Refundable |

|||||||||||

|

|||||||||||

What are the circumstances where GST is Refundable |

|||||||||||

|

|||||||||||

Is the GST once paid can be claimed back. There are circumstances where GST paid to the government can be claimed back . There is set procedure which is totally online where registered person can file and claim back the GST. There are two important aspect of GST Refund :

Circumstances when GST can be claimed Back :

Provided that No refund shall be allowed on accumulated ITC if export out of India is subject to export duty. Provided that no refund shall be allowed if supplier of goods or services or both avails drawback in respect of central tax or claim refund of IGST on such supplies.

Fully electronic refund process has been initiated since 26.09.2019.

in supersession of earlier Circulars viz. Circular No. 17/17/2017-GST dated 15.11.2017, 24/24/2017-GST dated 21.12.2017, 37/11/2018-GST dated 15.03.2018, 45/19/2018-GST dated 30.05.2018 (including corrigendum dated 18.07.2019), 59/33/2018-GST dated 04.09.2018, Circular No. 125/44/2019 - GST 70/44/2018-GST dated 26.10.2018, 79/53/2018-GST dated 31.12.2018 and 94/13/2019-GST dated 28.03.2019. All application filed under theses circulars were manual and shall be processed manually. But refund after 26.09.2019 shall be filed electronically and shall be processed accordingly.

Following type of refund shall be filed in RFD-01 on the common portal and the same shall be processed electronically. a. Refund of unutilized input tax credit (ITC) on account of exports without payment of tax; b. Refund of tax paid on export of services with payment of tax; c. Refund of unutilized ITC on account of supplies made to SEZ Unit/SEZ Developer without payment of tax; d. Refund of tax paid on supplies made to SEZ Unit/SEZ Developer with payment of tax; e. Refund of unutilized ITC on account of accumulation due to inverted tax structure; f. Refund to supplier of tax paid on deemed export supplies; g. Refund to recipient of tax paid on deemed export supplies; h. Refund of excess balance in the electronic cash ledger; i. Refund of excess payment of tax;

j. Refund of tax paid on intra-State supply which is subsequently held to be inter-State supply and vice versa; k. Refund on account of assessment/provisional assessment/appeal/any other order; l. Refund on account of “any other” ground or reason. Conditions for claiming refund

Verification of documents Since several cases of monetisation of credit fraudulently obtained or ineligible credit through refund of IGST on export of goods have been detected , the Govt. has issued SOP to be followed by exporter Vide circular no. 131 / 1/2020 dated 23.1.2020 Where 100% verification of export documents become necessary at the custom port. Exporter need to submit the information in Annexure ‘A’ as per the format attached to the said Circular no 131. Which has to verify within 14 days otherwise the exporter can approach the nodal cell of Pr. Chief Commissioner or Chief Commissioner office . Bunching of Refund across the Financial Years [ Cirular No. 135/05/2020 dated 31.3.2020] 2.1 Restriction on clubbing of tax periods across different financial years was put in vide para 11.2 of the Circular No. 37/11/2018-GST dated 15.03.2018. The said circular was rescinded being subsumed in the Master Circular on Refunds No. 125/44/2019-GST dated 18.11.2019 and the said restriction on the clubbing of tax periods across financial years for claiming refund thus has been continued vide Paragraph 8 of the Circular No. 125/44/2019-GST dated 18.11.2019 which is reproduced as under : Paragraph 8. “The applicant, at his option, may file a refund claim for a tax period or by clubbing successive tax periods. The period for which refund claim has been filed, however, cannot spread across different financial years. Registered persons having aggregate turnover of up to ₹ 1.5 crore in the preceding financial year or the current financial year opting to file FORM GSTR-1 on quarterly basis, can only apply for refund on a quarterly basis or clubbing successive quarters as aforesaid. However, refund claims under categories listed at (a), (c) and (e) in para 3 above must be filed by the applicant chronologically. This means that an applicant, after submitting a refund application under any of these categories for a certain period, shall not be subsequently allowed to file a refund claim under the same category for any previous period. This principle / limitation, however, shall not apply in cases where a fresh application is being filed pursuant to a deficiency memo having been issued earlier.” 2.2 Hon’ble Delhi High Court in Order dated 21.01.2020, in the case of M/s Pitambra Books Pvt Ltd., vide para 13 of the said order has stayed the rigour of paragraph 8 of Circular No. 125/44/2019-GST dated 18.11.2019 and has also directed the Government to either open the online portal so as to enable the petitioner to file the tax refund electronically, or to accept the same manually within 4 weeks from the Order. Hon’ble Delhi High Court vide para 12 of the aforesaid Order has observed that the Circulars can supplant but not supplement the law. Circulars might mitigate rigours of law by granting administrative relief beyond relevant provisions of the statute, however, Central Government is not empowered to withdraw benefits or impose stricter conditions than postulated by the law. 2.3. as per sub section-3 of section 16 of IGST Act,2017 and sub section 3 of section 54 of CGST Act, 2017 there appears no provision for claiming refund by clubbing different month across successive Financial Years. 2.4 Therefore circular no. 135/05/2020 dated 31.3.2020 will modify the Circular No. 125 dated 18.11.2019 to the extent i.e. restriction of bunching of refund claims across Financial Years shall not apply. 3.1 Guidelines for refund of Input Tax Credit u/s section 54[3] It has been decided that refund of accumulated ITC shall be restricted to the ITC as per those invoices , the detail of which are uploaded by the supplier in Form GSTR-1 and are being reflected in GSTR-2A of the applicant. Accordingly Para 36 of the Circular No. 125/44/2019 dated 18.11.2019 stands modified to that extent. 4.1 Statement of Invoices shall be submitted as per Annexure ‘B’ of the Circular No. 135/05/2020 dated 31.3.2020. -------------------- Disclaimer : The contents of this article are solely for information and knowledge and does not constitute any professional advice or recommendation. Author does not accept any liability for any loss or damage of any kind arising out of this information set out in the article and any action taken based thereon.

About the Author: CA. Sanjeev Singhal Author is Sr. Partner of G R A N D M A R K & ASSOCIATES , Chartered Accountants in Gurugram [ Haryana] and Domain Head of GST Department of GMA . He can be reached at [email protected]. WWW. grandmarkca.com

By: Sanjeev Singhal - April 4, 2020

Discussions to this article

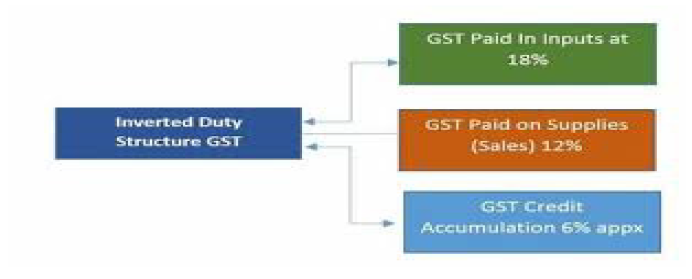

Can refund claim apply to the situation where, ITC accumulated due to inverted Tax Structure due to Higher Rate of Input Services than the the rate of Output supply of Service.? As Refund Provision speaking about Input or Goods only.

Sir, Your article has given detailed info. on GST Refunds. In that, I have two queries: 1) If the GST refund has been claimed for a particular period under "refund of IGST paid on exports", then whether the same taxpayer can claim refund of State Tax under Inverted duty structure as his Input rate is higher than output tax rate. 2) In Circular No. 37/11/2018-GST dated 15.03.2018, please refer Point No. 2.1(last three lines) where it states that "It is further clarified that refund of eligible Page 2 of 8 credit on account of State tax shall be available even if the supplier of goods or services or both has availed of drawback in respect of central tax". Can you please throw some light on its interpretation . Thank You for sharing your knowledge

|

|||||||||||

| |

|||||||||||

9911796707

9911796707