| News | |||||||||

|

|

|||||||||

Suggestions from the Industry and Trade Associations for Budget 2020-21 regarding changes in direct and indirect taxes |

|||||||||

| 12-11-2019 | |||||||||

F. No. 334/7/2019-TRU Government of India Ministry of Finance Department of Revenue (Tax Research Unit) Room No. 156 North Block New Delhi, dated the 11th November, 2019 To All Trade and Industry Associations Subject: Suggestions from the Industry and Trade Associations for Budget 2020-21 regarding changes in direct and indirect taxes. Sir/Madam, In the context of formulating the proposals for the Union Budget of 2020-21, the Ministry of Finance would like to be benefited by the suggestions and views of your Association. You may like to send your suggestions for changes in the duty structure, rates and broadening of tax base on both direct and indirect taxes giving economic justification for the same. 2. Your suggestions and views may be supplemented and justified by relevant statistical information about production, prices, revenue implication of the changes suggested and any other information to support your proposal. The request for correction of inverted duty structure, if any for a commodity, should necessarily be supported by value addition at each stage of manufacturing of the commodity. It would not be feasible to examine suggestions that are either not clearly explained or which are not supported by adequate justification / statistics. 3. Further, as regards direct taxes, while forwarding your proposals, please take into consideration the recent initiatives of the Government to reduce corporate tax rates applicable to domestic companies. It may be noted that Finance (No.2) Act, 2019 introduced a tax rate of 25 % for domestic companies having a turnover up to ₹ 400 crores in FY 2017-18. Further, the Taxation Laws (Amendment), Ordinance, 2019 promulgated on 20.09.2019 provides that certain domestic companies can avail the option to pay income-tax at reduced rates of 22 % plus applicable surcharge and cess from AY 2020-21 onwards. It also provides that new manufacturing companies established on or after 1 st October 2019, making fresh investment in manufacturing and which commence their manufacturing on or before 31st March, 2023, shall have an option to pay income-tax at the rate of 15% plus surcharge and cess from AY 2020-21 onwards. Both these options are available to companies which do not avail any exemption/incentive. As is evident, the Government policy with reference to direct taxes in the medium term is to phase out tax incentives, deductions and exemptions while simultaneously rationalising the rates of tax. It would be also desirable that while forwarding the suggestions/ recommendations positive externalities arising out of the said recommendations and their quantification are also indicated. The Synopsis of your suggestions could be given in the following format:

4. It may be noted that GST related requests are not examined as part of Annual Budget. Suggestions related to Customs and Central Excise may be forwarded in the following format:

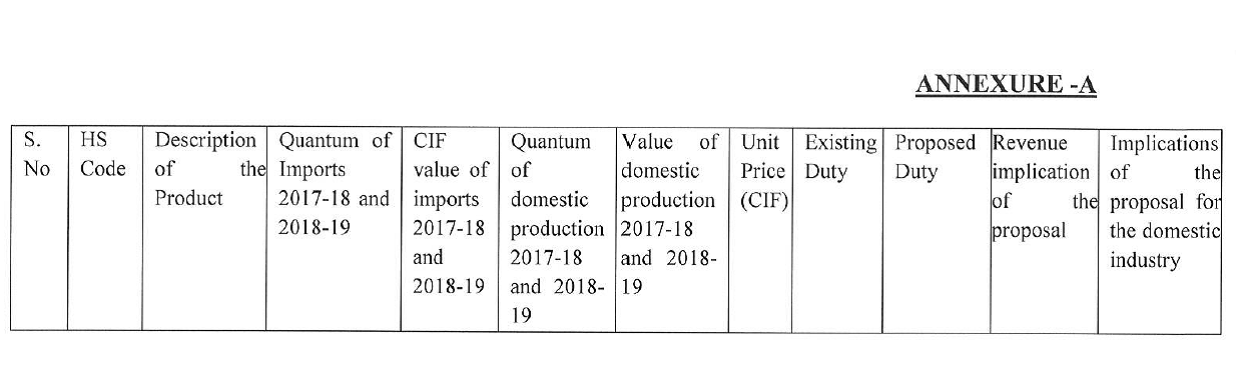

Additionally, the relevant information as prescribed in the Annexure-A enclosed herewith, may be provided. 5. Your suggestions and views may be emailed, as word document in the form of separate attachments, in respect of Indirect Taxes [Customs and Central Excise [for commodities outside GST)] to [email protected] and Direct Taxes to [email protected]. Hard copies of the Pre-Budget proposals/ suggestions relating to Customs & Central Excise may be addressed to Shri G. D. Lohani, Joint Secretary (TRU-I), CBIC, while the suggestions relating to Direct Taxes may be addressed to Shri K. C. Varshney, Joint Secretary, Tax Policy and Legislation (TPL-I), CBDT. It would be appreciated if your views and suggestions reach us by the 21st November, 2019. Yours sincerely,

(Modassar Shafi) Budget Officer (TRU) Tel: 011-2309 5547

|

|||||||||

9911796707

9911796707