The forty fourth meeting of the Monetary Policy Committee (MPC), constituted under Section 45ZB of the Reserve Bank of India Act, 1934, was held during August 8 to 10, 2023.

2. The meeting was attended by all the members – Dr. Shashanka Bhide, Honorary Senior Advisor, National Council of Applied Economic Research, Delhi; Dr. Ashima Goyal, Emeritus Professor, Indira Gandhi Institute of Development Research, Mumbai; Prof. Jayanth R. Varma, Professor, Indian Institute of Management, Ahmedabad; Dr. Rajiv Ranjan, Executive Director (the officer of the Reserve Bank nominated by the Central Board under Section 45ZB(2)(c) of the Reserve Bank of India Act, 1934); Dr. Michael Debabrata Patra, Deputy Governor in charge of monetary policy – and was chaired by Shri Shaktikanta Das, Governor.

3. According to Section 45ZL of the Reserve Bank of India Act, 1934, the Reserve Bank shall publish, on the fourteenth day after every meeting of the Monetary Policy Committee, the minutes of the proceedings of the meeting which shall include the following, namely:

-

the resolution adopted at the meeting of the Monetary Policy Committee;

-

the vote of each member of the Monetary Policy Committee, ascribed to such member, on the resolution adopted in the said meeting; and

- the statement of each member of the Monetary Policy Committee under sub-section (11) of section 45ZI on the resolution adopted in the said meeting.

4. The MPC reviewed the surveys conducted by the Reserve Bank to gauge consumer confidence, households’ inflation expectations, corporate sector performance, credit conditions, the outlook for the industrial, services and infrastructure sectors, and the projections of professional forecasters. The MPC also reviewed in detail the staff’s macroeconomic projections, and alternative scenarios around various risks to the outlook. Drawing on the above and after extensive discussions on the stance of monetary policy, the MPC adopted the resolution that is set out below.

Resolution

5. On the basis of an assessment of the current and evolving macroeconomic situation, the Monetary Policy Committee (MPC) at its meeting today (August 10, 2023) decided to:

- Keep the policy repo rate under the liquidity adjustment facility (LAF) unchanged at 6.50 per cent.

6. The standing deposit facility (SDF) rate remains unchanged at 6.25 per cent and the marginal standing facility (MSF) rate and the Bank Rate at 6.75 per cent.

- The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

These decisions are in consonance with the objective of achieving the medium-term target for consumer price index (CPI) inflation of 4 per cent within a band of +/- 2 per cent, while supporting growth.

The main considerations underlying the decision are set out in the statement below.

Assessment

Global Economy

7. The global economy is slowing and growth trajectories are diverging across regions amidst moderating but above target inflation, tight financial conditions, simmering geopolitical conflicts, and geoeconomic fragmentation. Sovereign bond yields have hardened. The US dollar fell to a 15-month low in mid-July on expectations of an early end to the monetary tightening cycle, although it recouped some of the losses subsequently. Equity markets have gained on expectations of a soft landing for the global economy. For several emerging market economies, weak external demand, elevated debt levels and tight external funding conditions pose risks to their growth prospects.

Domestic Economy

8. Domestic economic activity is maintaining resilience. The cumulative south-west monsoon rainfall was the same as the long period average up to August 9, 2023 although the temporal and spatial distribution has been uneven. The total area sown under kharif crops was 0.4 per cent higher than a year ago as on August 4, 2023. The index of industrial production (IIP) expanded by 5.2 per cent in May while core industries output rose by 8.2 per cent in June. Amongst high frequency indicators, e-way bills and toll collections expanded robustly in June-July, while rail freight and port traffic recovered in July after remaining muted in June. The composite purchasing managers’ index (PMI) rose to a 13-year high in July.

9. Urban demand remains robust, with domestic air passenger traffic and household credit exhibiting sustained double digit growth. The growth in passenger vehicle sales has, however, moderated. In the case of rural demand, tractor sales improved in June while two-wheeler sales moderated. Cement production and steel consumption recorded robust growth. Import and production of capital goods continued in expansion mode. Merchandise exports and non-oil non-gold imports remained in contraction territory in June. Services exports posted subdued growth amidst slowing external demand.

10. Headline CPI inflation picked up from 4.3 per cent in May to 4.8 per cent in June, driven largely by food group dynamics on the back of higher prices of vegetables, eggs, meat, fish, cereals, pulses and spices. Fuel inflation softened during May-June, primarily reflecting the fall in kerosene prices. Core inflation (i.e., CPI excluding food and fuel) was steady in June.

11. The daily absorption of liquidity under the LAF averaged ₹1.8 lakh crore during June-July as compared with ₹1.7 lakh crore in April-May. Money supply (M3) expanded by 10.6 per cent y-o-y as on July 28, 2023 as against 10.1 per cent on May 19, 2023. Bank credit grew by 14.7 per cent y-o-y as on July 28, 2023 as compared with 15.4 per cent on May 19, 2023. India’s foreign exchange reserves stood at US$ 601.5 billion as on August 4, 2023.

Outlook

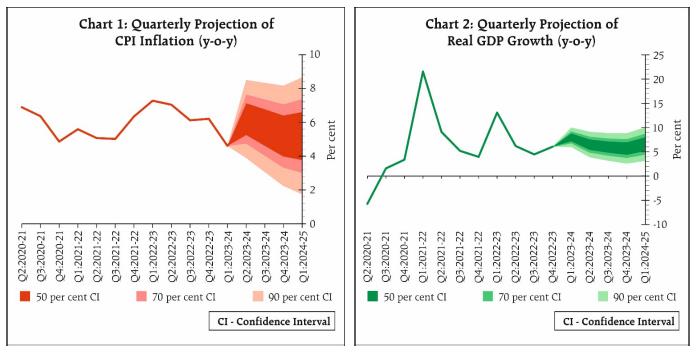

12. Going forward, the spike in vegetable prices, led by tomatoes, would exert sizeable upside pressures on the near-term headline inflation trajectory. This jump is, however, likely to correct with fresh market arrivals. There has been significant improvement in the progress of the monsoon and kharif sowing in July; however, the impact of the uneven rainfall distribution warrants careful monitoring. Crude oil prices have firmed up amidst production cuts. Manufacturing, services and infrastructure firms polled in the Reserve Bank’s enterprise surveys expect input costs to ease but output prices to harden. Taking into account these factors and assuming a normal monsoon, CPI inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent, with risks evenly balanced. CPI inflation for Q1:2024-25 is projected at 5.2 per cent (Chart 1).

13. Looking ahead, the recovery in kharif sowing and rural incomes, the buoyancy in services and consumer optimism should support household consumption. Healthy balance sheets of banks and corporates, supply chain normalisation, business optimism and robust government capital expenditure are favourable for a renewal of the capex cycle which is showing signs of getting broad-based. Headwinds from weak global demand, volatility in global financial markets, geopolitical tensions and geoeconomic fragmentation, however, pose risks to the outlook. Taking all these factors into consideration, real GDP growth for 2023-24 is projected at 6.5 per cent with Q1 at 8.0 per cent; Q2 at 6.5 per cent; Q3 at 6.0 per cent; and Q4 at 5.7 per cent, with risks broadly balanced. Real GDP growth for Q1:2024-25 is projected at 6.6 per cent (Chart 2).

14. The headline inflation is likely to witness a spike in the near months on account of supply disruptions due to adverse weather conditions. It is important to be vigilant about these shocks with a readiness to act appropriately so as to ensure that their effects on the general level of prices do not persist. There are risks from the impact of the skewed south-west monsoon so far, a possible El Niño event and upward pressures on global food prices due to geopolitical hostilities. Domestic economic activity is holding up well, supported by domestic demand in spite of the drag from weak external demand. With the cumulative rate hike of 250 basis points undertaken by the MPC working its way into the economy, the MPC decided to keep the policy repo rate unchanged at 6.50 per cent, but with preparedness to undertake policy responses, should the situation so warrant. The MPC will maintain a close vigil on the evolving inflation scenario and remain resolute in its commitment to aligning inflation to the target and anchoring inflation expectations. The MPC also decided to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

15. All members of the MPC – Dr. Shashanka Bhide, Dr. Ashima Goyal, Prof. Jayanth R. Varma, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das – unanimously voted to keep the policy repo rate unchanged at 6.50 per cent.

16. Dr. Shashanka Bhide, Dr. Ashima Goyal, Dr. Rajiv Ranjan, Dr. Michael Debabrata Patra and Shri Shaktikanta Das voted to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth. Prof. Jayanth R. Varma expressed reservations on this part of the resolution.

17. The minutes of the MPC’s meeting will be published on August 24, 2023.

18. The next meeting of the MPC is scheduled during October 4-6, 2023.

Voting on the Resolution to keep the policy repo rate unchanged at 6.50 per cent

| Member |

Vote |

| Dr. Shashanka Bhide |

Yes |

| Dr. Ashima Goyal |

Yes |

| Prof. Jayanth R. Varma |

Yes |

| Dr. Rajiv Ranjan |

Yes |

| Dr. Michael Debabrata Patra |

Yes |

| Shri Shaktikanta Das |

Yes |

Statement by Dr. Shashanka Bhide

19. Growth indicators for the first four months of FY 2023-24 point to the resilience of the economy in the face of adverse external economic conditions and the uneven spread of monsoon over the months and spatially across the regions. The headline inflation rate dropped significantly in Q1: FY2023-24 but the headline inflation rate for FY 2023-24 as a whole as projected in the June 2023 MPC meeting was above 5 per cent, highlighting the distance to the policy target of 4 per cent. The policy rate was kept unchanged in the last MPC meeting in view of the need to assess the course of the inflation rate and the economic activity in the context of the increase in the policy rates effected since May 2022.

20. As far as the overall domestic economic activity is concerned, the outlook for the near term appears to be one of lower GDP growth compared to the 7.2 per cent growth rate achieved in FY 2022-23. The outlook for the global economic growth has become more optimistic with the IMF increasing its projection of the world GDP growth in its July update of the World Economic Outlook to 3.0 per cent in 2023 from the earlier projection of 2.8 per cent. However, there are risks of adverse shocks such as the further deterioration of geopolitical conflicts and the adverse climatic conditions affecting agriculture. The same is the case with respect to inflation outlook. Vulnerability to spikes in international commodity and energy prices caused by disruptions in supply chains pose a significant challenge to maintaining domestic price stability.

21. The high frequency indicators of the economic activity reflect growth resilience and the need for a cautious outlook. Merchandise exports and imports including non-oil non-gold imports have registered negative YOY growth rates in the recent months. Services exports are rising but the growth has decelerated. Services imports declined in June. Construction related indicators such as cement production and finished steel production point to sustained growth. Indicators such as E-way bills, GST collection and toll collection suggest sustained expansion in domestic economic activity. But air cargo, rail freight and port traffic show weak trends. The PMI for manufacturing and services for July 2023 re-iterate the resilience of the economy in the face of weak external demand conditions and uncertainties faced over the quality of the monsoon rains this year. However, expectations of the future output are on a cautious note.

22. The indicators related to household consumption expenditure reflect its moderate momentum. The Consumer Confidence Survey of urban households by RBI conducted in July 2023 indicates cautious optimism for the year ahead: the households are optimistic of improved economic conditions one-year ahead and the level of optimism remains stable at the level seen in the survey conducted in May 2023. The increased consumption spending is still driven by the ‘essential expenditure’ and the ‘non-essential or discretionary expenditure’ is expected to gain strength in the year ahead, though the optimism declined marginally in the latest round of the survey. The trends in IIP for consumer goods also appear to reflect this pattern: IIP for consumer non-durables has shown significant growth in April-May 2023 and the YOY growth rate of IIP for consumer durables remains negative. Indicators of consumption growth such as passenger vehicle sales, 2-wheeler sales and air travel are higher in April-May 2023 YOY basis, with the performance slowing in June for the auto sector. Maintaining the growth momentum of the agricultural sector seen in the last 2-3 years would be crucial in sustaining rural consumption demand.

23. The impact of the government’s capital expenditure support both at the Central and state levels for infrastructure and support for building production capacity in the industry is reflected in the indicators related to industrial activity. The IIP for infrastructure/ construction is the only sub-sector of industry to register double digit YOY growth during April-May 2023. The IIP for capital goods has also registered growth of 6.5 per cent in the same period but it is a sharp decline from the growth in Q4: FY2022-23. RBI’s survey of enterprises carried out in April-June 2023 reflected increased levels of investment plans for FY 2023-24. The investment intentions reflected in the funds raised for investment purpose in Q1 FY 2023-24 by the private corporates, based on an analysis by RBI, are strikingly high. The net FDI inflows in April- May 2023 at USD 5.5 billion are about half the level seen in the same period in 2022. Maintaining high investment demand would be important for sustaining growth momentum in FY 2023-34.

24. Considering the developments in the economy and the external global environment, the YOY GDP growth for 2023-24 has been retained at 6.5 per cent, the same as in the June meeting of the MPC. The quarterly growth projections are Q1 at 8.0 per cent, Q2 at 6.5 per cent, Q3 at 6.0 per cent and Q4 at 5.7 per cent. The median forecast of YOY GDP growth for FY 2023-24 from the RBI Survey of Professional Forecasters is 6.1 per cent.

25. At 4.6 per cent, the CPI based YOY headline inflation rate in Q1: FY2023-24, is below the 6 per cent mark after a run of above 5 per cent for the previous eight quarters. On the positive side, in Q1, the core inflation rate excluding food and fuel, has also come close to 5 per cent. Both food and fuel & light components of headline inflation were below 5 per cent in Q1.

26. The downward momentum of the inflation is complemented by the expectations of moderating inflation. The recent RBI bi-monthly sample survey of urban households indicates that the 3-months and one-year median expected inflation rates are lower than in the previous two consecutive rounds. The ‘Business Inflation Expectations Survey’ of firms conducted by the IIM Ahmedabad in June 2023 indicates a decline in the one-year-ahead expected CPI headline inflation rate of below 5 per cent.

27. Based on an assessment of the various factors affecting price trends, and an assumption of a normal monsoon, CPI headline inflation is projected at 5.4 per cent for 2023-24, with Q2 at 6.2 per cent, Q3 at 5.7 per cent and Q4 at 5.2 per cent. The projected inflation rate in Q2 and Q3 is now higher than the projections of the June MPC meeting, primarily on account of risks to food inflation. The Survey of Professional Forecasters conducted in July 2023 provides median forecast of headline inflation rate of 5.2 per cent in 2023-24.

28. While there is a moderating trend in the headline inflation rate, there are clearly upside risks on account of the weather uncertainty affecting agricultural prices. The international commodity prices have remained low in 2023 relative to the peaks of 2022; however, the volatility has increased for some of the agricultural commodities and there is hardening in the case of energy in the recent period. While the spikes in prices of a few commodities may not lead to persistent overall price pressures, broadening of price pressures would be a concern. The impact of policy rate actions initiated in May 2022 leading to an increase in the repo rate by 250 basis points by February 2023 is yet to be fully realised. There are also risks to growth projections, particularly as they relate to export demand. Therefore, there is a need at this juncture to retain the current policy rate and the policy stance to sustain the moderating forces on inflation.

29. Accordingly, I vote:

-

to keep the policy repo rate unchanged at 6.50 per cent and

-

to remain focused on withdrawal of accommodation to ensure that inflation progressively aligns with the target, while supporting growth.

Statement by Dr. Ashima Goyal

30. Since global inflation is moderating without a major impact on growth a soft landing becomes more feasible. But financial fragilities in some countries, erratic weather and geopolitics continue to remain threats.

31. Indian growth also continues to be healthy especially since the rise in fixed investment can raise potential output. There are indications investment is becoming broad-based as state governments and small firms also invest more. It needs to strengthen further, however, for which policy certainty and smoothing of shocks is required. Export dependent industries such as textiles are not doing well.

32. Despite a late start, the monsoon more than made up in July. Precipitation is uneven, however, and extreme weather has caused unprecedented spikes in key vegetable prices. Even as headline inflation rose in June, core inflation stayed soft and professional forecasters expect it to fall below 5%. The pandemic related rise in firm costs has more than reversed. For example, container shipping rates in July were about half their 10 year average rates.

33. Since the Indian middle income consumer is price sensitive, profits have risen for FMCG firms that have passed on the fall in costs. Nominal sales growth of manufacturing companies softened in Q1 according to the early corporate results while real growth rose, pointing to factors limiting price rise. The RBI end June enterprise survey also shows the moderation in input cost is expected to continue in the 2nd half of the year. This should impact pricing. Prices are expected to rise, but by how much?

34. Research suggests that Indian firms change prices about once in three years, so the passing on of cost softening is not yet complete and should continue as long as current supply-shocks reverse. Moreover, for firms that print a maximum retail price on packages, the increase is found to be at around 4%1. This may indicate the inflation target is becoming a focal point. The sectoral structure of inflation also supports softening core inflation. In IT services where share of wage cost is above 50% wage growth is reducing as export demand slows. Wage growth was the highest in this sector in 2022-23. In manufacturing, raw material cost is the largest share of cost and it has fallen.

35. In the initial period when inflation targeting was introduced, causality was thought to be from headline to core inflation2. Then food inflation could have persistent effects on inflation. But later research showed this result was special to a period of sustained high food inflation that began in 2007 and led to second round rise in wages. In normal conditions, it was the more persistent core that affected volatile food inflation3. Spikes in food prices can therefore be looked through as long as they remain just that.

36. The household inflation expectation and consumer confidence surveys suggest households are doing exactly this looking through, since inflation perceptions have risen but one year ahead inflation expectations have fallen.

37. However, agricultural prices must become more resistant to possibly more frequent weather shocks. For this diversified and resilient vegetable supply chains are required. Well-functioning markets respond before price spikes become very large. Delhi should not be buying tomatoes only from Himachal Pradesh. States can experiment with allowing corporations more direct access to farmer organizations. Large food retail chains also buying from mandies aggravates price movement in India. Farmer cooperatives have more bargaining power and platforms like Open Network for Digital Commerce (ONDC) can aid them in establishing supply agreements anywhere in the country. Processing and storage facilities must improve. In addition to these longer-term actions, trade offers short term degrees of freedom in an open economy.

38. Pre-emptive supply-side action that prevents repeated or persistent food price shocks would abort second round increase in wages and other prices that could require further monetary tightening and growth sacrifice.

39. Slower global growth is likely to keep a lid on international oil prices. Indian oil majors turned profitable in the summer last year and are showing large profits. They are in a position to reduce domestic prices. Oil price cuts have a large impact on household inflation expectations.

40. Commitment to flexible inflation targeting that anchors inflation expectations requires aligning the nominal repo rate with medium term expected inflation. The latter is less affected by transient shocks and measurement issues. Headline inflation forecasts have risen in the short-term but remain slightly above 5% for the next year so that a repo rate of 6.5% still gives a positive real rate of around unity. This is the apt real rate given uncertainties in both growth and inflation.

41. Therefore, in this meeting it continues to be appropriate for the MPC to pause. I thus vote for keeping the repo rate unchanged in this meeting. I also vote for the present stance to continue since at present liquidity is in surplus and policy needs to signal continuing watchfulness towards bringing inflation to the target. The progress of the rest of the monsoon, possible supply-side action, further pass through of past rate hikes, the behaviour of food prices and the evolution of core inflation, have all to be carefully observed.

Statement by Prof. Jayanth R. Varma

42. In June, I warned against declaring victory based on the inflation prints of just a couple of months, and expressed discomfort with the self-congratulatory tone of the MPC statement of that month about inflation having come inside the tolerance band. It is now clear that we would have a couple of months of inflation readings well above the tolerance band. I view these monthly gyrations with some degree of equanimity. Just as a couple of low readings do not call for celebration, it is equally true that a couple of very high readings do not call for panic. What is important is the projected trajectory of inflation over the next several quarters. On this basis, I continue to have the same cautious optimism that I had in the June meeting. I expect the continuing slowdown in China to keep a lid on commodity prices. Moreover, rains in July have attenuated the monsoon risks, though there are continuing worries about the spatio-temporal distribution.

43. Considering the balance of risks, I vote for keeping the repo rate unchanged in this meeting. I am of the view that the current level of the repo rate is high enough to bring inflation below the upper tolerance band on a sustained basis and also glide it towards the middle of the band.

44. Turning to the stance, my reservations remain the same as in the past. However, this would be the third successive meeting at which the repo rate has been left unchanged (assuming that the MPC decides to pause now). This disconnect between stance and action has completely hollowed out whatever meaning the stance might have originally had, and turned it into a harmless ritualism. So I am content with expressing reservations about the stance.

Statement by Dr. Rajiv Ranjan

45. In the last minutes, I had mentioned how growth momentum had surprised positively whereas inflation was turning soft, implying a goldilocks kind of scenario. That assessment broadly holds true, albeit with a transitory spurt in inflation. I had highlighted that the spatial and temporal distribution of the monsoon would be critical for the evolving inflation dynamics. As per the latest available information, this risk has materialised with the uneven progress of the monsoon manifesting in the form of excess rains in the north-west regions and disrupting supply, and deficient rains in the eastern part delaying crop sowing. Vegetables prices rose sharply in June-July – much above the seasonal trend and the largest in recent memory.

46. High frequency food price data for July indicate a major price shock from vegetables, particularly, tomatoes and this time around it is turning out to be different than earlier episodes. Since mid-June to end-July 2023 tomato prices have surged by 362 per cent, with more than 80 per cent of the price escalation happening during end-June and first half of July. The magnitude and intensity of the price shock this time around was substantially higher when compared to earlier years.4 Our historical experience, however, suggests that the inflationary shocks emanating from commodities like vegetables are in fact transitory in nature. In 2017, when tomato prices soared by 27 per cent in the month of June and further by 138 per cent in July, this was followed by a sharp correction over the subsequent two months. Likewise, in June 2016, the steep increase in tomato prices was fully corrected within the next three months as market supplies improved. Although the catch up in kharif sowing augurs well for agricultural production, price increases observed across other vegetables as well as other food sub-groups such as cereals, pulses and spices remain a point of concern, demanding our vigilant monitoring. The forecast of continuation of uneven monsoon in the next two months together with an El Nino event, amid volatile global food prices, makes the food price outlook uncertain.

47. On the growth front, available information for Q1:2023-24 shows that domestic economic activity has been holding well, on the back of healthy growth in agriculture, rebound in the manufacturing sector, and continued robust expansion in services activity. In the agriculture sector, GVA growth is expected to be above 5.0 per cent on the back of 9.5 per cent growth in rabi foodgrains production.5 Turning to the manufacturing sector, the early listed corporate results of Q1:2023-246 suggest increase in nominal GVA with moderating input cost pressures and double-digit expansion in staff cost. When seen in conjunction with negative deflator-based inflation of around 2.7 per cent and robust unorganised manufacturing activity7, real growth of manufacturing GVA could be over 7.0 per cent in Q1:2023-24. Services activity gained an accelerated momentum in Q4:2022-23, which seems to have continued in Q1:2023-24. Among services activities, ‘trade, hotel, transportation, communication’ component was 10.2 per cent below the pre-pandemic levels in Q1:2022-23, suggesting that this sub-group will receive a strong positive base effect in Q1:2023-24. Furthermore, strong momentum of this sub-group from Q4:2022-23 has carried forward to Q1:2023-24 as suggested by available indicators such as e-way bills, toll collections, GST collections etc. Considering all these factors, real GDP growth is expected to be around 8.0 per cent in Q1:2023-24.

48. Looking ahead, the real GDP growth will be driven by strengthening rural consumption on the back of good prospects of kharif crops; the manufacturing sector supported by easing input costs and wide scope for services activity to catch up with pre-pandemic trend, particularly in “trade, hotels, transportation, communication, etc.”. Thus, taking all these factors, real GDP growth has been projected at 6.5 per cent for 2023-24.

49. Monetary policy clearly can do little about the first-round effect of a supply side shock emanating from say vegetables. If monetary policy responds to such a surge in headline inflation, the policy would likely be excessively tight and induce high volatility in macroeconomic conditions.8 On the other hand, if these shocks do not go away and become persistent then inflation expectations can become unanchored, leading to a drift in inflation away from its underlying trend. It may be noted that on the earlier two occasions, during mid-2020 and during mid-2021, the MPC’s prognosis of looking through transitory pressures on inflation has in fact proved accurate.

50. Against the balance of risks, I vote for a pause in the rate action. While the impact of our actions so far continues to play out in the economy, our job is not yet fully over. The costs of high inflation regime are simply too high to take any chances (BIS, 2023).9 It is in this context that the primacy of 4 per cent inflation target (as distinct from tolerance of deviation from target) emphasised in my last minutes assumes importance. Accordingly, I vote for the continuance of the stance of withdrawal of accommodation.

Statement by Dr. Michael Debabrata Patra

51. With the visceral effects of the pandemic fading, the Indian economy is expanding at a moderate pace on the shoulder of the business cycle, and the output gap has closed. Corporate profitability is surging despite moderating top line growth. In the financial sector, credit conditions remain strong even as the cost of funds tightens. The revenge spending related rotation of demand towards services is in full tide, but the peak is subsiding. From the second quarter of 2023-24, unfavourable base effects may create a ‘wet patch’ in the trajectory of GDP; hence, strengthening the momentum of domestic economic activity is key to realising the projected path of the economy over the rest of the year.

52. Recent spikes in food, metal and energy prices have destabilised the international inflation environment as new spates of geopolitical hostilities take their toll on food and energy security worldwide. In addition, India faces the onslaught of overlapping localised supply shocks, which are causing price-sensitive food items in the CPI to spike and push up headline inflation. The elephant in India is the monsoon, with August shortfalls rendering the outlook uncertain in the shadow of El Niño effects even as Indian Ocean dipole conditions are turning positive.

53. Against this backdrop, recent inflation developments and outlook warrant careful assessment and strategy. Through the current episode, inflation has declined from an average of 7.3 per cent in the first quarter of 2022-23 (peak at 7.8 per cent in April 2022) to 4.6 per cent in the first quarter of 2023-24 (4.8 per cent in June 2023), i.e., by 270 basis points. Monetary policy tightening by a cumulative increase of 250 basis points in the policy rate contributed 130 basis points of disinflation, while the waning of supply shocks contributed 140 basis points and other factors offset each other. At the current juncture, however, the gains in output stabilisation are being threatened by the incidence of sporadic supply shocks which elevate the general level of prices instead of dissipating through relative price adjustments within the budget constraint. Our surveys suggest that households’ inflation perceptions have been impacted by these food price developments – which is also reflected in consumer perceptions regarding the price level and inflation – but they should stabilise over the year ahead as supply conditions improve. A risk to the inflation outlook stems from the liquidity overhang in the banking system. Withdrawal of excess liquidity should engage primacy in the attention of the RBI going forward as it presents a direct threat to the RBI/MPC resolve to align India’s inflation with the target, besides the potential risks to financial stability.

54. While unanticipated and short-lived supply demand mismatches lie outside the realm of monetary policy, the commitment to price stability requires the RBI to see off these price perturbations by guarding against spillovers – in India, food price flares can permeate through wages, rents, transport costs and, importantly, through expectations into core inflation. Ensuring the sustained easing of core inflation is crucial to the MPC’s objective of bringing inflation down to the target. This objective should not be undermined by supply shocks that show any signs of persisting and getting broader-based. Accordingly, I vote for maintaining status quo on the policy rate and for persevering with the withdrawal of monetary policy accommodation.

Statement by Shri Shaktikanta Das

55. The global economic environment continues to be uncertain. Financial conditions remain tight and volatile. Inflation remains above target in major economies. Amidst all these, India stands out for its resilience and stability and is emerging as the new growth engine of the world.

56. The resilience of Indian economy continued in Q1:2023-24 as reflected in high frequency indicators. The economy is largely evolving on the expected lines. The total acreage under kharif crops has crossed last year’s levels. The manufacturing sector continued to expand, supported by moderating input cost pressures. Services activity remained strong in Q1:2023-24 and it is likely to follow through during the remaining period of 2023-24.

57. Rural consumption has shown signs of improvement in Q1:2023-24 while urban consumption has remained stable. Investment activity is supported by strong government capex. State governments’ capex has also seen a jump.10 The higher government capex and the twin-balance sheet advantage of banks and corporates provide a congenial environment for private sector investments to gather pace. Private investments are already happening in a few critical sectors like iron and steel, automobiles, petroleum, metals and chemicals. These growth drivers are expected to support the real GDP growth projection of 6.5 per cent for 2023-24 and 6.6 per cent for Q1:2024-25.

58. Headline inflation had eased significantly from 6.2 per cent in Q4:2022-23 to 4.3 per cent in May 2023 reflecting the combined impact of monetary tightening and supply augmenting measures. Inflationary pressures are, however, emerging again with inflation rising to 4.8 per cent in June on the back of rising food prices. Headline CPI is expected to harden significantly in July-August, driven by the spike in tomato and other vegetable prices. While the vegetable price shocks are expected to correct quickly with the arrival of fresh crops, there are risks to the food and the overall inflation outlook from El Nino conditions, volatile global food prices and skewed monsoon distribution - all of which warrant close monitoring. In the non-food category, crude oil prices have firmed up reflecting tighter supply conditions. Against this backdrop, supply side measures need to be continued to prevent the spiraling of frequent food supply shocks into generalised economy-wide price impulses. The softening of core inflation (CPI excluding food and fuel) by around 100 bps, from 6.0 per cent in Q4:2022-23 to 5.1 per cent in Q1:2023-24 is a source of some comfort in the face of rising food prices, although it is still at an elevated level.

59. The Reserve Bank’s liquidity management has been nimble and two-sided as per requirement. We will manage the liquidity overhang proactively using the various instruments at our command while ensuring that the banking system has adequate liquidity to meet the productive requirements of the economy.

60. Headline inflation has softened from last year’s elevated level but it still rules above the target. Our task is still not over. Given the likely short-term nature of the vegetable price shocks, monetary policy can look through the first-round impact of fleeting shocks on headline inflation. At the same time, we need to be ready to pre-empt any second-round impact of food price shocks on the broader inflationary pressures and risks to anchoring of inflation expectations. The impact of the cumulative rate hike of 250 basis points on the economy is still playing out. Considering all these aspects, I vote to keep the policy repo rate unchanged at 6.50 per cent with preparedness to act, should the situation so warrant. Further, as transmission of the repo rate increase of 250 bps to lending and deposit rates is still incomplete, I vote to continue with the stance of withdrawal of accommodation.

61. In this dynamic environment, we remain steadfastly committed to our goal of aligning inflation to the target of 4.0 per cent. We continuously assess the impact of our past actions, the implications of incoming data for the evolving inflation and growth dynamics and stand in readiness to act whenever necessary.

(Yogesh Dayal)

Chief General Manager

---

1 ‘Price Stickiness in CPI and its Sensitivity to Demand Shocks in India’, Sujata Kundu, Himani Shekhar and Vimal Kishore, RBI occasional papers, 42(2): 101-147, 2021.

2 ‘Food Inflation in India: The Role for Monetary Policy’, Anand, R., Ding, D., & Tulin, V., International Monetary Fund, Working Paper Series no. WP/14/178, 2014.

3 ‘Inflation Convergence and Anchoring of Expectations in India’, Ashima Goyal and Prashant Parab, Economic and Political Weekly, November 28, 55(47): 37-46. 2020.

4 By end-July 2023, according to the Department of Consumer Affairs data, the tomato prices were at Rs. 125 per kg. Between end-September and end-November 2021, the peak of tomato prices was Rs. 64 per kg. Between mid-June to end-July 2017 tomato prices increased to touch Rs. 67 per kg.

5 As mentioned in my last statement that around half of rabi production is likely to be accounted for in Q1:2023-24.

6 Private non-financial entities

7 Reflected by index of industrial production (IIP) manufacturing growth of 5.5 per cent in April-May

8 Frederic S Mishkin (2007), ‘Headline versus Core Inflation in the Conduct of Monetary Policy’, Remarks at the Business Cycles, International Transmission and Macroeconomic Policies Conference, HEC Montreal, Montreal, 20 October 2007.

9 Bank for International Settlements (2023), Annual Report, June.

10 The data available from the Comptroller and Auditor General of India (CAG) for 20 states indicates that capital expenditure of the states increased sharply by 74.4 per cent during Q1:2023-24 aided by the Union Government's 'Scheme for Special Assistance to States for Capital Investment'. As on July 25, 2023, the central government has approved expenditure amounting to ₹84,884 crore accounting for 65.3 per cent of the ₹1.3 lakh crore budgeted for 2023-24.