| News | |||

|

|

|||

GST Revenue collection for Aprilí 21 sets new record |

|||

| 1-5-2021 | |||

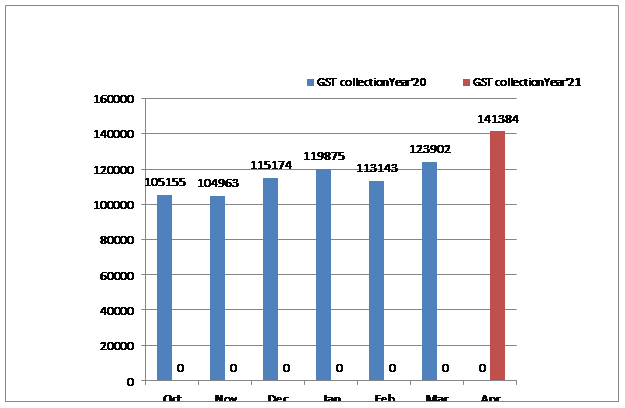

GST Revenue collection for April’ 21 sets new record The gross GST revenue collected in the month of April’ 2021 is at a record high of Rs. 1,41,384 crore of which CGST is Rs. 27,837 crore, SGST is Rs. 35,621, IGST is Rs 68,481 crore (including ₹ 29,599 crore collected on import of goods) and Cess is Rs. 9,445 crore (including ₹ 981 crore collected on import of goods). Despite the second wave of COVID-19 pandemic affecting several parts of the country, Indian businesses have once again shown remarkable resilience by not only complying with the return filing requirements but also paying their GST dues in a timely manner during the month. The GST revenues during April 2021 are the highest since the introduction of GST even surpassing collections in the last month (March’2021). In line with the trend of recovery in the GST revenues over past six months, the revenues for the month of April 2021 are 14% higher than the GST revenues in the last month of March’2021. During the month, the revenues from domestic transaction (including import of services) are 21% higher than the revenues from these sources during the last month. GST revenues have not only crossed the ₹ 1 lakh crore mark during successively for the last seven months but have also shown a steady increase. These are clear indicators of sustained economic recovery during this period. Closer monitoring against fake-billing, deep data analytics using data from multiple sources including GST, Income-tax and Customs IT systems and effective tax administration have also contributed to the steady increase in tax revenue. Quarterly return and monthly payment scheme has been successfully implemented bringing relief to the small taxpayers as they now file only one return every three months. Providing IT support to taxpayers in the form of pre-filled GSTR 2A and 3B returns and ramped up System capacity have also eased the return filing process. During this month the government has settled ₹ 29,185 crore to CGST and ₹ 22,756 crore to SGST from IGST as regular settlement. The total revenue of Centre and the States after regular and ad-hoc settlements in the month of April’ 2021 is ₹ 57,022 crore for CGST and ₹ 58,377 crore for the SGST. The chart below shows trends in monthly gross GST revenues during the October’20 to Mar’20 and April’2021.

|

|||

9911796707

9911796707