| News | |||

|

|

|||

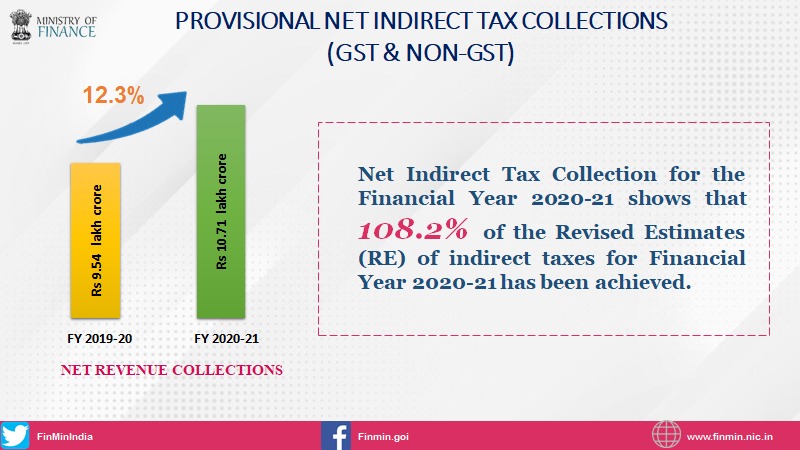

Provisional Net Indirect Tax collections (GST & Non-GST) for the Financial Year 2020-21 show growth of more than 12% compared to actual Revenue Receipts in FY 2019-20. |

|||

| 13-4-2021 | |||

Provisional Net Indirect Tax collections (GST & Non-GST) for the Financial Year 2020-21 show growth of more than 12% compared to actual Revenue Receipts in FY 2019-20. The provisional figures for indirect tax collections (GST & non-GST) for the Financial Year 2020-21 show that net revenue collections are at ₹ 10.71 lakh crore as compared to 9.54 lakh Crore for the Financial Year 2019-20, thereby registering a growth of 12.3%. Net Indirect Tax Collection for the Financial Year 2020-21 shows that 108.2% of the Revised Estimates (RE) of indirect taxes for Financial Year 2020-21 has been achieved.

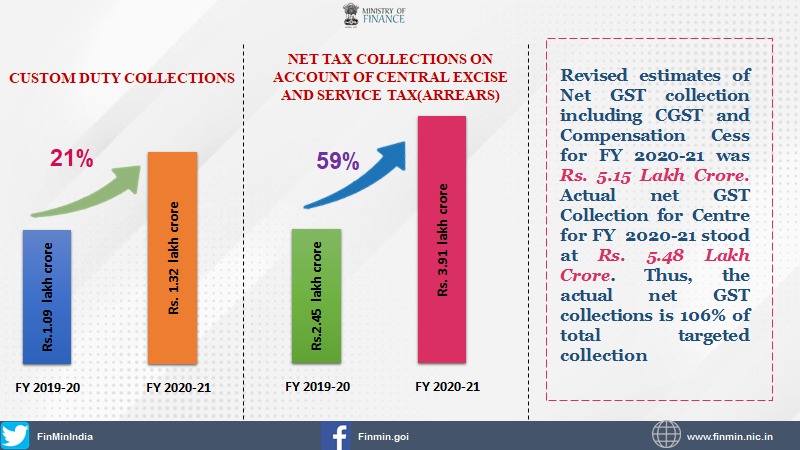

As regards customs, net tax collections stood at ₹ 1.32 lakh crore during Financial Year 2020-21 as compared to ₹ 1.09 lakh crore during the previous Financial Year, thereby registering a growth of around 21%. Net Tax collections on account of Central Excise and Service Tax(Arrears) during Financial Year 2020-21 stood at ₹ 3.91 lakh crore as compared to ₹ 2.45 lakh crore in the previous Financial Year, thereby registering a growth of more than 59%.

Net Tax collections on account of GST of Centre (CGST+IGST+ Compensation Cess) during Financial Year 2020-21 is ₹ 5.48 lakh crore as compared to ₹ 5.99 lakh crore in the previous Financial Year. Revised estimates of Net GST collection including CGST and Compensation Cess for FY 2020-21 was ₹ 5.15 Lakh Crore , Thus, the actual net GST collections is 106% of total targeted collection, though these are 8% lower than the last FYs collection. The GST collections were severely affected in the first half of the Financial year on account of Covid. However, in the second half, the GST collections registered a good growth and collections exceeded ₹ 1 lakh crore in each of the last six months. March saw an all-time high of GST collection at ₹ 1.24 lakh crore after very good figures in the month of January and February. Several measures taken by the Central Government helped in improving compliance in GST. The above figures are as yet provisional and subject to change pending reconciliation. |

|||

9911796707

9911796707